Unretirement allows older workers to rejoin the workforce full-time or part-time after retiring, boosting personal income and contributing to economic growth. Partial pension schemes enable retirees to receive a portion of their pension while continuing to earn wages, balancing financial stability with ongoing employment. Explore how unretirement and partial pensions are reshaping retirement economics and workforce dynamics.

Why it is important

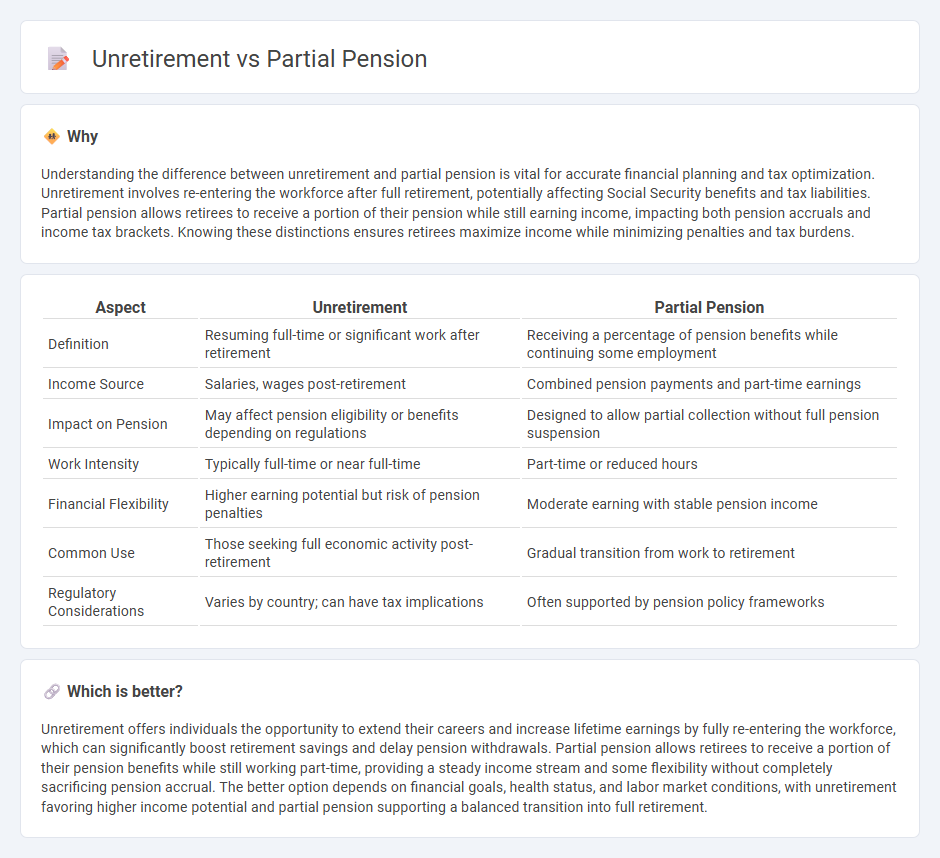

Understanding the difference between unretirement and partial pension is vital for accurate financial planning and tax optimization. Unretirement involves re-entering the workforce after full retirement, potentially affecting Social Security benefits and tax liabilities. Partial pension allows retirees to receive a portion of their pension while still earning income, impacting both pension accruals and income tax brackets. Knowing these distinctions ensures retirees maximize income while minimizing penalties and tax burdens.

Comparison Table

| Aspect | Unretirement | Partial Pension |

|---|---|---|

| Definition | Resuming full-time or significant work after retirement | Receiving a percentage of pension benefits while continuing some employment |

| Income Source | Salaries, wages post-retirement | Combined pension payments and part-time earnings |

| Impact on Pension | May affect pension eligibility or benefits depending on regulations | Designed to allow partial collection without full pension suspension |

| Work Intensity | Typically full-time or near full-time | Part-time or reduced hours |

| Financial Flexibility | Higher earning potential but risk of pension penalties | Moderate earning with stable pension income |

| Common Use | Those seeking full economic activity post-retirement | Gradual transition from work to retirement |

| Regulatory Considerations | Varies by country; can have tax implications | Often supported by pension policy frameworks |

Which is better?

Unretirement offers individuals the opportunity to extend their careers and increase lifetime earnings by fully re-entering the workforce, which can significantly boost retirement savings and delay pension withdrawals. Partial pension allows retirees to receive a portion of their pension benefits while still working part-time, providing a steady income stream and some flexibility without completely sacrificing pension accrual. The better option depends on financial goals, health status, and labor market conditions, with unretirement favoring higher income potential and partial pension supporting a balanced transition into full retirement.

Connection

Unretirement and partial pension are interconnected as partial pension schemes enable retirees to re-enter the workforce without forfeiting their entire pension benefits, promoting financial stability and workforce participation among older adults. This connection supports economic growth by leveraging experienced labor while easing pension system burdens. Partial pension arrangements thus create flexibility in retirement planning, encouraging extended employment and mitigating the risk of insufficient retirement income.

Key Terms

Eligibility Criteria

Partial pension eligibility often requires meeting specific age and work history thresholds, typically allowing retirees to draw a percentage of their pension while continuing limited employment. Unretirement eligibility focuses on individuals re-entering the workforce after full retirement, usually without restrictions on pension benefits but with considerations for income limits and tax implications. Explore detailed eligibility criteria and benefits of partial pension versus unretirement to make informed financial decisions.

Income Adjustment

Partial pension allows retirees to receive a reduced pension benefit while continuing to work, which results in a balanced income adjustment that supports financial stability without fully sacrificing current earnings. Unretirement refers to the act of returning to work after retirement, often requiring careful income recalibration to manage both earned income and pension benefits effectively. Explore deeper insights on optimizing income strategies related to partial pension and unretirement to maximize financial benefits.

Labor Force Participation

Partial pension schemes enable retirees to receive a portion of their retirement benefits while continuing to work, fostering increased labor force participation among older adults. In contrast, unretirement refers to the phenomenon where individuals retire fully and then re-enter the workforce, often due to financial necessity or personal fulfillment, which can complicate labor market dynamics. Explore the detailed impacts of these pathways on workforce demographics and economic productivity.

Source and External Links

What is partial retirement? - Knowledge Base - NHSBSA - Partial retirement allows NHS Pension Scheme members who have reached minimum pension age to take some or all of their pension benefits without fully retiring, provided they reduce their pensionable pay by at least 10% and meet specific criteria.

Glossary: Partial retirement pension - Statistics Explained - Partial retirement pension refers to periodic payments to individuals above retirement age who continue paid employment with reduced hours or income, typically receiving a portion of a full retirement pension.

Partial Lump Sum Payment Option - This option allows pensioners to receive a lump sum payment in exchange for a reduced monthly pension, by electing to take between 1% and 10% of their pension as a lump sum while continuing to receive monthly benefits.

dowidth.com

dowidth.com