Zombie companies, characterized by their inability to cover debt servicing costs from profits, perpetuate economic inefficiencies and limit market dynamism, contrasting sharply with FAANG companies--Facebook, Amazon, Apple, Netflix, and Google--that drive innovation, growth, and substantial market capitalization. While zombie companies often survive through low-interest rates and creditor forbearance, FAANG firms leverage cutting-edge technology and vast consumer bases to expand their dominance and influence global economic trends. Discover how these contrasting entities shape the modern economy and impact future investment landscapes.

Why it is important

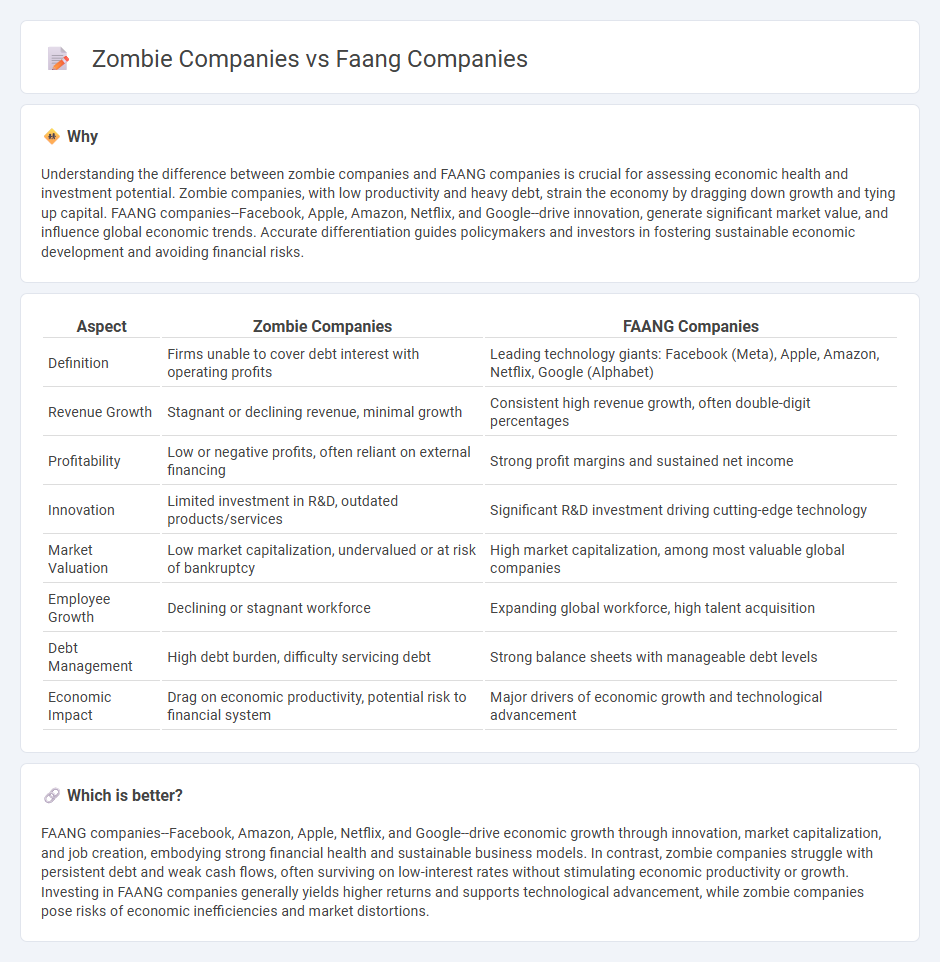

Understanding the difference between zombie companies and FAANG companies is crucial for assessing economic health and investment potential. Zombie companies, with low productivity and heavy debt, strain the economy by dragging down growth and tying up capital. FAANG companies--Facebook, Apple, Amazon, Netflix, and Google--drive innovation, generate significant market value, and influence global economic trends. Accurate differentiation guides policymakers and investors in fostering sustainable economic development and avoiding financial risks.

Comparison Table

| Aspect | Zombie Companies | FAANG Companies |

|---|---|---|

| Definition | Firms unable to cover debt interest with operating profits | Leading technology giants: Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet) |

| Revenue Growth | Stagnant or declining revenue, minimal growth | Consistent high revenue growth, often double-digit percentages |

| Profitability | Low or negative profits, often reliant on external financing | Strong profit margins and sustained net income |

| Innovation | Limited investment in R&D, outdated products/services | Significant R&D investment driving cutting-edge technology |

| Market Valuation | Low market capitalization, undervalued or at risk of bankruptcy | High market capitalization, among most valuable global companies |

| Employee Growth | Declining or stagnant workforce | Expanding global workforce, high talent acquisition |

| Debt Management | High debt burden, difficulty servicing debt | Strong balance sheets with manageable debt levels |

| Economic Impact | Drag on economic productivity, potential risk to financial system | Major drivers of economic growth and technological advancement |

Which is better?

FAANG companies--Facebook, Amazon, Apple, Netflix, and Google--drive economic growth through innovation, market capitalization, and job creation, embodying strong financial health and sustainable business models. In contrast, zombie companies struggle with persistent debt and weak cash flows, often surviving on low-interest rates without stimulating economic productivity or growth. Investing in FAANG companies generally yields higher returns and supports technological advancement, while zombie companies pose risks of economic inefficiencies and market distortions.

Connection

Zombie companies, characterized by their inability to cover debt servicing costs, and FAANG companies (Facebook, Apple, Amazon, Netflix, Google) influence the economy differently but intersect through capital allocation and market dynamics. FAANG firms, with strong cash flows and innovation, attract significant investment, potentially crowding out capital that could support struggling zombie companies and affecting overall economic productivity. The disparity between resource allocation to high-growth tech giants and the persistence of inefficient zombie firms reflects challenges in market efficiency and economic growth sustainability.

Key Terms

Profitability

FAANG companies consistently demonstrate robust profitability driven by high revenue growth, scalable business models, and strong market demand in technology sectors. In contrast, zombie companies survive primarily through debt refinancing with minimal or negative profits, lacking the financial health to invest in innovation or expansion. Explore more to understand how profitability differentiates market leaders from struggling firms.

Innovation

FAANG companies--Facebook, Amazon, Apple, Netflix, and Google--dominate the tech industry by investing heavily in research and development, consistently pushing the boundaries of innovation with advancements in artificial intelligence, cloud computing, and consumer technology. Zombie companies, on the other hand, often lack sustainable innovation, surviving primarily on debt and struggling to generate significant growth or competitive advantage. Explore how the innovation strategies of FAANG firms set industry standards and define the future of technology.

Debt Sustainability

FAANG companies maintain robust balance sheets with manageable debt levels and strong cash flow, ensuring high debt sustainability and investment-grade credit ratings. In contrast, zombie companies struggle with excessive debt burdens, relying on low interest rates to service obligations without generating sufficient profits to reduce principal, leading to heightened default risks. Explore deeper insights on how debt sustainability differentiates tech giants from vulnerable firms in evolving markets.

Source and External Links

What are FAANG Companies? - Quartr Insights - This article discusses the FAANG companies, which include Meta, Amazon, Apple, Netflix, and Google, highlighting their market dominance and diversity across various sectors.

What are FAANG Companies? - Pesto Tech - This article provides an introduction to FAANG companies--Facebook, Amazon, Apple, Netflix, and Google (now Alphabet)--examining their impact, innovative approach, and future prospects.

FAANG Stocks: Investing in the Future of Tech - Business Insider - This piece explains the concept of FAANG stocks, focusing on Facebook, Amazon, Apple, Netflix, and Google, and their significant influence on the stock market and economy.

dowidth.com

dowidth.com