A polycrisis involves multiple, interconnected economic challenges that exacerbate instability, while a currency crisis specifically targets the value and stability of a nation's currency, often leading to rapid devaluation. Key factors in a currency crisis include loss of investor confidence, high foreign debt, and speculative attacks, whereas a polycrisis encompasses broader systemic risks like geopolitical tensions, supply chain disruptions, and inflationary pressures. Explore deeper insights to understand how these crises impact global economies and financial markets.

Why it is important

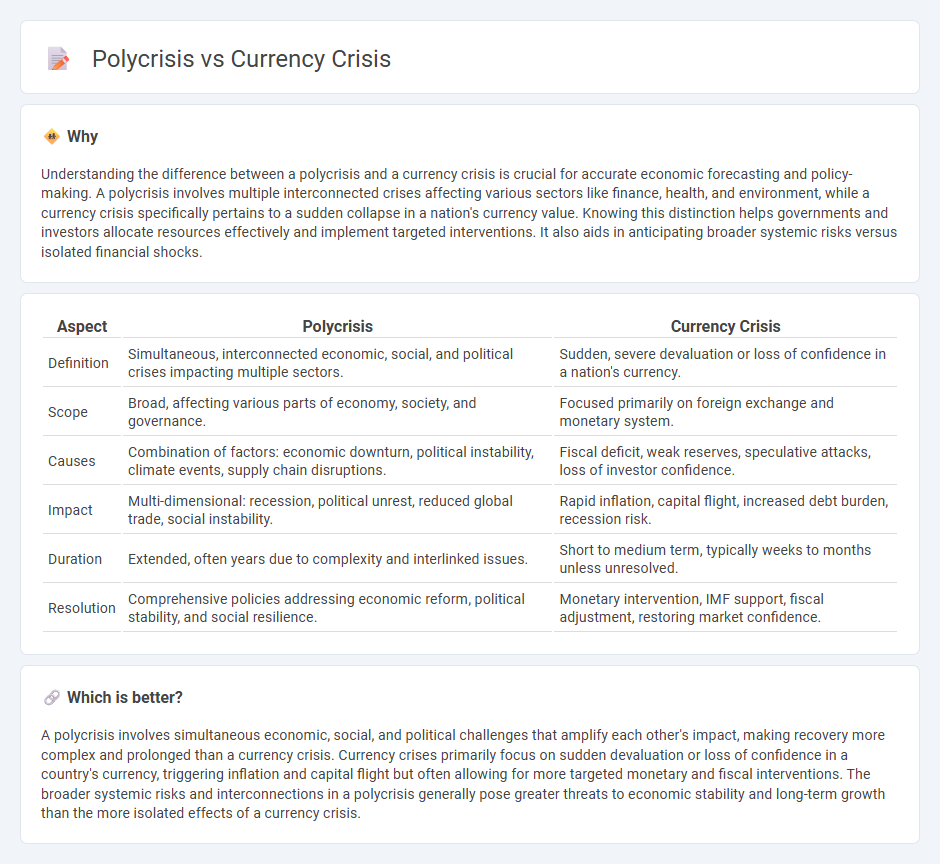

Understanding the difference between a polycrisis and a currency crisis is crucial for accurate economic forecasting and policy-making. A polycrisis involves multiple interconnected crises affecting various sectors like finance, health, and environment, while a currency crisis specifically pertains to a sudden collapse in a nation's currency value. Knowing this distinction helps governments and investors allocate resources effectively and implement targeted interventions. It also aids in anticipating broader systemic risks versus isolated financial shocks.

Comparison Table

| Aspect | Polycrisis | Currency Crisis |

|---|---|---|

| Definition | Simultaneous, interconnected economic, social, and political crises impacting multiple sectors. | Sudden, severe devaluation or loss of confidence in a nation's currency. |

| Scope | Broad, affecting various parts of economy, society, and governance. | Focused primarily on foreign exchange and monetary system. |

| Causes | Combination of factors: economic downturn, political instability, climate events, supply chain disruptions. | Fiscal deficit, weak reserves, speculative attacks, loss of investor confidence. |

| Impact | Multi-dimensional: recession, political unrest, reduced global trade, social instability. | Rapid inflation, capital flight, increased debt burden, recession risk. |

| Duration | Extended, often years due to complexity and interlinked issues. | Short to medium term, typically weeks to months unless unresolved. |

| Resolution | Comprehensive policies addressing economic reform, political stability, and social resilience. | Monetary intervention, IMF support, fiscal adjustment, restoring market confidence. |

Which is better?

A polycrisis involves simultaneous economic, social, and political challenges that amplify each other's impact, making recovery more complex and prolonged than a currency crisis. Currency crises primarily focus on sudden devaluation or loss of confidence in a country's currency, triggering inflation and capital flight but often allowing for more targeted monetary and fiscal interventions. The broader systemic risks and interconnections in a polycrisis generally pose greater threats to economic stability and long-term growth than the more isolated effects of a currency crisis.

Connection

Polycrisis amplifies economic instability by simultaneously triggering multiple systemic failures, which can erode investor confidence and disrupt financial markets, leading to a currency crisis. A currency crisis occurs when a nation's currency rapidly depreciates due to speculative attacks or loss of reserves, often exacerbated by the interconnected risks inherent in a polycrisis scenario. The combined effects undermine economic resilience, causing capital flight and inflation that deepen both crises.

Key Terms

**Currency Crisis:**

A currency crisis occurs when a nation's currency experiences a rapid and significant devaluation, often triggered by loss of investor confidence, large current account deficits, or insufficient foreign reserves. This can lead to inflation spikes, capital flight, and severe economic instability within the affected country. Explore the dynamics and preventive measures of currency crises for a deeper understanding.

Exchange Rate

A currency crisis occurs when a nation's exchange rate rapidly depreciates, triggering capital flight and economic instability. In contrast, a polycrisis involves multiple, interconnected crises, including exchange rate volatility, geopolitical tensions, and financial system weaknesses, amplifying systemic risk. Explore how exchange rate dynamics differ in currency crises versus polycrises for a deeper understanding.

Capital Flight

Currency crisis often triggers massive capital flight as investors rapidly withdraw assets to avoid devaluation and loss, destabilizing the national economy. In a polycrisis, capital flight is compounded by overlapping systemic risks like political instability, financial shocks, and environmental disasters, amplifying vulnerabilities across multiple sectors. Explore how capital flight shapes the dynamics of currency crisis and polycrisis for a deeper understanding.

Source and External Links

Currency Crisis - Definition, Signs, Inflation - A currency crisis occurs when a currency suddenly and unexpectedly loses substantial value relative to other currencies, often following financial or socio-political instability, and is typically preceded by rising inflation and inflation expectations.

Currency crisis - A currency crisis is a type of financial crisis often linked to real economic turmoil, marked by a sharp decline in the value of a nation's currency, speculative attacks in foreign exchange markets, and heightened risk of banking or default crises.

Lessons from history from three generations of currency crises - Currency crises often result from a loss of investor confidence in a government's ability to maintain fixed exchange rates, leading to capital flight and eventual devaluation, as seen in Latin America and Asia in the 1980s and 1990s.

dowidth.com

dowidth.com