Shrinkflation occurs when product sizes or quantities decrease while prices remain constant, effectively increasing the cost per unit without apparent price hikes. Price gouging involves raising prices significantly during periods of high demand or limited supply, often seen in emergencies or crises. Explore detailed differences and economic implications to better understand consumer impacts and market dynamics.

Why it is important

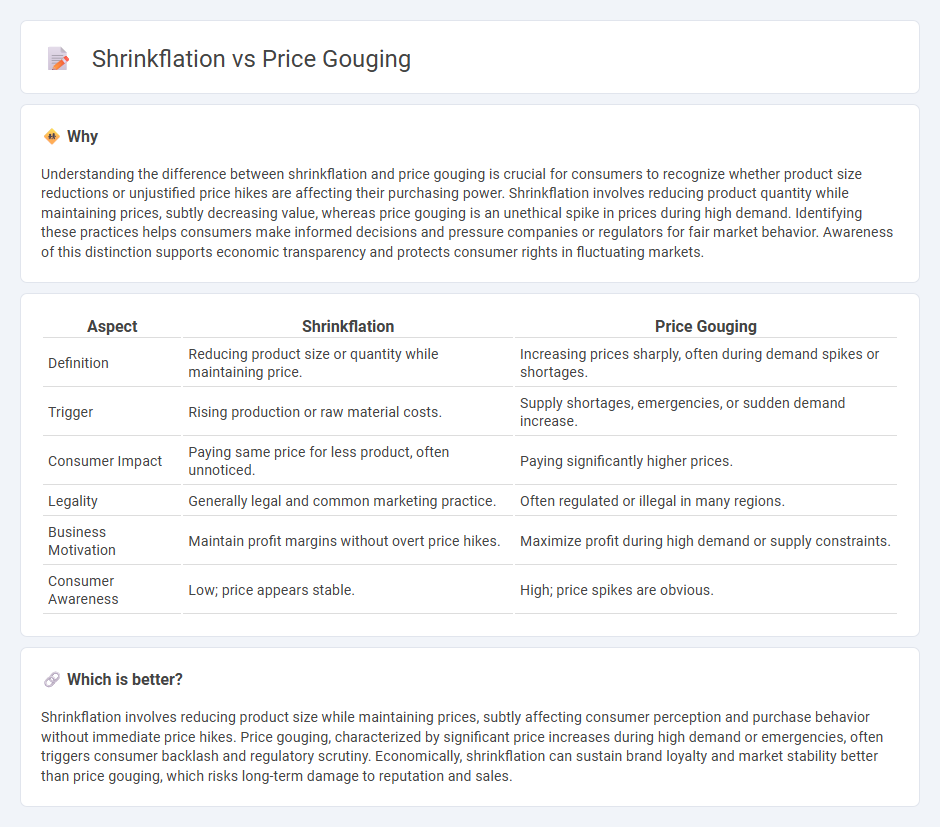

Understanding the difference between shrinkflation and price gouging is crucial for consumers to recognize whether product size reductions or unjustified price hikes are affecting their purchasing power. Shrinkflation involves reducing product quantity while maintaining prices, subtly decreasing value, whereas price gouging is an unethical spike in prices during high demand. Identifying these practices helps consumers make informed decisions and pressure companies or regulators for fair market behavior. Awareness of this distinction supports economic transparency and protects consumer rights in fluctuating markets.

Comparison Table

| Aspect | Shrinkflation | Price Gouging |

|---|---|---|

| Definition | Reducing product size or quantity while maintaining price. | Increasing prices sharply, often during demand spikes or shortages. |

| Trigger | Rising production or raw material costs. | Supply shortages, emergencies, or sudden demand increase. |

| Consumer Impact | Paying same price for less product, often unnoticed. | Paying significantly higher prices. |

| Legality | Generally legal and common marketing practice. | Often regulated or illegal in many regions. |

| Business Motivation | Maintain profit margins without overt price hikes. | Maximize profit during high demand or supply constraints. |

| Consumer Awareness | Low; price appears stable. | High; price spikes are obvious. |

Which is better?

Shrinkflation involves reducing product size while maintaining prices, subtly affecting consumer perception and purchase behavior without immediate price hikes. Price gouging, characterized by significant price increases during high demand or emergencies, often triggers consumer backlash and regulatory scrutiny. Economically, shrinkflation can sustain brand loyalty and market stability better than price gouging, which risks long-term damage to reputation and sales.

Connection

Shrinkflation and price gouging both represent covert methods companies use to increase profit margins amid rising production costs or inflation. Shrinkflation reduces product size or quantity while maintaining prices, subtly decreasing consumer value, whereas price gouging directly raises prices beyond fair market value during high demand or shortages. Both practices negatively impact consumer purchasing power and trust, contributing to economic inflationary pressures.

Key Terms

Supply and Demand

Price gouging occurs when sellers significantly raise prices during high demand or limited supply, exploiting urgent consumer needs. Shrinkflation involves maintaining stable prices while reducing product quantity or size, subtly impacting consumer purchasing power amid supply constraints. Explore further to understand how these market dynamics affect consumer behavior and economic stability.

Consumer Protection

Price gouging involves sharp, often unfair, increases in product prices during emergencies, while shrinkflation refers to reducing product size or quantity without lowering prices, effectively raising the unit cost. Consumer protection laws aim to prevent price gouging through regulatory caps and penalties, but shrinkflation remains harder to regulate due to its subtle nature. Explore how consumer rights groups and legislation tackle these practices to better safeguard buyers.

Inflation

Price gouging and shrinkflation are inflation-related phenomena impacting consumer costs differently; price gouging involves retailers dramatically increasing prices during high demand or shortages, while shrinkflation reduces product size or quantity without lowering price, effectively raising the unit cost. Both practices distort market value perceptions and drive inflationary pressures by limiting consumer purchasing power even when nominal prices seem stable. Explore deeper insights into how these tactics influence inflation metrics and consumer behavior in various economic conditions.

Source and External Links

What Is Price Gouging, and Is It Criminal? - Price gouging is when sellers raise prices excessively on essential goods during a declared state of emergency, and while federal law does not prohibit it, many U.S. states have laws forbidding this practice to protect consumers during crises like natural disasters or the COVID-19 pandemic.

Price gouging - Price gouging describes sharply increasing prices on essential goods temporarily, typically during emergencies, and is regulated by laws in the U.S. and Canada; it became prominent during the COVID-19 pandemic due to widespread shortages and increased demand.

Price Gouging Complaint - Price gouging is illegal under North Carolina law when declared emergencies occur, allowing the Attorney General to stop such acts and impose penalties, including refunds to consumers and fines up to $5,000 per violation.

dowidth.com

dowidth.com