Neobanks leverage advanced digital platforms to offer seamless financial services, attracting tech-savvy consumers with lower fees and innovative features compared to traditional building societies. Building societies emphasize member-owned models focused on community engagement and stable, long-term savings and mortgage products. Explore the evolving financial landscape to understand how these institutions impact modern banking choices.

Why it is important

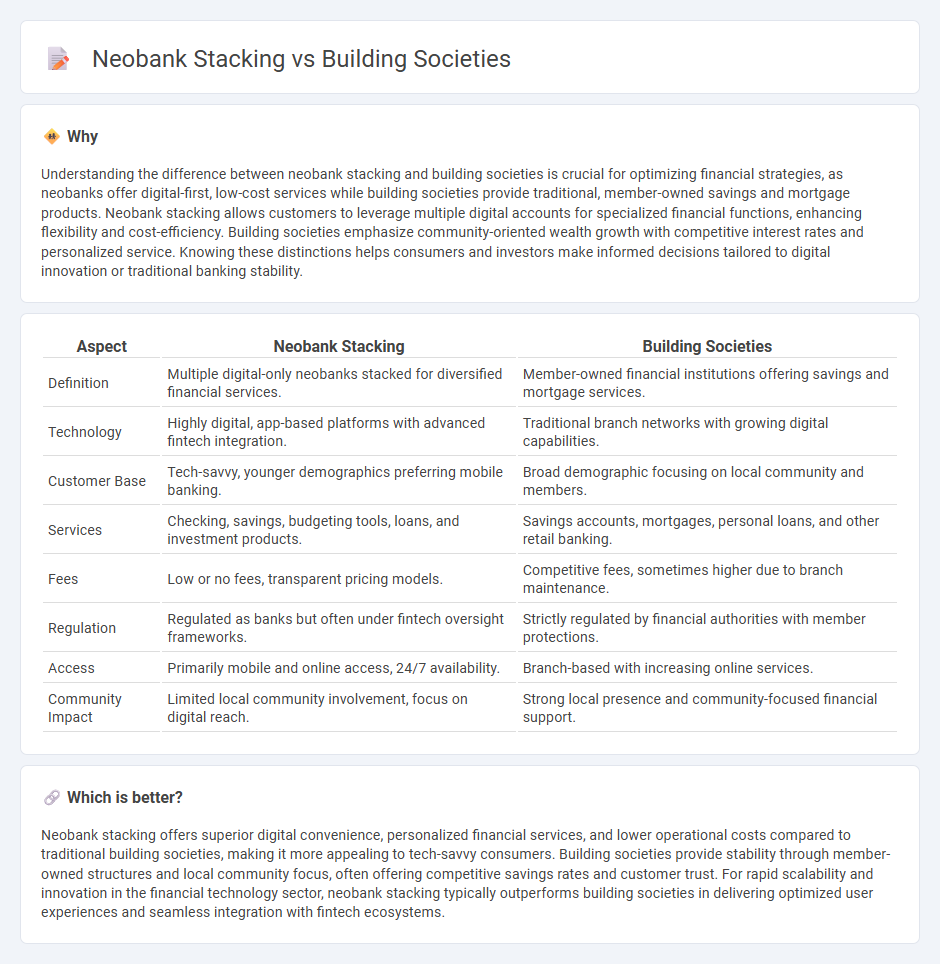

Understanding the difference between neobank stacking and building societies is crucial for optimizing financial strategies, as neobanks offer digital-first, low-cost services while building societies provide traditional, member-owned savings and mortgage products. Neobank stacking allows customers to leverage multiple digital accounts for specialized financial functions, enhancing flexibility and cost-efficiency. Building societies emphasize community-oriented wealth growth with competitive interest rates and personalized service. Knowing these distinctions helps consumers and investors make informed decisions tailored to digital innovation or traditional banking stability.

Comparison Table

| Aspect | Neobank Stacking | Building Societies |

|---|---|---|

| Definition | Multiple digital-only neobanks stacked for diversified financial services. | Member-owned financial institutions offering savings and mortgage services. |

| Technology | Highly digital, app-based platforms with advanced fintech integration. | Traditional branch networks with growing digital capabilities. |

| Customer Base | Tech-savvy, younger demographics preferring mobile banking. | Broad demographic focusing on local community and members. |

| Services | Checking, savings, budgeting tools, loans, and investment products. | Savings accounts, mortgages, personal loans, and other retail banking. |

| Fees | Low or no fees, transparent pricing models. | Competitive fees, sometimes higher due to branch maintenance. |

| Regulation | Regulated as banks but often under fintech oversight frameworks. | Strictly regulated by financial authorities with member protections. |

| Access | Primarily mobile and online access, 24/7 availability. | Branch-based with increasing online services. |

| Community Impact | Limited local community involvement, focus on digital reach. | Strong local presence and community-focused financial support. |

Which is better?

Neobank stacking offers superior digital convenience, personalized financial services, and lower operational costs compared to traditional building societies, making it more appealing to tech-savvy consumers. Building societies provide stability through member-owned structures and local community focus, often offering competitive savings rates and customer trust. For rapid scalability and innovation in the financial technology sector, neobank stacking typically outperforms building societies in delivering optimized user experiences and seamless integration with fintech ecosystems.

Connection

Neobank stacking involves integrating multiple digital financial services to offer seamless user experiences, while building societies provide traditional savings and mortgage products with member ownership structures. Both entities focus on customer-centric financial solutions, leveraging technology to enhance accessibility and efficiency in banking. The connection lies in their shared goal of democratizing finance through innovative platforms that blend neobanking agility with building societies' community-oriented trust.

Key Terms

Deposit-taking

Building societies offer traditional deposit-taking services with a strong emphasis on member ownership and community-focused savings accounts, while neobanks provide digital-first deposit solutions featuring rapid account setup, high-yield savings, and integrated financial tools. Unlike building societies, neobanks leverage technology stacks to enhance user experience, enabling real-time deposits and seamless fund transfers. Discover more about how deposit-taking innovations differentiate building societies and neobank platforms.

Digital-only banking

Building societies traditionally offer community-focused financial services with physical branches, emphasizing personalized customer interaction and savings products. Neobanks operate entirely online, leveraging advanced digital-only platforms to provide seamless account management, instant payments, and lower fees through innovative fintech solutions. Discover how digital-only banking transforms financial services by exploring the strengths of building societies and neobank stacking.

Financial regulation

Building societies operate under stringent traditional financial regulations, maintaining secure deposits and offering protected savings accounts regulated by national authorities such as the Financial Conduct Authority (FCA) in the UK. Neobank stacking involves multiple digital-only banks, each regulated individually to comply with electronic payment standards and consumer protection laws but often benefits from innovative, agile regulatory frameworks designed for fintech. Explore the complexities of financial regulation in building societies versus neobank stacking to understand risks, compliance, and consumer safeguards.

Source and External Links

Difference between banks and building societies - This webpage discusses the differences between banks and building societies, focusing on their ownership structures and financial services.

Building society - Wikipedia - This article provides an overview of building societies, including their history and structure as mutual organizations offering financial services.

What is a Building Society? - NerdWallet - This webpage explains the role of building societies as mutual organizations providing financial services like savings and mortgages without shareholder profit focus.

dowidth.com

dowidth.com