Revenge spending describes the surge in consumer purchases following periods of restricted economic activity, driven by pent-up demand and emotional responses. In contrast, the income effect explains changes in spending behavior resulting from variations in disposable income, impacting consumers' purchasing power. Explore how these concepts influence economic recovery and consumer trends in greater detail.

Why it is important

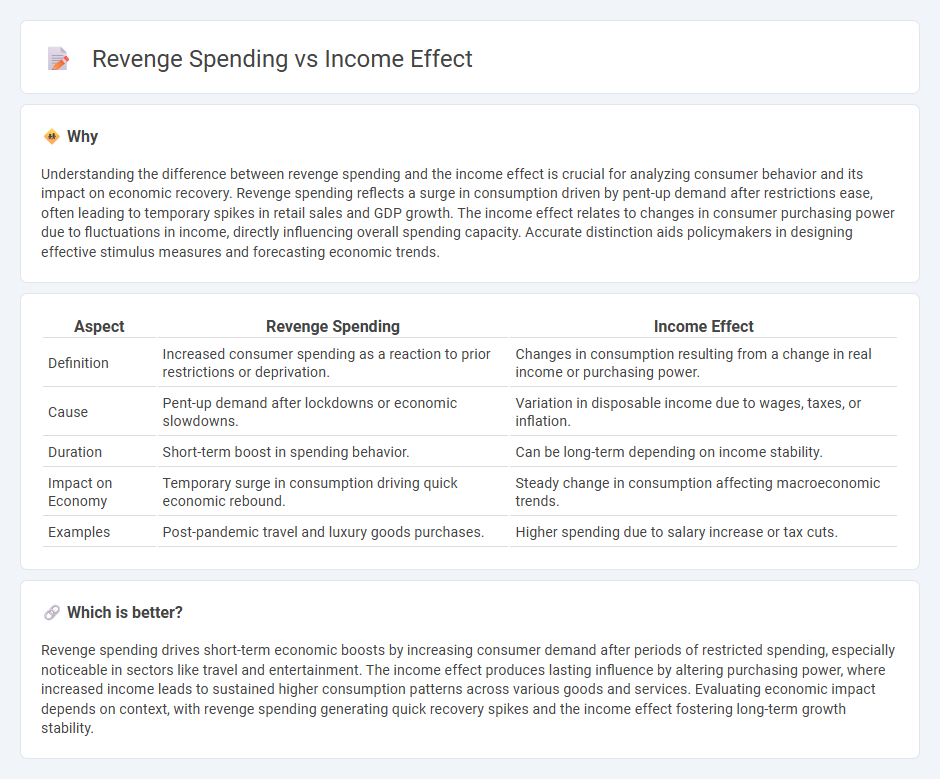

Understanding the difference between revenge spending and the income effect is crucial for analyzing consumer behavior and its impact on economic recovery. Revenge spending reflects a surge in consumption driven by pent-up demand after restrictions ease, often leading to temporary spikes in retail sales and GDP growth. The income effect relates to changes in consumer purchasing power due to fluctuations in income, directly influencing overall spending capacity. Accurate distinction aids policymakers in designing effective stimulus measures and forecasting economic trends.

Comparison Table

| Aspect | Revenge Spending | Income Effect |

|---|---|---|

| Definition | Increased consumer spending as a reaction to prior restrictions or deprivation. | Changes in consumption resulting from a change in real income or purchasing power. |

| Cause | Pent-up demand after lockdowns or economic slowdowns. | Variation in disposable income due to wages, taxes, or inflation. |

| Duration | Short-term boost in spending behavior. | Can be long-term depending on income stability. |

| Impact on Economy | Temporary surge in consumption driving quick economic rebound. | Steady change in consumption affecting macroeconomic trends. |

| Examples | Post-pandemic travel and luxury goods purchases. | Higher spending due to salary increase or tax cuts. |

Which is better?

Revenge spending drives short-term economic boosts by increasing consumer demand after periods of restricted spending, especially noticeable in sectors like travel and entertainment. The income effect produces lasting influence by altering purchasing power, where increased income leads to sustained higher consumption patterns across various goods and services. Evaluating economic impact depends on context, with revenge spending generating quick recovery spikes and the income effect fostering long-term growth stability.

Connection

Revenge spending, a surge in consumer purchases following periods of restricted spending, is closely linked to the income effect, where changes in income alter consumers' purchasing power. When individuals experience increased disposable income, they tend to spend more, amplifying revenge spending behaviors as pent-up demand is released. This dynamic interaction drives economic growth by boosting consumption and stimulating retail sectors in the aftermath of economic slowdowns or restrictions.

Key Terms

Consumer Behavior

Income effect influences consumer behavior by altering purchasing power due to changes in income levels, leading to adjustments in spending patterns on normal and inferior goods. Revenge spending reflects a psychological response where consumers indulge in increased discretionary purchases to compensate for past restrictions or emotional deprivation, often seen after economic downturns or crises. Explore more about how these contrasting factors shape consumer decision-making and retail trends.

Disposable Income

Disposable income significantly influences both income effect and revenge spending behaviors, determining consumer purchasing power after taxes and necessary expenses. The income effect describes changes in consumption patterns as disposable income fluctuates, while revenge spending reflects increased discretionary spending driven by pent-up demand and emotional factors. Explore how disposable income dynamics shape these consumption trends in detail.

Marginal Propensity to Consume

The income effect refers to changes in consumer spending driven by variations in income levels, while revenge spending describes the surge in consumption after periods of restricted spending, often due to external constraints like lockdowns. Marginal Propensity to Consume (MPC) quantifies how much additional income leads to increased consumption, typically higher during revenge spending as consumers attempt to reclaim lost experiences. Explore more insights on how MPC influences behavioral economics and consumer decision-making.

Source and External Links

Income Effect in Economics | Definition & Examples - Lesson - The income effect describes how a consumer's demand changes as their net income increases or decreases, influencing spending habits and desires, and also relates to how changes in prices affect real disposable income and demand.

Income Effect - Definition, Example, Analysis - The income effect refers to the change in demand for a good caused by a change in consumer income, with examples showing how income increases can have similar effects to price decreases on consumption patterns.

Income-consumption curve - Wikipedia - The income effect in economics is the change in consumption resulting from a change in real income, reflected in how budget lines shift outward and new optimal consumption bundles are chosen as income changes.

dowidth.com

dowidth.com