Revenge spending refers to the surge in consumer expenditures following periods of restricted economic activity, driven by pent-up demand and a desire to regain lost experiences. Precautionary saving involves setting aside income to buffer against future uncertainties, often increasing during economic downturns. Explore the dynamics between these two behaviors to understand their impact on economic recovery.

Why it is important

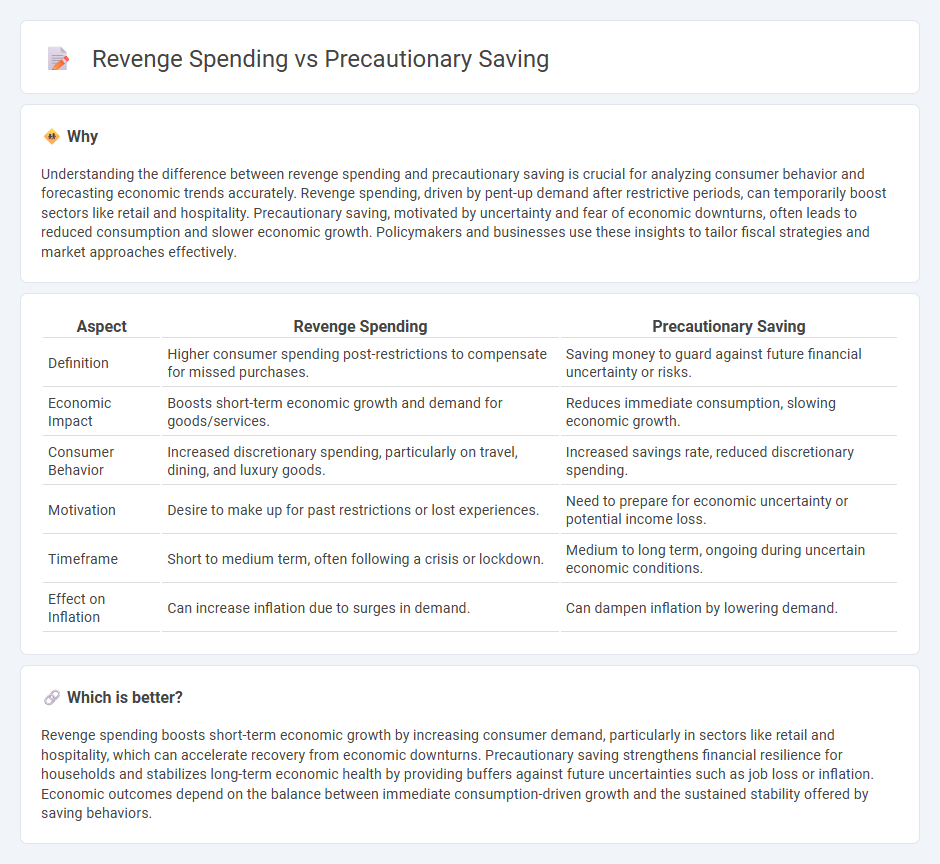

Understanding the difference between revenge spending and precautionary saving is crucial for analyzing consumer behavior and forecasting economic trends accurately. Revenge spending, driven by pent-up demand after restrictive periods, can temporarily boost sectors like retail and hospitality. Precautionary saving, motivated by uncertainty and fear of economic downturns, often leads to reduced consumption and slower economic growth. Policymakers and businesses use these insights to tailor fiscal strategies and market approaches effectively.

Comparison Table

| Aspect | Revenge Spending | Precautionary Saving |

|---|---|---|

| Definition | Higher consumer spending post-restrictions to compensate for missed purchases. | Saving money to guard against future financial uncertainty or risks. |

| Economic Impact | Boosts short-term economic growth and demand for goods/services. | Reduces immediate consumption, slowing economic growth. |

| Consumer Behavior | Increased discretionary spending, particularly on travel, dining, and luxury goods. | Increased savings rate, reduced discretionary spending. |

| Motivation | Desire to make up for past restrictions or lost experiences. | Need to prepare for economic uncertainty or potential income loss. |

| Timeframe | Short to medium term, often following a crisis or lockdown. | Medium to long term, ongoing during uncertain economic conditions. |

| Effect on Inflation | Can increase inflation due to surges in demand. | Can dampen inflation by lowering demand. |

Which is better?

Revenge spending boosts short-term economic growth by increasing consumer demand, particularly in sectors like retail and hospitality, which can accelerate recovery from economic downturns. Precautionary saving strengthens financial resilience for households and stabilizes long-term economic health by providing buffers against future uncertainties such as job loss or inflation. Economic outcomes depend on the balance between immediate consumption-driven growth and the sustained stability offered by saving behaviors.

Connection

Revenge spending often arises when consumers increase expenditure to make up for past financial restraint, reflecting pent-up demand after periods of limited spending. This behavior contrasts with precautionary saving, where individuals set aside funds to guard against economic uncertainty and potential future income shocks. The interplay between revenge spending and precautionary saving illustrates fluctuations in consumer confidence that significantly influence overall economic activity and recovery patterns.

Key Terms

Uncertainty

Precautionary saving refers to accumulating funds to buffer against economic uncertainty, driven by unpredictable income or job instability. Revenge spending, on the other hand, emerges as a response to prolonged periods of deprivation, motivating individuals to splurge once financial conditions improve. Explore how these contrasting behaviors influence personal finance strategies in uncertain times.

Consumer behavior

Precautionary saving involves consumers increasing their savings to buffer against economic uncertainties, often driven by fear of income loss or unexpected expenses. Revenge spending, conversely, occurs when consumers splurge on luxury or discretionary items following periods of restrained spending, motivated by a desire to reclaim lost happiness or compensate for previous deprivation. Explore consumer behavior trends to understand how these contrasting strategies impact economic cycles and market demands.

Economic cycle

During economic downturns, precautionary saving increases as households build financial buffers against income uncertainty and job loss, leading to reduced consumption and slower economic activity. Conversely, revenge spending surges in economic recoveries, driven by pent-up demand and increased consumer confidence, which boosts retail sales and accelerates growth. Explore how these contrasting behaviors shape economic cycles and influence policymaking decisions.

Source and External Links

Precautionary savings - Wikipedia - Precautionary saving is the practice of saving part of income due to uncertainty about future income, acting as a hedge against income fluctuations and imperfect insurance markets, with empirical research showing mixed but significant effects on saving behavior.

Disentangling the Importance of the Precautionary Saving Motive - This study finds that precautionary saving is a widespread motive affecting nearly all households but accounts for about 8% of total wealth, being especially important for older households and business owners.

Precautionary Saving and the Timing of Taxes - Miles S. Kimball - This paper analyzes how income uncertainty influences consumption and saving through the precautionary saving motive in a model with income shocks and shows how government debt and taxes affect such behaviors.

dowidth.com

dowidth.com