Carbon border tax targets imported goods based on their carbon emissions to encourage global climate responsibility and reduce carbon leakage. Export levies impose charges on goods leaving a country, often used to regulate resource depletion or generate revenue. Explore how these trade policies impact economic competitiveness and environmental goals.

Why it is important

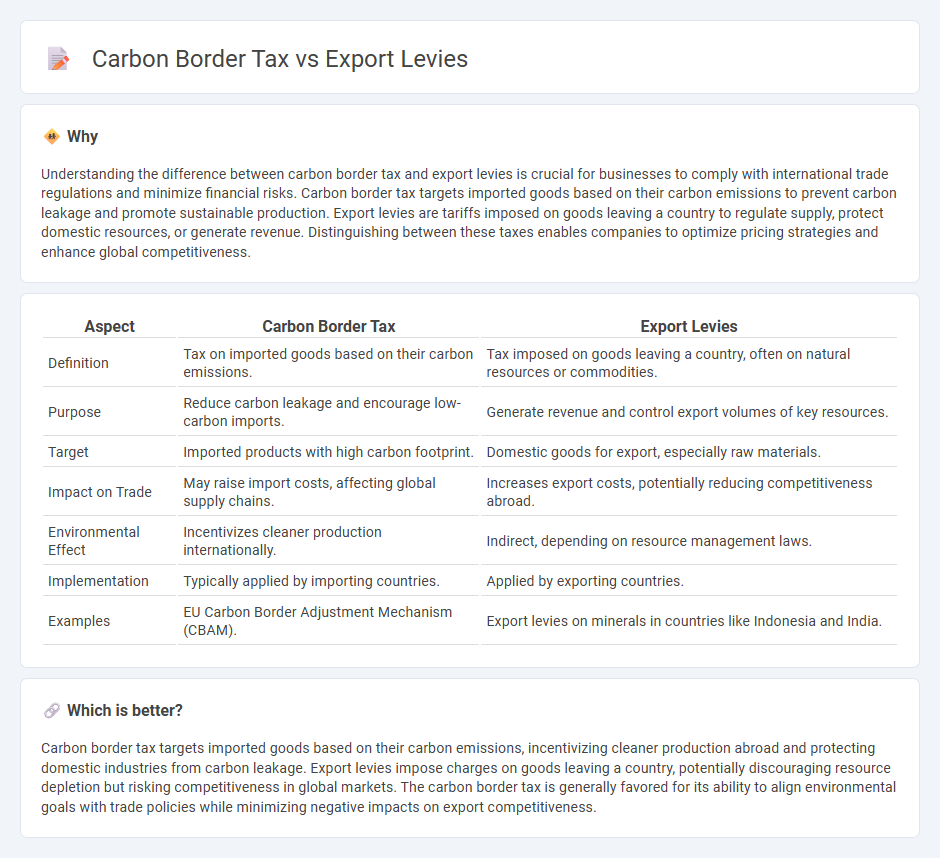

Understanding the difference between carbon border tax and export levies is crucial for businesses to comply with international trade regulations and minimize financial risks. Carbon border tax targets imported goods based on their carbon emissions to prevent carbon leakage and promote sustainable production. Export levies are tariffs imposed on goods leaving a country to regulate supply, protect domestic resources, or generate revenue. Distinguishing between these taxes enables companies to optimize pricing strategies and enhance global competitiveness.

Comparison Table

| Aspect | Carbon Border Tax | Export Levies |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions. | Tax imposed on goods leaving a country, often on natural resources or commodities. |

| Purpose | Reduce carbon leakage and encourage low-carbon imports. | Generate revenue and control export volumes of key resources. |

| Target | Imported products with high carbon footprint. | Domestic goods for export, especially raw materials. |

| Impact on Trade | May raise import costs, affecting global supply chains. | Increases export costs, potentially reducing competitiveness abroad. |

| Environmental Effect | Incentivizes cleaner production internationally. | Indirect, depending on resource management laws. |

| Implementation | Typically applied by importing countries. | Applied by exporting countries. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | Export levies on minerals in countries like Indonesia and India. |

Which is better?

Carbon border tax targets imported goods based on their carbon emissions, incentivizing cleaner production abroad and protecting domestic industries from carbon leakage. Export levies impose charges on goods leaving a country, potentially discouraging resource depletion but risking competitiveness in global markets. The carbon border tax is generally favored for its ability to align environmental goals with trade policies while minimizing negative impacts on export competitiveness.

Connection

Carbon border tax and export levies are interconnected through their role in regulating international trade to address carbon emissions and environmental impact. Carbon border taxes impose fees on imported goods based on their carbon footprint to prevent carbon leakage and promote sustainable production. Export levies, on the other hand, can discourage the export of carbon-intensive products by increasing their cost, aligning with the objectives of carbon border taxes to incentivize lower emissions globally.

Key Terms

Trade Tariffs

Export levies are taxes imposed by exporting countries to control the outflow of specific goods and protect domestic industries, often impacting global supply chains and trade costs. Carbon border tax, designed to equalize carbon pricing between domestic products and imports, aims to prevent carbon leakage and incentivize greener production methods worldwide by applying tariffs based on carbon emissions. Explore how these trade tariffs affect international commerce, environmental policy, and competitive market dynamics.

Emissions Pricing

Export levies impose charges on goods leaving a country to discourage resource depletion or generate revenue, while carbon border taxes specifically target the carbon emissions embedded in imported goods to prevent carbon leakage and promote emissions pricing equity. Emissions pricing mechanisms, including carbon border adjustments, align domestic climate policies with international trade by internalizing the environmental cost of carbon emissions, incentivizing cleaner production methods globally. Explore detailed insights on how emissions pricing strategies balance economic interests and environmental goals through export levies and carbon border taxes.

Competitiveness

Export levies impose extra costs on raw materials leaving a country, which can protect domestic industries but may reduce global competitiveness. Carbon border tax targets imported goods based on their carbon footprint, leveling the playing field by accounting for environmental costs and encouraging green production practices. Explore how these mechanisms influence international trade and competitiveness in evolving markets.

Source and External Links

Export Levy - Financial Dictionary - An export levy is a tax imposed by a country on its exports, making them more expensive and potentially encouraging domestic consumption of locally produced goods.

Indonesia: Indonesia Simplifies Palm Oil Export Levies in Response to Decreasing CPO Exports - Indonesia recently simplified its palm oil export levies, setting rates between 3% and 7.5% of the government-set reference price to address declining crude palm oil exports.

Exports - U.S. Trade Policy - Library of Congress Research Guides - The U.S. Constitution prohibits federal export taxes, though fees may be charged for export-related services such as inspections and certifications.

dowidth.com

dowidth.com