Shadow bailouts involve indirect financial support to distressed institutions without overt government intervention, often utilizing off-balance-sheet mechanisms to stabilize markets. Quantitative easing (QE) refers to central banks purchasing assets to increase money supply and lower interest rates, aiming to stimulate economic growth during downturns. Discover how these contrasting approaches impact financial stability and economic recovery strategies.

Why it is important

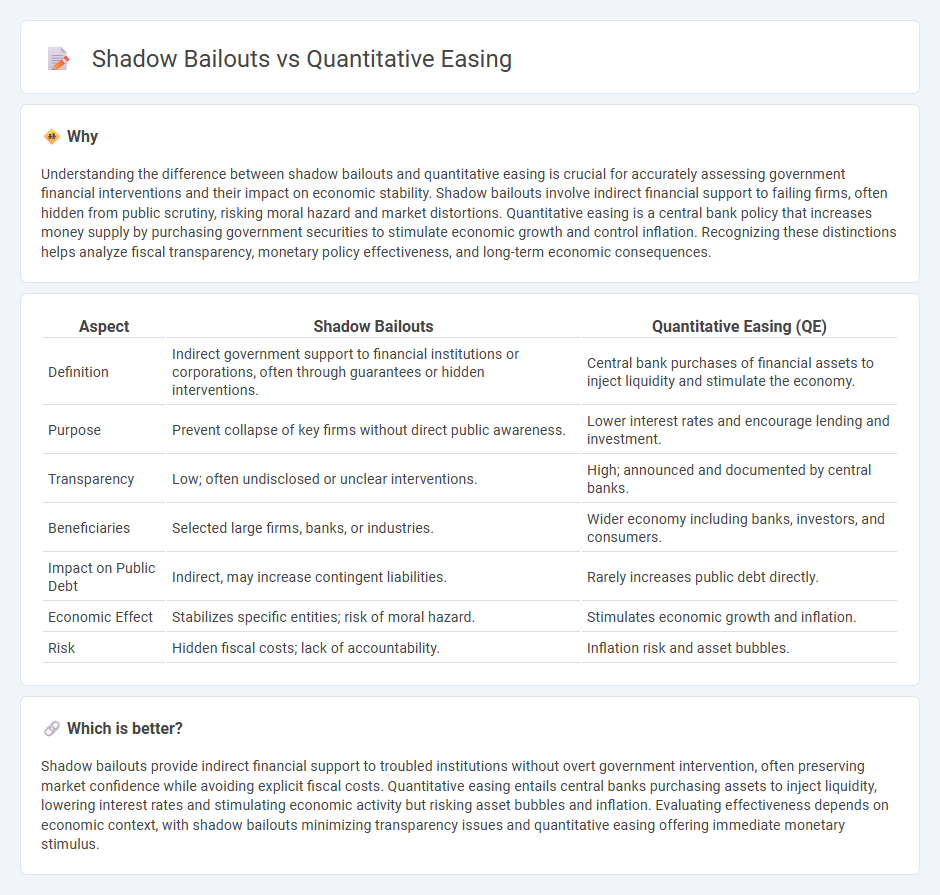

Understanding the difference between shadow bailouts and quantitative easing is crucial for accurately assessing government financial interventions and their impact on economic stability. Shadow bailouts involve indirect financial support to failing firms, often hidden from public scrutiny, risking moral hazard and market distortions. Quantitative easing is a central bank policy that increases money supply by purchasing government securities to stimulate economic growth and control inflation. Recognizing these distinctions helps analyze fiscal transparency, monetary policy effectiveness, and long-term economic consequences.

Comparison Table

| Aspect | Shadow Bailouts | Quantitative Easing (QE) |

|---|---|---|

| Definition | Indirect government support to financial institutions or corporations, often through guarantees or hidden interventions. | Central bank purchases of financial assets to inject liquidity and stimulate the economy. |

| Purpose | Prevent collapse of key firms without direct public awareness. | Lower interest rates and encourage lending and investment. |

| Transparency | Low; often undisclosed or unclear interventions. | High; announced and documented by central banks. |

| Beneficiaries | Selected large firms, banks, or industries. | Wider economy including banks, investors, and consumers. |

| Impact on Public Debt | Indirect, may increase contingent liabilities. | Rarely increases public debt directly. |

| Economic Effect | Stabilizes specific entities; risk of moral hazard. | Stimulates economic growth and inflation. |

| Risk | Hidden fiscal costs; lack of accountability. | Inflation risk and asset bubbles. |

Which is better?

Shadow bailouts provide indirect financial support to troubled institutions without overt government intervention, often preserving market confidence while avoiding explicit fiscal costs. Quantitative easing entails central banks purchasing assets to inject liquidity, lowering interest rates and stimulating economic activity but risking asset bubbles and inflation. Evaluating effectiveness depends on economic context, with shadow bailouts minimizing transparency issues and quantitative easing offering immediate monetary stimulus.

Connection

Shadow bailouts and quantitative easing are interconnected through their roles in stabilizing financial markets during economic crises. Shadow bailouts involve indirect government support to failing institutions, often via central banks, while quantitative easing injects liquidity by purchasing government securities to lower interest rates. Both mechanisms aim to restore confidence, promote lending, and prevent systemic collapse without explicit fiscal expenditure.

Key Terms

Central Bank Balance Sheet

Quantitative easing expands the Central Bank balance sheet by purchasing government securities to inject liquidity and lower interest rates, boosting economic activity. Shadow bailouts involve indirect financial support through off-balance-sheet mechanisms or lending facilities that stabilize markets without explicit asset purchases. Explore the distinction between these strategies and their impact on monetary policy in detail.

Off-Balance Sheet Lending

Quantitative easing involves central banks purchasing financial assets to inject liquidity into the economy, whereas shadow bailouts refer to off-balance sheet lending practices by financial institutions to support troubled entities without direct disclosure. Off-balance sheet lending hides significant financial risks and liabilities from official reports, complicating transparency and regulatory oversight. Explore further to understand the impact of these mechanisms on financial stability and economic policy.

Liquidity Injection

Quantitative easing (QE) involves central banks purchasing government securities to inject liquidity directly into the financial system, stabilizing markets and encouraging lending. Shadow bailouts refer to indirect liquidity support through non-transparent mechanisms, such as guarantees or off-balance-sheet arrangements, which can obscure financial risks. Explore how these liquidity injection strategies impact economic stability and monetary policy effectiveness.

Source and External Links

Quantitative easing - Wikipedia - A monetary policy tool where central banks purchase long-term financial assets to inject liquidity, encourage lending, and stimulate economic activity when conventional policy rates are near zero.

How Quantitative Easing Actually Works | Chicago Booth Review - By buying large quantities of government and other bonds, central banks aim to lower yields, prompt portfolio rebalancing, and support real economic activity during crises.

Understanding quantitative easing - Bank of Canada - QE reduces borrowing costs to encourage spending and investment when interest rates are already low, and the policy is reversed via quantitative tightening once the economy stabilizes.

dowidth.com

dowidth.com