Neobank stacking revolutionizes the economy by offering integrated financial services that combine multiple digital banking features into a single platform, enhancing user convenience and operational efficiency. Payment service providers focus primarily on facilitating secure, seamless transaction processing, enabling businesses and consumers to exchange funds globally with reduced friction. Explore how the contrast between neobank stacking and payment service providers shapes the future of digital financial ecosystems.

Why it is important

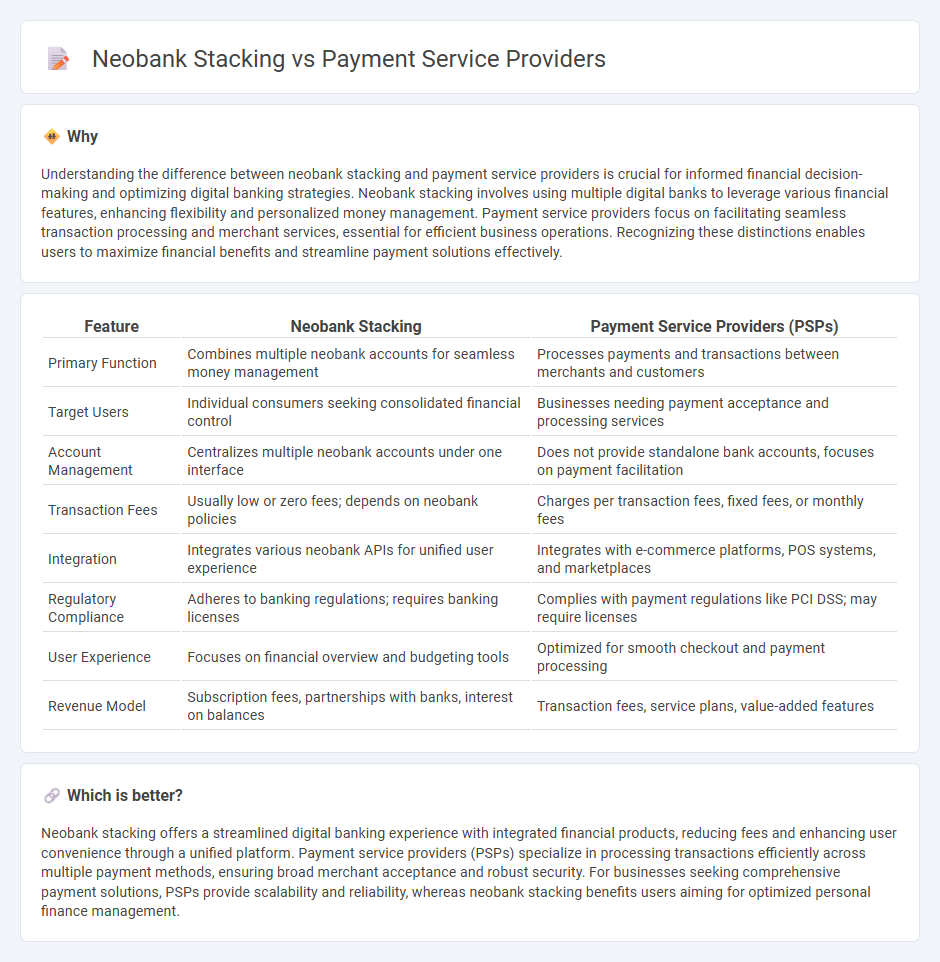

Understanding the difference between neobank stacking and payment service providers is crucial for informed financial decision-making and optimizing digital banking strategies. Neobank stacking involves using multiple digital banks to leverage various financial features, enhancing flexibility and personalized money management. Payment service providers focus on facilitating seamless transaction processing and merchant services, essential for efficient business operations. Recognizing these distinctions enables users to maximize financial benefits and streamline payment solutions effectively.

Comparison Table

| Feature | Neobank Stacking | Payment Service Providers (PSPs) |

|---|---|---|

| Primary Function | Combines multiple neobank accounts for seamless money management | Processes payments and transactions between merchants and customers |

| Target Users | Individual consumers seeking consolidated financial control | Businesses needing payment acceptance and processing services |

| Account Management | Centralizes multiple neobank accounts under one interface | Does not provide standalone bank accounts, focuses on payment facilitation |

| Transaction Fees | Usually low or zero fees; depends on neobank policies | Charges per transaction fees, fixed fees, or monthly fees |

| Integration | Integrates various neobank APIs for unified user experience | Integrates with e-commerce platforms, POS systems, and marketplaces |

| Regulatory Compliance | Adheres to banking regulations; requires banking licenses | Complies with payment regulations like PCI DSS; may require licenses |

| User Experience | Focuses on financial overview and budgeting tools | Optimized for smooth checkout and payment processing |

| Revenue Model | Subscription fees, partnerships with banks, interest on balances | Transaction fees, service plans, value-added features |

Which is better?

Neobank stacking offers a streamlined digital banking experience with integrated financial products, reducing fees and enhancing user convenience through a unified platform. Payment service providers (PSPs) specialize in processing transactions efficiently across multiple payment methods, ensuring broad merchant acceptance and robust security. For businesses seeking comprehensive payment solutions, PSPs provide scalability and reliability, whereas neobank stacking benefits users aiming for optimized personal finance management.

Connection

Neobank stacking integrates multiple financial services within a single platform, enabling seamless transactions and account management through payment service providers (PSPs). Payment service providers facilitate real-time payment processing and security protocols, which neobanks leverage to offer instant transfers, digital wallets, and personalized financial products. This synergy enhances customer experience by combining neobanks' user-centric interfaces with PSPs' robust payment infrastructures.

Key Terms

Transaction Processing

Payment service providers excel in seamless transaction processing by integrating multiple payment methods and ensuring rapid authorization and settlement. Neobank stacking enhances user experience by layering digital banking services atop traditional transaction systems, enabling real-time tracking and personalized insights. Discover how transaction processing innovations drive efficiency and customer satisfaction in modern financial ecosystems.

Digital Banking Integration

Payment service providers offer seamless transaction processing and API integration, facilitating efficient payment acceptance across various platforms. Neobank stacking enhances digital banking integration by combining multiple banking services within a single interface, delivering a unified user experience and real-time financial management. Explore how these innovations transform digital banking ecosystems and drive customer-centric solutions.

Regulatory Compliance

Payment service providers (PSPs) and neobank stacking face distinct regulatory compliance challenges, with PSPs required to adhere to payment-specific frameworks such as PSD2 and AML directives, while neobanks must comply with broader banking regulations including capital adequacy and customer due diligence. PSPs often focus on secure transaction processing and data protection standards, whereas neobanks navigate complex licensing, deposit insurance, and anti-money laundering laws. Explore the detailed regulatory differences and compliance strategies to optimize your financial service operations.

Source and External Links

15 Online Payment Service Providers You Need to Know - Payment service providers (PSPs) like PayPal, Stripe, Square, and Authorize.net enable businesses to accept various payment methods including credit/debit cards and digital wallets while offering services like transaction reporting and fraud protection.

The 8 Best Payment Processing Systems - PSPs such as Square, Adyen, and GoCardless provide solutions for both in-person and online payments, supporting multiple channels for seamless money transfers for businesses of all sizes.

What is a Payment Service Provider? - PSPs act as third-party intermediaries between businesses and banks/card networks to securely process payments, offering additional services like fraud protection and easy integration, which simplifies accepting payments especially for small businesses.

dowidth.com

dowidth.com