Global shifts in economic power have spurred debates on de-dollarization and de-yuanization as nations seek to reduce reliance on the US dollar and Chinese yuan in international trade and finance. De-dollarization involves strategies like expanding alternative currency reserves and creating regional payment systems, while de-yuanization reflects concerns over China's geopolitical influence and economic policies. Explore the evolving dynamics of currency dominance and their implications for global markets.

Why it is important

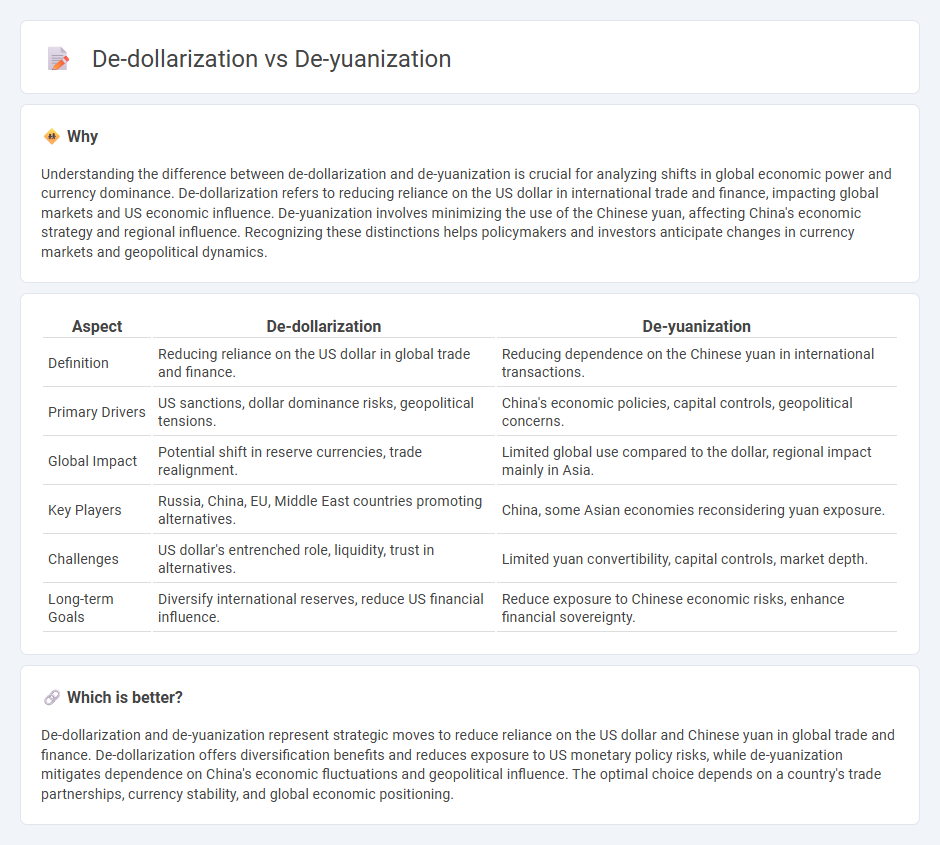

Understanding the difference between de-dollarization and de-yuanization is crucial for analyzing shifts in global economic power and currency dominance. De-dollarization refers to reducing reliance on the US dollar in international trade and finance, impacting global markets and US economic influence. De-yuanization involves minimizing the use of the Chinese yuan, affecting China's economic strategy and regional influence. Recognizing these distinctions helps policymakers and investors anticipate changes in currency markets and geopolitical dynamics.

Comparison Table

| Aspect | De-dollarization | De-yuanization |

|---|---|---|

| Definition | Reducing reliance on the US dollar in global trade and finance. | Reducing dependence on the Chinese yuan in international transactions. |

| Primary Drivers | US sanctions, dollar dominance risks, geopolitical tensions. | China's economic policies, capital controls, geopolitical concerns. |

| Global Impact | Potential shift in reserve currencies, trade realignment. | Limited global use compared to the dollar, regional impact mainly in Asia. |

| Key Players | Russia, China, EU, Middle East countries promoting alternatives. | China, some Asian economies reconsidering yuan exposure. |

| Challenges | US dollar's entrenched role, liquidity, trust in alternatives. | Limited yuan convertibility, capital controls, market depth. |

| Long-term Goals | Diversify international reserves, reduce US financial influence. | Reduce exposure to Chinese economic risks, enhance financial sovereignty. |

Which is better?

De-dollarization and de-yuanization represent strategic moves to reduce reliance on the US dollar and Chinese yuan in global trade and finance. De-dollarization offers diversification benefits and reduces exposure to US monetary policy risks, while de-yuanization mitigates dependence on China's economic fluctuations and geopolitical influence. The optimal choice depends on a country's trade partnerships, currency stability, and global economic positioning.

Connection

De-dollarization and de-yuanization reflect global shifts as countries diversify foreign reserves to reduce reliance on dominant currencies like the US dollar and Chinese yuan. Both processes are driven by geopolitical tensions, currency volatility, and a desire for national economic sovereignty in international trade and finance. The interconnected movement influences global currency markets, prompting central banks to explore alternative reserves and bilateral trade agreements.

Key Terms

Reserve Currency

De-yuanization and de-dollarization represent strategic shifts in global reserve currency preferences, with de-dollarization highlighting the gradual reduction of the US dollar's dominance in central bank reserves, while de-yuanization involves countries limiting holdings of the Chinese yuan due to geopolitical or economic concerns. Central banks worldwide hold approximately 59% of their reserves in US dollars, compared to around 3% in yuan, reflecting the prevailing trust and liquidity in the dollar as a reserve currency. Explore comprehensive analysis on how these dynamics reshape international financial stability and reserve diversification strategies.

Currency Swap Agreements

Currency swap agreements serve as strategic tools in both de-yuanization and de-dollarization efforts, enabling countries to bypass dominant currencies like the Chinese yuan and US dollar in bilateral trade. These agreements facilitate direct currency exchanges, reducing dependence on global reserve currencies and enhancing monetary sovereignty. Explore how these swap mechanisms reshape global financial relationships and impact currency dominance dynamics.

Financial Sanctions

De-yuanization and de-dollarization are financial strategies aimed at reducing reliance on the Chinese yuan and US dollar, respectively, in international trade and finance, particularly in response to financial sanctions imposed by these nations. De-dollarization has gained momentum as countries seek alternatives to the dollar to avoid US financial sanctions and protect their economic sovereignty, while de-yuanization is emerging as nations reconsider the yuan's stability and geopolitical implications amid China's stricter regulatory policies. Explore the nuances and impacts of these currency shifts on global economic power dynamics and sanction evasion strategies.

Source and External Links

China's De-dollarization Mechanisms within the Yuan Internationalization Strategy - De-dollarization is a key part of China's strategy to promote the yuan internationally, including mechanisms like offshore yuan operations and the development of Hong Kong as the primary offshore yuan market, enabling yuan-denominated trade and financial transactions outside mainland China.

De-dollarization and Emergence of Chinese Yuan - De-dollarization refers to the global trend of countries reducing their reliance on the US dollar for trade and payments, with examples including Pakistan and Argentina increasingly using the yuan for major international transactions, signaling a shift toward alternative currencies and challenging the dollar's dominance.

The Risks of Russia's Growing Dependence on the Yuan - Russia's de-dollarization has effectively turned into "yuanization," as it accumulates yuan reserves and relies on the yuan for trade payments, which introduces new economic vulnerabilities connected to Chinese monetary policies and geopolitical relations.

dowidth.com

dowidth.com