Dollarization refers to a country's use of the US dollar alongside or instead of its local currency, often stabilizing inflation and attracting foreign investment. Local currency adoption supports national economic sovereignty, enabling tailored monetary policies to address specific economic conditions and promote growth. Explore the implications of dollarization versus local currency adoption to understand their impact on economic stability and development.

Why it is important

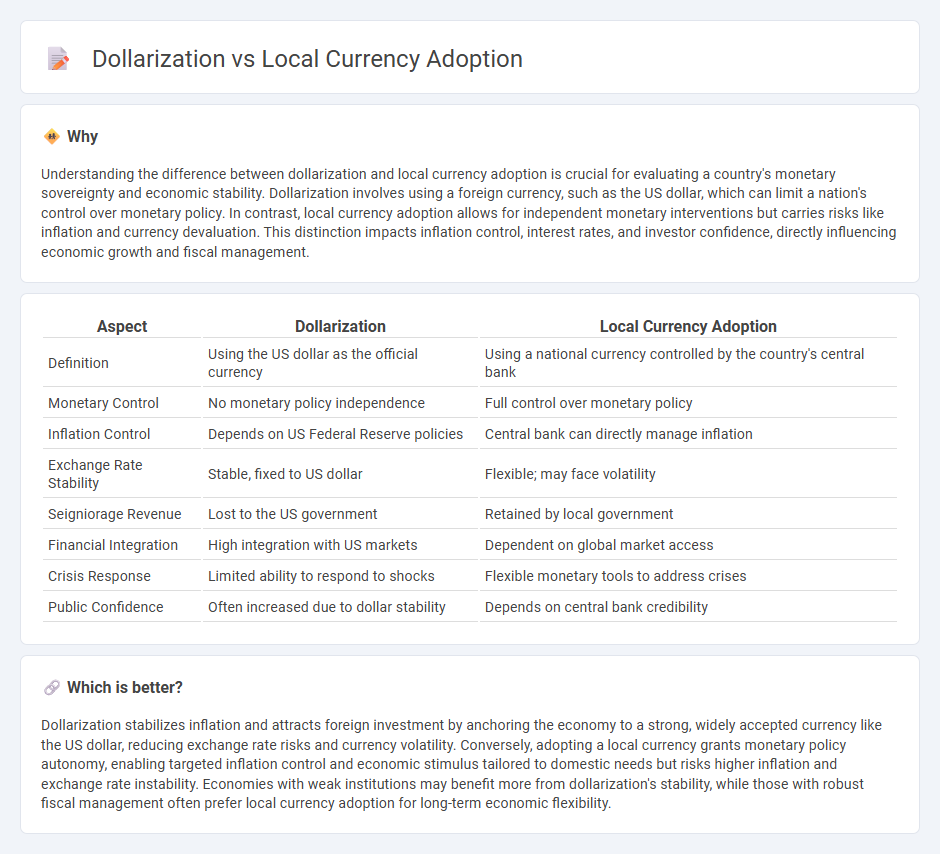

Understanding the difference between dollarization and local currency adoption is crucial for evaluating a country's monetary sovereignty and economic stability. Dollarization involves using a foreign currency, such as the US dollar, which can limit a nation's control over monetary policy. In contrast, local currency adoption allows for independent monetary interventions but carries risks like inflation and currency devaluation. This distinction impacts inflation control, interest rates, and investor confidence, directly influencing economic growth and fiscal management.

Comparison Table

| Aspect | Dollarization | Local Currency Adoption |

|---|---|---|

| Definition | Using the US dollar as the official currency | Using a national currency controlled by the country's central bank |

| Monetary Control | No monetary policy independence | Full control over monetary policy |

| Inflation Control | Depends on US Federal Reserve policies | Central bank can directly manage inflation |

| Exchange Rate Stability | Stable, fixed to US dollar | Flexible; may face volatility |

| Seigniorage Revenue | Lost to the US government | Retained by local government |

| Financial Integration | High integration with US markets | Dependent on global market access |

| Crisis Response | Limited ability to respond to shocks | Flexible monetary tools to address crises |

| Public Confidence | Often increased due to dollar stability | Depends on central bank credibility |

Which is better?

Dollarization stabilizes inflation and attracts foreign investment by anchoring the economy to a strong, widely accepted currency like the US dollar, reducing exchange rate risks and currency volatility. Conversely, adopting a local currency grants monetary policy autonomy, enabling targeted inflation control and economic stimulus tailored to domestic needs but risks higher inflation and exchange rate instability. Economies with weak institutions may benefit more from dollarization's stability, while those with robust fiscal management often prefer local currency adoption for long-term economic flexibility.

Connection

Dollarization influences local currency adoption by creating a dual currency environment that affects monetary policy effectiveness and inflation control. In economies with high dollarization, local currencies face reduced demand, leading governments to implement stabilization measures or reforms to encourage local currency usage. Understanding this connection is critical for formulating strategies that balance currency stability with economic growth.

Key Terms

Exchange Rate Stability

Local currency adoption often enhances exchange rate stability by allowing central banks to implement independent monetary policies tailored to domestic economic conditions, reducing vulnerability to external shocks. In contrast, dollarization fixes the exchange rate to the U.S. dollar, eliminating currency risk but sacrificing monetary policy autonomy and potentially exposing the economy to foreign economic fluctuations. Explore further to understand how these approaches impact financial stability and economic growth.

Monetary Policy Independence

Local currency adoption allows central banks to maintain autonomous monetary policy, enabling tailored inflation control and economic stabilization. Dollarization, while providing currency stability and reducing exchange rate risk, limits a country's ability to implement independent monetary policies. Explore the impacts of these approaches on economic sovereignty and financial resilience for deeper insights.

Currency Substitution

Currency substitution occurs when residents of a country use a foreign currency, typically the US dollar, in parallel with or instead of the local currency, affecting monetary policy effectiveness and financial stability. Local currency adoption aims to strengthen national identity and economic sovereignty but can face challenges like inflation and lack of trust, which often drive currency substitution. Explore the dynamics of currency substitution to understand its impacts on economies and the trade-offs between local currency use and dollarization.

Source and External Links

Local currency - Wikipedia - Local currencies are complementary to national money, aim to boost local spending, keep wealth within communities, and can increase economic activity without causing inflation when local capacity is underutilized.

Understanding the growing use of local currencies in cross-border payments - Groups like ASEAN and BRICS are advancing frameworks for local currency transactions in cross-border trade and payments, reducing reliance on major reserve currencies and promoting financial inclusion.

Local Currencies in the 21st Century - The local currency movement is innovating with consumer-credit systems, "Buy Local First" incentives, and no-interest loans to support community businesses and reduce dependence on imports.

dowidth.com

dowidth.com