Excess savings represent the surplus of household and corporate savings beyond typical levels, often accumulating during periods of economic uncertainty or reduced consumption. The output gap measures the difference between actual and potential economic output, indicating underutilized resources or overheating in the economy. Explore how the interplay between excess savings and the output gap influences inflation, investment, and policy decisions.

Why it is important

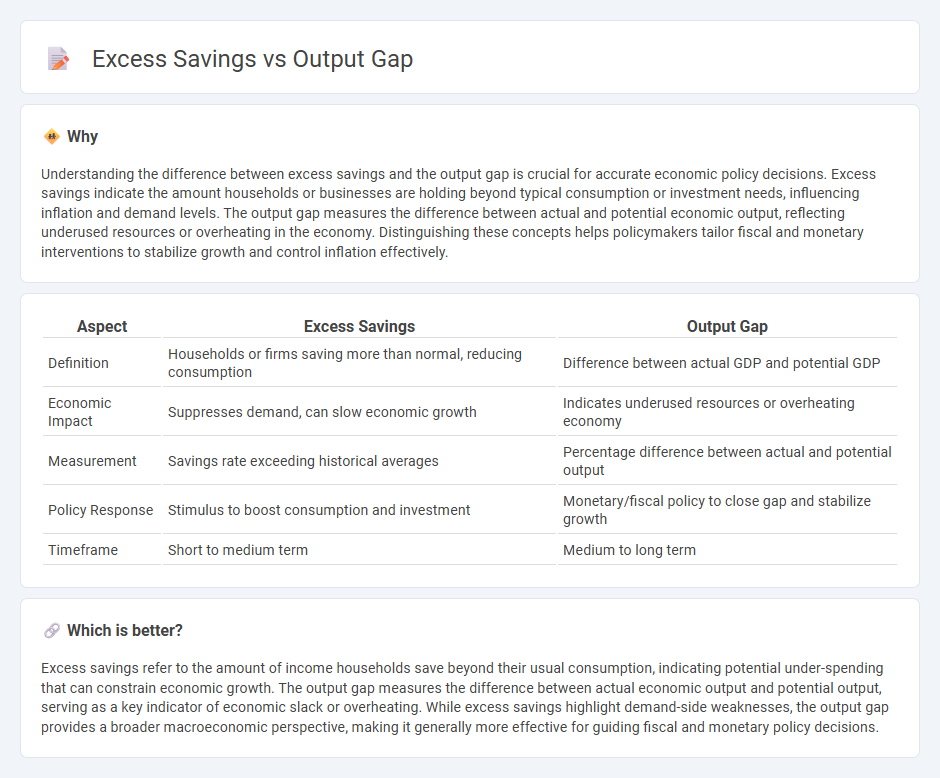

Understanding the difference between excess savings and the output gap is crucial for accurate economic policy decisions. Excess savings indicate the amount households or businesses are holding beyond typical consumption or investment needs, influencing inflation and demand levels. The output gap measures the difference between actual and potential economic output, reflecting underused resources or overheating in the economy. Distinguishing these concepts helps policymakers tailor fiscal and monetary interventions to stabilize growth and control inflation effectively.

Comparison Table

| Aspect | Excess Savings | Output Gap |

|---|---|---|

| Definition | Households or firms saving more than normal, reducing consumption | Difference between actual GDP and potential GDP |

| Economic Impact | Suppresses demand, can slow economic growth | Indicates underused resources or overheating economy |

| Measurement | Savings rate exceeding historical averages | Percentage difference between actual and potential output |

| Policy Response | Stimulus to boost consumption and investment | Monetary/fiscal policy to close gap and stabilize growth |

| Timeframe | Short to medium term | Medium to long term |

Which is better?

Excess savings refer to the amount of income households save beyond their usual consumption, indicating potential under-spending that can constrain economic growth. The output gap measures the difference between actual economic output and potential output, serving as a key indicator of economic slack or overheating. While excess savings highlight demand-side weaknesses, the output gap provides a broader macroeconomic perspective, making it generally more effective for guiding fiscal and monetary policy decisions.

Connection

Excess savings occur when households and businesses save more than the economy's current demand for investment, leading to a surplus of funds that can depress consumption and aggregate demand. This imbalance often contributes to a negative output gap, where actual GDP falls below potential GDP due to underutilized resources and lower economic activity. Addressing the excess savings through increased investment or consumption is crucial to closing the output gap and promoting sustainable economic growth.

Key Terms

Potential GDP

The output gap measures the difference between actual GDP and potential GDP, indicating whether an economy is operating above or below its full productive capacity. Excess savings occur when households or businesses save more than what is needed to finance investment, often leading to a demand shortfall that widens the output gap. Understanding the relationship between output gap and excess savings is crucial for assessing economic slack and inflationary pressures; explore further to grasp their impact on monetary policy decisions.

Aggregate demand

The output gap measures the difference between actual and potential economic output, directly reflecting underutilized aggregate demand. Excess savings indicate a higher level of income not spent, leading to suppressed consumption and investment, which reduces aggregate demand and widens the output gap. Explore how these dynamics influence economic policy and growth strategies.

Interest rates

The output gap measures the difference between actual and potential economic production, influencing central banks to adjust interest rates to stimulate or cool down the economy. Excess savings occur when households and businesses save more than they invest, leading to lower demand and downward pressure on interest rates to encourage spending. Understanding how these dynamics shape monetary policy offers valuable insights into interest rate trends; discover more to explore their intricate relationship.

Source and External Links

Understanding Potential GDP and the Output Gap - The output gap measures the difference between an economy's actual output and its potential output, indicating whether the economy is underperforming (negative gap) or overperforming (positive gap) relative to its capacity.

What Is the Output Gap? - Back to Basics - The output gap represents the difference between actual GDP and potential GDP, showing whether an economy is producing below or above its maximum efficient capacity, which signals slack or overheating.

Understanding the output gap - The output gap reflects how far real economic output deviates from ideal balanced production levels, with a positive gap indicating demand exceeds supply and a negative gap pointing to underused resources.

dowidth.com

dowidth.com