Greedflation occurs when companies increase prices beyond cost-driven factors to maximize profits, intensifying inflationary pressures without an underlying demand surge. Hyperinflation, by contrast, involves a rapid, uncontrollable increase in prices due to excessive money supply and loss of public confidence in currency stability. Explore further to understand the distinct causes and impacts of greedflation versus hyperinflation on economic stability.

Why it is important

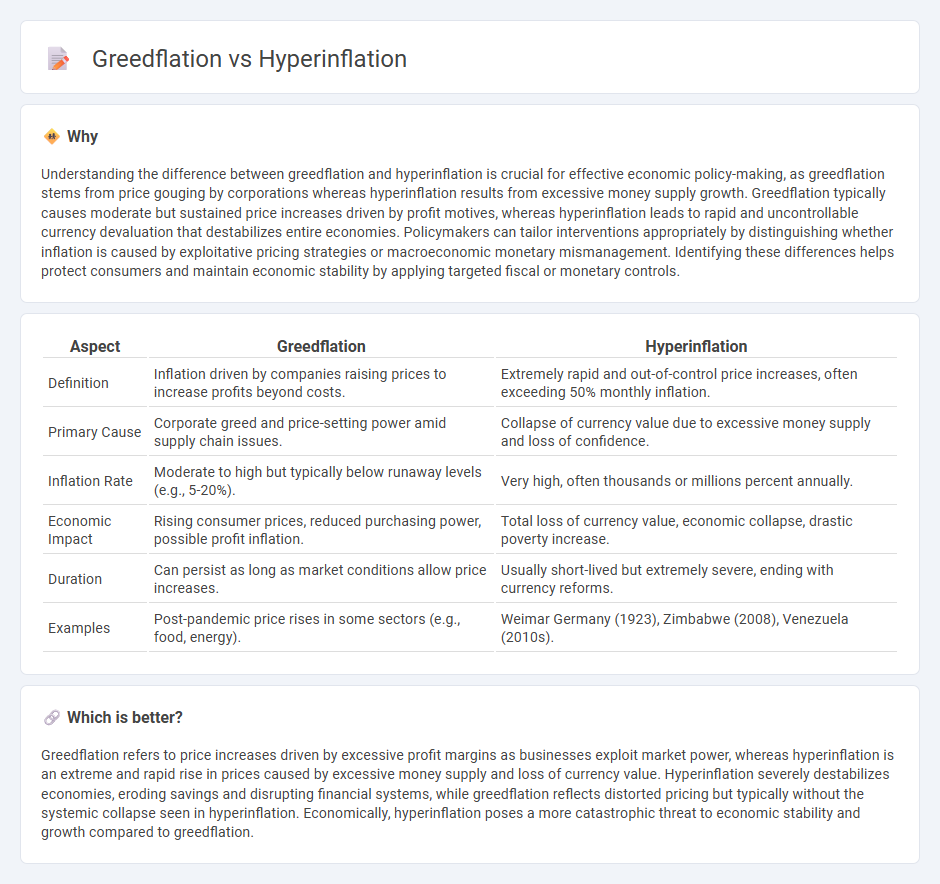

Understanding the difference between greedflation and hyperinflation is crucial for effective economic policy-making, as greedflation stems from price gouging by corporations whereas hyperinflation results from excessive money supply growth. Greedflation typically causes moderate but sustained price increases driven by profit motives, whereas hyperinflation leads to rapid and uncontrollable currency devaluation that destabilizes entire economies. Policymakers can tailor interventions appropriately by distinguishing whether inflation is caused by exploitative pricing strategies or macroeconomic monetary mismanagement. Identifying these differences helps protect consumers and maintain economic stability by applying targeted fiscal or monetary controls.

Comparison Table

| Aspect | Greedflation | Hyperinflation |

|---|---|---|

| Definition | Inflation driven by companies raising prices to increase profits beyond costs. | Extremely rapid and out-of-control price increases, often exceeding 50% monthly inflation. |

| Primary Cause | Corporate greed and price-setting power amid supply chain issues. | Collapse of currency value due to excessive money supply and loss of confidence. |

| Inflation Rate | Moderate to high but typically below runaway levels (e.g., 5-20%). | Very high, often thousands or millions percent annually. |

| Economic Impact | Rising consumer prices, reduced purchasing power, possible profit inflation. | Total loss of currency value, economic collapse, drastic poverty increase. |

| Duration | Can persist as long as market conditions allow price increases. | Usually short-lived but extremely severe, ending with currency reforms. |

| Examples | Post-pandemic price rises in some sectors (e.g., food, energy). | Weimar Germany (1923), Zimbabwe (2008), Venezuela (2010s). |

Which is better?

Greedflation refers to price increases driven by excessive profit margins as businesses exploit market power, whereas hyperinflation is an extreme and rapid rise in prices caused by excessive money supply and loss of currency value. Hyperinflation severely destabilizes economies, eroding savings and disrupting financial systems, while greedflation reflects distorted pricing but typically without the systemic collapse seen in hyperinflation. Economically, hyperinflation poses a more catastrophic threat to economic stability and growth compared to greedflation.

Connection

Greedflation and hyperinflation are interconnected through escalating price increases driven by excessive profit-seeking behavior and loss of currency value. Greedflation occurs when companies raise prices beyond cost increases to boost profits, amplifying inflationary pressures and contributing to runaway price hikes. Hyperinflation results when monetary value collapses, often exacerbated by unchecked greedflation, leading to rapid and uncontrollable rises in the overall price level.

Key Terms

Money Supply (Hyperinflation)

Hyperinflation occurs when the money supply expands rapidly and uncontrollably, causing currency devaluation and soaring consumer prices. This excessive increase in money supply undermines purchasing power, often triggered by government policies such as excessive printing of money to finance deficits. Explore how money supply mechanisms specifically drive hyperinflation and distinguish it from greedflation dynamics.

Corporate Profiteering (Greedflation)

GREEDFLATION, driven by corporate profiteering, occurs when businesses deliberately increase prices beyond cost pressures to boost profit margins, contrasting with HYPERINFLATION, which stems from excessive money supply and loss of currency value. Major corporations exploit market power, supply chain disruptions, and consumer inelasticity to sustain elevated prices, exacerbating inflation without corresponding increases in production costs. Explore the intricate dynamics of GREEDFLATION and its impact on economies to better understand this subtle yet damaging form of inflation.

Price Stability

Hyperinflation involves rapid and excessive price increases driven by an overwhelming supply of money and loss of confidence in currency value, severely undermining price stability. Greedflation occurs when firms exploit market power to raise prices beyond supply and demand factors, destabilizing prices without the typical monetary causes. Explore how these distinct mechanisms impact economic policies and price stability further.

Source and External Links

Hyperinflation | EBSCO Research Starters - Hyperinflation is an extremely rapid rise in prices defined by inflation rates exceeding 50% per month, caused by excessive money printing without economic growth, leading to currency devaluation and severe economic distress as seen historically in Germany, Hungary, Zimbabwe, and Venezuela.

Hyperinflation - Wikipedia - Hyperinflation is a very high and accelerating inflation rate that quickly erodes the value of the local currency, often driven by government budget stresses, wars, or collapses in revenue, causing rapid price increases and a shift to more stable foreign currencies.

Hyperinflation: Definition, Causes, Effects and Examples - Hyperinflation occurs when confidence in government and currency collapses, typically after political upheavals, leading to uncontrolled price increases of 50% or more per month and ultimately destroying the currency, which must be replaced to restore stability.

dowidth.com

dowidth.com