Greenflation refers to the rising costs of goods and services driven by environmentally sustainable practices and regulations, impacting energy prices and raw materials. Core inflation measures the long-term trend in price changes, excluding volatile items like food and energy, providing insight into underlying economic conditions. Explore the intricate relationship between greenflation and core inflation to understand current economic challenges.

Why it is important

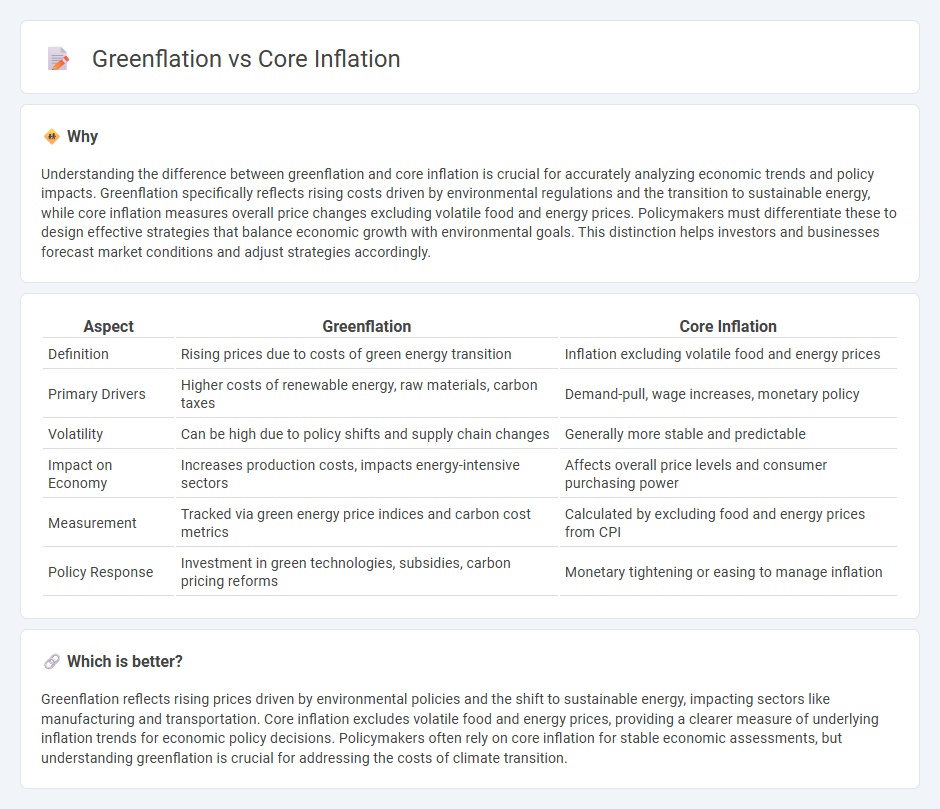

Understanding the difference between greenflation and core inflation is crucial for accurately analyzing economic trends and policy impacts. Greenflation specifically reflects rising costs driven by environmental regulations and the transition to sustainable energy, while core inflation measures overall price changes excluding volatile food and energy prices. Policymakers must differentiate these to design effective strategies that balance economic growth with environmental goals. This distinction helps investors and businesses forecast market conditions and adjust strategies accordingly.

Comparison Table

| Aspect | Greenflation | Core Inflation |

|---|---|---|

| Definition | Rising prices due to costs of green energy transition | Inflation excluding volatile food and energy prices |

| Primary Drivers | Higher costs of renewable energy, raw materials, carbon taxes | Demand-pull, wage increases, monetary policy |

| Volatility | Can be high due to policy shifts and supply chain changes | Generally more stable and predictable |

| Impact on Economy | Increases production costs, impacts energy-intensive sectors | Affects overall price levels and consumer purchasing power |

| Measurement | Tracked via green energy price indices and carbon cost metrics | Calculated by excluding food and energy prices from CPI |

| Policy Response | Investment in green technologies, subsidies, carbon pricing reforms | Monetary tightening or easing to manage inflation |

Which is better?

Greenflation reflects rising prices driven by environmental policies and the shift to sustainable energy, impacting sectors like manufacturing and transportation. Core inflation excludes volatile food and energy prices, providing a clearer measure of underlying inflation trends for economic policy decisions. Policymakers often rely on core inflation for stable economic assessments, but understanding greenflation is crucial for addressing the costs of climate transition.

Connection

Greenflation, driven by rising costs in renewable energy and raw materials for sustainable technologies, directly impacts core inflation, which excludes volatile food and energy prices. As investments in green infrastructure increase production expenses, these higher costs are reflected in the prices of goods and services, elevating core inflation rates. Central banks closely monitor this relationship to balance inflation control with the transition to a low-carbon economy.

Key Terms

Consumer Price Index (CPI)

Core inflation measures the change in Consumer Price Index (CPI) excluding volatile food and energy prices to provide a clearer view of underlying inflation trends. Greenflation refers to price increases in the CPI driven by rising costs associated with green technologies, carbon pricing, and environmental regulations. Explore how these concepts impact economic policies and household costs by delving deeper into their effects on the CPI.

Energy Transition

Core inflation excludes volatile energy prices to provide a stable measure of underlying inflation trends, while greenflation specifically captures rising costs linked to the energy transition, including increased demand for renewable technologies and scarce raw materials. Energy transition investments drive up prices in metals like lithium, cobalt, and copper, contributing to greenflation pressures distinct from traditional inflation measures. Explore further how these inflation dynamics impact economic strategies and sustainability goals.

Supply Chain Costs

Core inflation primarily measures the steady rise in prices by excluding volatile items like food and energy, offering insight into underlying inflation trends. Greenflation refers to the inflationary pressures driven by the transition to green technologies, often causing supply chain disruptions and increased costs in raw materials such as lithium, cobalt, and rare earth elements. Explore how supply chain dynamics intertwine with these inflation types to understand their impact on global markets.

Source and External Links

Core inflation - Wikipedia - Core inflation measures the underlying long-term trend in price levels by excluding items with short-term price volatility, such as food and energy, to better indicate persistent inflationary pressures.

United States Core Inflation Rate - Trading Economics - The U.S. core inflation rate, which excludes food and energy, was 2.9% year-over-year in June 2025, with expectations for it to remain around 3% in the near term.

Core inflation: a measure of inflation for policy purposes - Core inflation is used by policymakers to filter out temporary price shocks and noise, providing a clearer signal of the inflation trend most relevant for monetary policy decisions.

dowidth.com

dowidth.com