Soft saving refers to holding assets in forms that may lose value due to inflation or currency depreciation, such as local currency or non-interest-bearing accounts. Hard currency, like the US dollar or euro, maintains value and stability internationally, serving as a reliable store of wealth during economic uncertainty. Discover how choosing between soft saving and hard currency affects financial security and investment strategies.

Why it is important

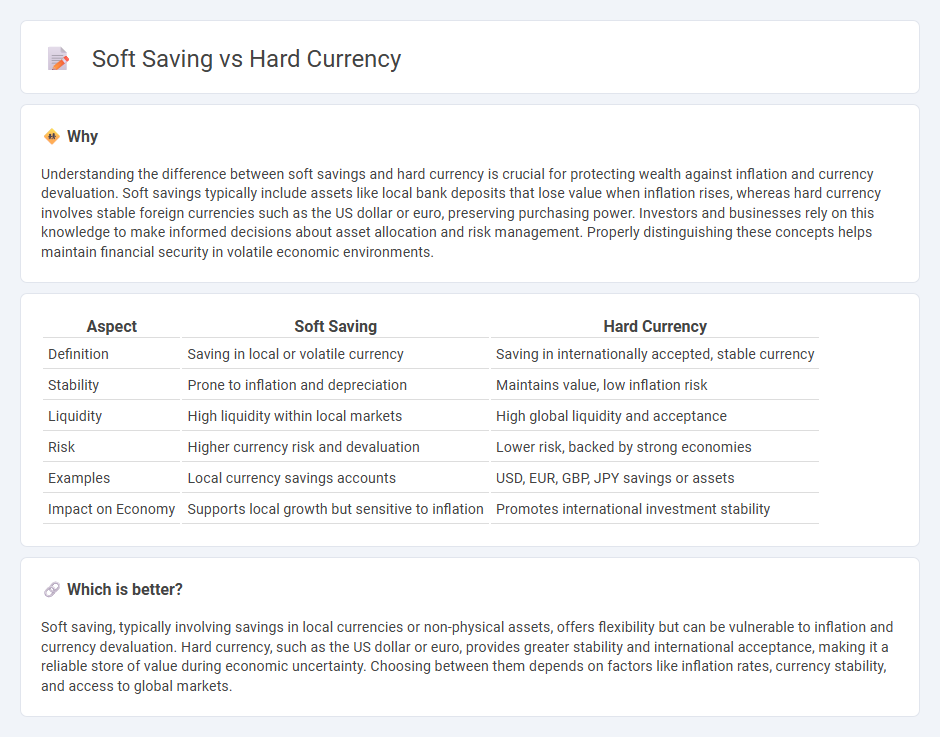

Understanding the difference between soft savings and hard currency is crucial for protecting wealth against inflation and currency devaluation. Soft savings typically include assets like local bank deposits that lose value when inflation rises, whereas hard currency involves stable foreign currencies such as the US dollar or euro, preserving purchasing power. Investors and businesses rely on this knowledge to make informed decisions about asset allocation and risk management. Properly distinguishing these concepts helps maintain financial security in volatile economic environments.

Comparison Table

| Aspect | Soft Saving | Hard Currency |

|---|---|---|

| Definition | Saving in local or volatile currency | Saving in internationally accepted, stable currency |

| Stability | Prone to inflation and depreciation | Maintains value, low inflation risk |

| Liquidity | High liquidity within local markets | High global liquidity and acceptance |

| Risk | Higher currency risk and devaluation | Lower risk, backed by strong economies |

| Examples | Local currency savings accounts | USD, EUR, GBP, JPY savings or assets |

| Impact on Economy | Supports local growth but sensitive to inflation | Promotes international investment stability |

Which is better?

Soft saving, typically involving savings in local currencies or non-physical assets, offers flexibility but can be vulnerable to inflation and currency devaluation. Hard currency, such as the US dollar or euro, provides greater stability and international acceptance, making it a reliable store of value during economic uncertainty. Choosing between them depends on factors like inflation rates, currency stability, and access to global markets.

Connection

Soft saving involves holding assets or savings in currencies prone to inflation or depreciation, while hard currency refers to stable and widely accepted forms of money like the US dollar or euro. Investors often convert soft savings into hard currency to preserve value and protect against economic instability. This connection ensures financial security by leveraging the reliability and global acceptance of hard currency to safeguard wealth stored in less stable monetary forms.

Key Terms

Exchange rate

Hard currencies, such as the US Dollar, Euro, and Japanese Yen, maintain high exchange rate stability and global acceptance, making them ideal for international savings and transactions. Soft currencies often experience volatility due to lower demand, inflation, or political instability, leading to unpredictable exchange rate fluctuations. Explore more about how exchange rates impact saving strategies and currency selection.

Inflation

Hard currency maintains its value and purchasing power despite inflation, making it a reliable store of wealth during economic instability. Soft saving, often held in local currencies, tends to lose value as inflation erodes its purchasing power over time. Explore the differences between hard currency and soft saving to better protect your assets from inflation risks.

Store of value

Hard currency, such as the US dollar or Swiss franc, serves as a reliable store of value due to its stability and widespread acceptance in global markets. Soft savings, including local currencies or assets susceptible to inflation, often lose purchasing power over time, undermining their effectiveness as long-term value holders. Explore the advantages and risks of each to optimize your financial strategy.

Source and External Links

Hard Currency - Overview, Factors, Examples, Comparison - A hard currency is a stable, government-issued currency from politically and economically stable developed countries that is widely traded internationally and trusted not to fluctuate dramatically in value.

What is a Hard Currency? - SuperfastCPA CPA Review - Hard currency is a widely accepted global currency usually from stable industrialized countries, often used as reserve currencies, examples include USD, EUR, GBP, JPY, CHF, CAD, and AUD.

Hard currency - Wikipedia - Hard currency is a globally traded, reliable, and stable store of value preferred in times of inflation or political risk, in contrast to soft currencies which are unstable or restricted.

dowidth.com

dowidth.com