Shadow bailouts occur when financial institutions receive indirect support through covert measures, contrasting with government guarantees, which openly promise to cover certain losses or obligations. Shadow bailouts often involve emergency liquidity provisions or asset purchases without formal disclosure, impacting market stability and taxpayer risk. Explore these mechanisms further to understand their implications for economic resilience and transparency.

Why it is important

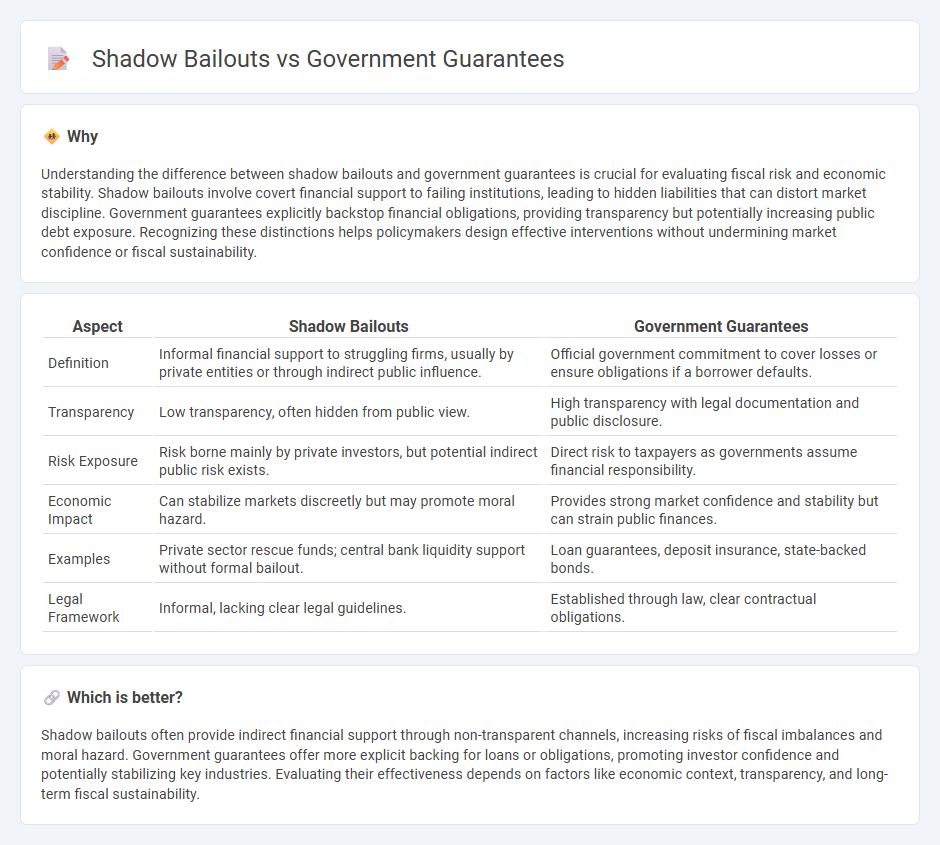

Understanding the difference between shadow bailouts and government guarantees is crucial for evaluating fiscal risk and economic stability. Shadow bailouts involve covert financial support to failing institutions, leading to hidden liabilities that can distort market discipline. Government guarantees explicitly backstop financial obligations, providing transparency but potentially increasing public debt exposure. Recognizing these distinctions helps policymakers design effective interventions without undermining market confidence or fiscal sustainability.

Comparison Table

| Aspect | Shadow Bailouts | Government Guarantees |

|---|---|---|

| Definition | Informal financial support to struggling firms, usually by private entities or through indirect public influence. | Official government commitment to cover losses or ensure obligations if a borrower defaults. |

| Transparency | Low transparency, often hidden from public view. | High transparency with legal documentation and public disclosure. |

| Risk Exposure | Risk borne mainly by private investors, but potential indirect public risk exists. | Direct risk to taxpayers as governments assume financial responsibility. |

| Economic Impact | Can stabilize markets discreetly but may promote moral hazard. | Provides strong market confidence and stability but can strain public finances. |

| Examples | Private sector rescue funds; central bank liquidity support without formal bailout. | Loan guarantees, deposit insurance, state-backed bonds. |

| Legal Framework | Informal, lacking clear legal guidelines. | Established through law, clear contractual obligations. |

Which is better?

Shadow bailouts often provide indirect financial support through non-transparent channels, increasing risks of fiscal imbalances and moral hazard. Government guarantees offer more explicit backing for loans or obligations, promoting investor confidence and potentially stabilizing key industries. Evaluating their effectiveness depends on factors like economic context, transparency, and long-term fiscal sustainability.

Connection

Shadow bailouts often occur when governments provide implicit guarantees to financial institutions, creating a safety net without direct fiscal intervention. These guarantees reduce perceived risk for lenders and investors, encouraging risky behavior that can destabilize the economy. The interconnectedness of shadow bailouts and government guarantees highlights the hidden fiscal liabilities that can emerge during financial crises.

Key Terms

Moral Hazard

Government guarantees protect financial institutions by ensuring repayment, reducing perceived risk and encouraging risk-taking behavior that can lead to moral hazard; shadow bailouts, often covert rescues without explicit government backing, similarly incentivize risky decisions by implicit assurance of support. These mechanisms distort market discipline by weakening the consequences of failure, prompting financial actors to engage in excessive risk without adequate accountability. Explore deeper into the impact of government guarantees and shadow bailouts on financial stability and risk management.

Contingent Liabilities

Government guarantees create explicit contingent liabilities reflected in fiscal accounts, enhancing transparency and enabling better risk management. In contrast, shadow bailouts represent implicit contingent liabilities often hidden off the balance sheet, increasing fiscal risk and reducing accountability. Explore the differences between explicit guarantees and shadow bailouts to understand their impact on public finances.

Off-Balance-Sheet Support

Government guarantees provide explicit financial backing for loans or obligations, often appearing off-balance-sheet to avoid immediate fiscal impact, whereas shadow bailouts involve indirect support through non-transparent mechanisms that may conceal true government exposure. Off-balance-sheet support allows governments to manage risk without increasing public debt figures visibly, raising concerns about hidden liabilities during financial crises. Explore our detailed analysis to understand the implications of these financial tools on economic stability and fiscal transparency.

Source and External Links

Government Guarantee - Overview, Examples, Benefits - Government guarantees provide indirect security to financial institutions, promising to cover credit losses if borrowers default, thus encouraging lending to higher-risk or underserved groups like small businesses, farmers, and military families.

Chapter 2. Government Guarantees and Fiscal Risk - Government guarantees legally commit the government to fulfill a financial obligation if a specified uncertain event occurs, most commonly in the form of loan guarantees for borrowers such as farmers, small businesses, home buyers, and students.

Government Guarantees: A Framework and Scenario Analysis - Government guarantees are a fiscal tool to promote development by reducing perceived risk for investors and facilitating investment, but require careful management due to the uncertainty of their potential fiscal impact.

dowidth.com

dowidth.com