Tipflation describes rising costs associated with tipping, impacting consumer spending and service industry wages, while reflation involves government policies aimed at stimulating economic growth and inflation after a downturn. Both phenomena influence inflation rates and purchasing power but operate through different mechanisms and sectors. Explore how these trends shape market dynamics and financial planning strategies.

Why it is important

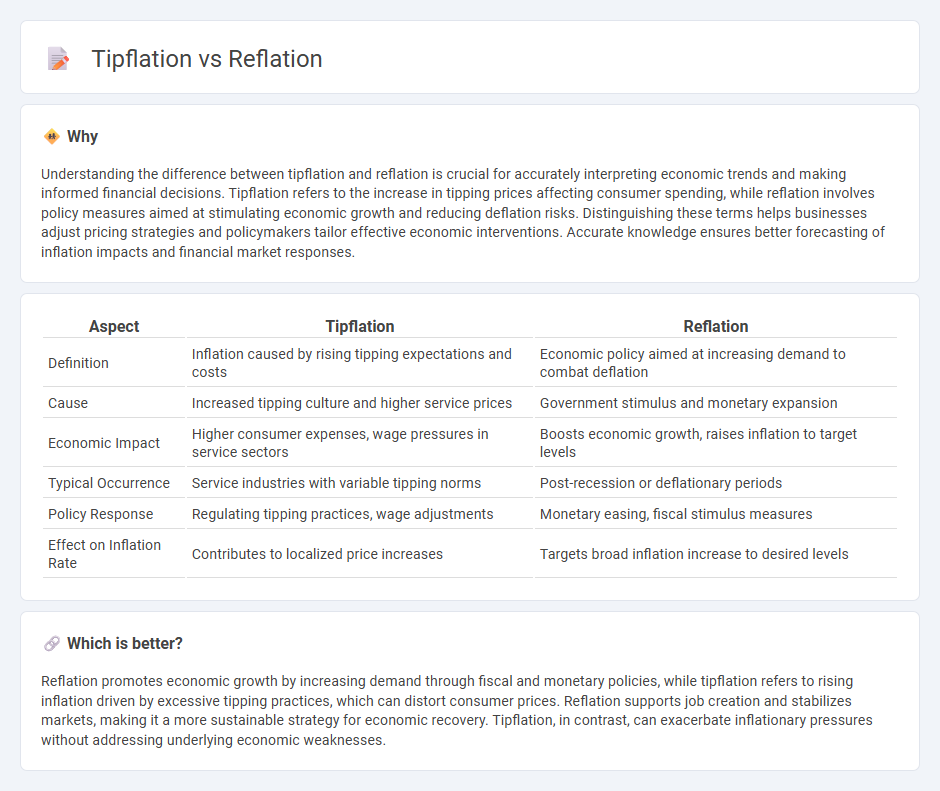

Understanding the difference between tipflation and reflation is crucial for accurately interpreting economic trends and making informed financial decisions. Tipflation refers to the increase in tipping prices affecting consumer spending, while reflation involves policy measures aimed at stimulating economic growth and reducing deflation risks. Distinguishing these terms helps businesses adjust pricing strategies and policymakers tailor effective economic interventions. Accurate knowledge ensures better forecasting of inflation impacts and financial market responses.

Comparison Table

| Aspect | Tipflation | Reflation |

|---|---|---|

| Definition | Inflation caused by rising tipping expectations and costs | Economic policy aimed at increasing demand to combat deflation |

| Cause | Increased tipping culture and higher service prices | Government stimulus and monetary expansion |

| Economic Impact | Higher consumer expenses, wage pressures in service sectors | Boosts economic growth, raises inflation to target levels |

| Typical Occurrence | Service industries with variable tipping norms | Post-recession or deflationary periods |

| Policy Response | Regulating tipping practices, wage adjustments | Monetary easing, fiscal stimulus measures |

| Effect on Inflation Rate | Contributes to localized price increases | Targets broad inflation increase to desired levels |

Which is better?

Reflation promotes economic growth by increasing demand through fiscal and monetary policies, while tipflation refers to rising inflation driven by excessive tipping practices, which can distort consumer prices. Reflation supports job creation and stabilizes markets, making it a more sustainable strategy for economic recovery. Tipflation, in contrast, can exacerbate inflationary pressures without addressing underlying economic weaknesses.

Connection

Tipflation drives up consumer spending by increasing tipping amounts, which raises overall service costs and contributes to inflationary pressures within the economy. Reflation involves government policies aimed at stimulating economic growth and increasing price levels after a downturn, often leading to increased consumer demand and higher wages. The connection between tipflation and reflation lies in their combined effect on rising prices and wages, amplifying inflation trends during economic recovery phases.

Key Terms

Monetary Policy

Reflation refers to monetary policy measures aimed at stimulating the economy by increasing the money supply and lowering interest rates to counteract deflationary pressures. Tipflation, on the other hand, involves targeted inflationary tactics designed to subtly increase prices in specific sectors without triggering broad-based inflation, often complicating central bank interventions. Explore the nuances of these monetary strategies and their implications for economic stability and policy effectiveness.

Inflation

Reflation refers to government policies aimed at increasing economic output and inflation to pre-recession levels, typically through fiscal stimulus and monetary easing. Tipflation, a newer concept, highlights the rising costs in specific sectors like dining and services, driven by tipping expectations and wage pressures, contributing to overall inflation dynamics. Explore more insights on how reflation and tipflation impact inflation trends and economic policy responses.

Consumer Prices

Reflation describes a rise in consumer prices driven by economic policies aiming to increase demand and counteract deflation, while tipflation specifically refers to the increase in prices and size of gratuity or tips, impacting overall consumer spending differently. Consumer price indexes often reflect reflation through broad-based price increases across goods and services, whereas tipflation influences discretionary spending within service sectors like dining and hospitality. Explore how these distinct inflation phenomena shape consumer behavior and economic forecasts.

Source and External Links

Reflation - Wikipedia - Reflation is the return of prices to a previous rate of inflation, typically achieved by economic stimulus such as increasing the money supply or reducing taxes to bring the economy back up to its long-term trend after a downturn or deflation.

What's the Reflation Trade? - SoFi - The reflation trade is an investment strategy that bets on economic recovery and growth by focusing on sectors expected to benefit from the post-recession price recovery and employment growth, such as energy, materials, and financials.

What is Reflation and How Do You Trade it? | IG International - Reflationary policies involve fiscal stimulus and monetary easing to halt deflation and lift the economy, aiming to restore prices to a long-term trend following a recession or economic contraction.

dowidth.com

dowidth.com