Micro-dosing spending involves incremental, targeted injections of funds into specific sectors, aiming to stimulate economic activity without triggering inflation. Monetary injection, in contrast, refers to large-scale infusion of liquidity to boost overall market demand and liquidity ratios. Explore the detailed impacts of these fiscal strategies on economic stability and growth.

Why it is important

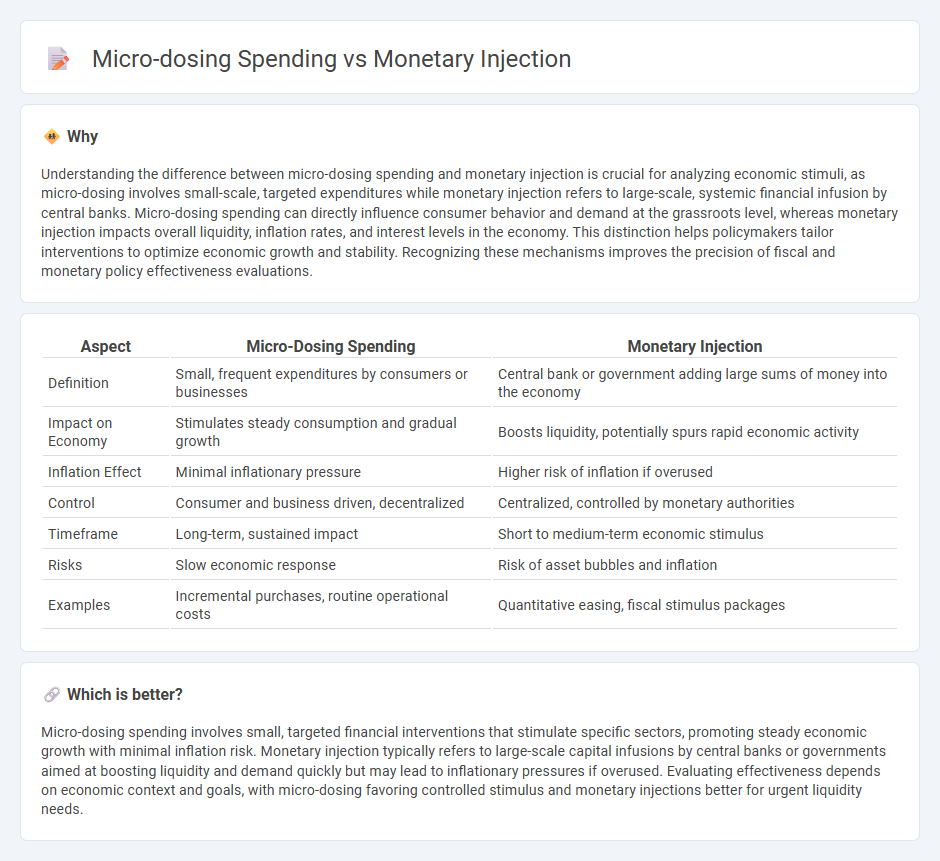

Understanding the difference between micro-dosing spending and monetary injection is crucial for analyzing economic stimuli, as micro-dosing involves small-scale, targeted expenditures while monetary injection refers to large-scale, systemic financial infusion by central banks. Micro-dosing spending can directly influence consumer behavior and demand at the grassroots level, whereas monetary injection impacts overall liquidity, inflation rates, and interest levels in the economy. This distinction helps policymakers tailor interventions to optimize economic growth and stability. Recognizing these mechanisms improves the precision of fiscal and monetary policy effectiveness evaluations.

Comparison Table

| Aspect | Micro-Dosing Spending | Monetary Injection |

|---|---|---|

| Definition | Small, frequent expenditures by consumers or businesses | Central bank or government adding large sums of money into the economy |

| Impact on Economy | Stimulates steady consumption and gradual growth | Boosts liquidity, potentially spurs rapid economic activity |

| Inflation Effect | Minimal inflationary pressure | Higher risk of inflation if overused |

| Control | Consumer and business driven, decentralized | Centralized, controlled by monetary authorities |

| Timeframe | Long-term, sustained impact | Short to medium-term economic stimulus |

| Risks | Slow economic response | Risk of asset bubbles and inflation |

| Examples | Incremental purchases, routine operational costs | Quantitative easing, fiscal stimulus packages |

Which is better?

Micro-dosing spending involves small, targeted financial interventions that stimulate specific sectors, promoting steady economic growth with minimal inflation risk. Monetary injection typically refers to large-scale capital infusions by central banks or governments aimed at boosting liquidity and demand quickly but may lead to inflationary pressures if overused. Evaluating effectiveness depends on economic context and goals, with micro-dosing favoring controlled stimulus and monetary injections better for urgent liquidity needs.

Connection

Micro-dosing spending involves incremental, targeted financial injections into specific sectors to stimulate economic activity without causing inflationary pressure. Monetary injection refers to the broader infusion of capital by central banks or governments to increase liquidity and encourage lending. Both strategies aim to optimize money flow within the economy, balancing growth stimulation with financial stability by carefully managing the timing and scale of expenditure.

Key Terms

Money Supply

Monetary injection increases the money supply rapidly through mechanisms such as quantitative easing and direct fiscal stimulus, leading to a significant boost in liquidity for economic activities. Micro-dosing spending, on the other hand, gradually expands money supply by small, controlled increments aimed at maintaining steady demand without triggering inflation. Explore more on how these monetary strategies impact inflation, economic growth, and financial stability.

Marginal Propensity to Consume

Monetary injection involves large-scale fiscal stimulus aimed at boosting economic activity, often resulting in varying Marginal Propensity to Consume (MPC) across income groups, with higher MPC typically observed in lower-income households. Micro-dosing spending refers to smaller, more frequent expenditures that can sustain consumer demand and stimulate economic growth through consistent marginal consumption increases. Explore how these strategies differentially impact MPC for targeted economic policies and optimal stimulus effectiveness.

Aggregate Demand

Monetary injection increases aggregate demand by boosting overall money supply, encouraging higher consumer and business spending. Micro-dosing spending targets specific sectors or demographics, leading to more efficient demand stimulation and reduced inflationary pressures. Explore how these strategies influence economic growth and policy outcomes in detail.

Source and External Links

Monetary stimulus: Through Wall Street or Main Street? - Monetary injection refers to an increase in the money circulating in the economy, which boosts funds available for loans at lower interest rates, intended to stimulate economic activity and spending through multiplier effects.

Long-Run and Short-Run Effects of Money Injections - Money injections can have short-term deflationary or inflationary effects and influence aggregate output; large injections tend to be inflationary and can produce lasting real effects through changes in the distribution of money holdings.

Monetary Injection and AD | Macroeconomics - A monetary injection occurs when a central bank increases the money supply, which typically causes interest rates to decrease, aiming to encourage borrowing and spending.

dowidth.com

dowidth.com