Scrap metal arbitrage involves exploiting price differences in scrap metal markets by buying low in one region and selling high in another, leveraging supply chain inefficiencies and market demand fluctuations. Regulatory arbitrage focuses on capitalizing on variations in laws and regulations across jurisdictions to reduce costs, avoid taxes, or bypass restrictions, often seen in financial markets and corporate structures. Explore in-depth how these arbitrage strategies influence economic dynamics and risk management.

Why it is important

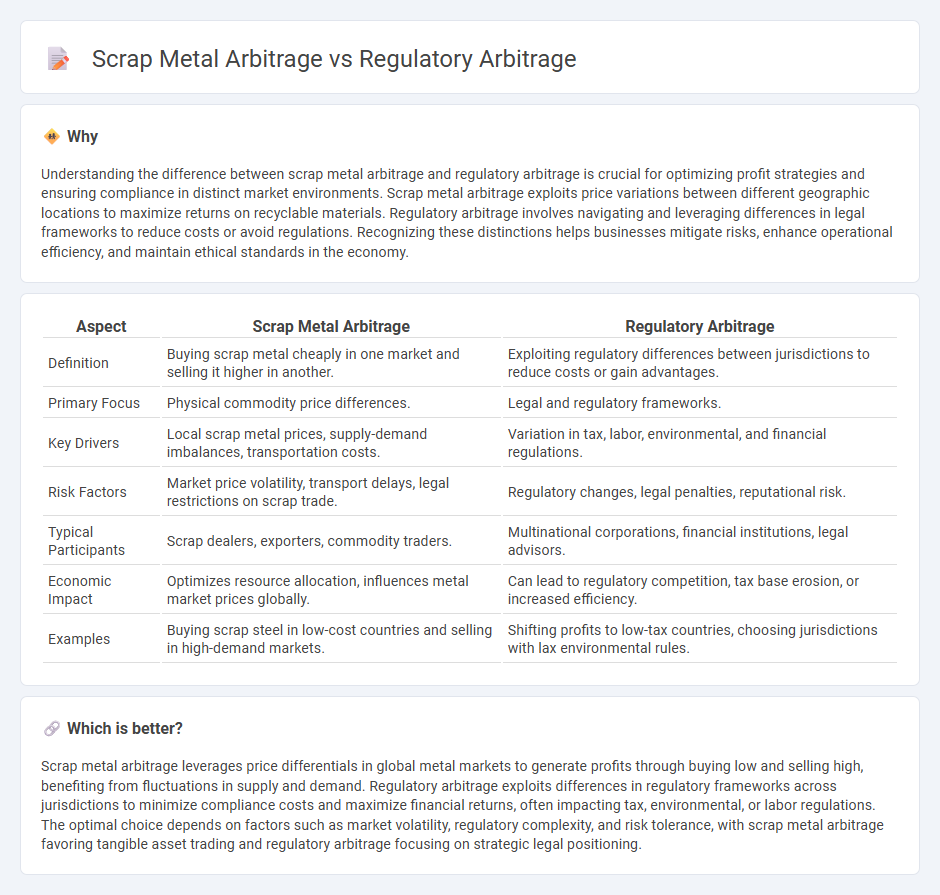

Understanding the difference between scrap metal arbitrage and regulatory arbitrage is crucial for optimizing profit strategies and ensuring compliance in distinct market environments. Scrap metal arbitrage exploits price variations between different geographic locations to maximize returns on recyclable materials. Regulatory arbitrage involves navigating and leveraging differences in legal frameworks to reduce costs or avoid regulations. Recognizing these distinctions helps businesses mitigate risks, enhance operational efficiency, and maintain ethical standards in the economy.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Regulatory Arbitrage |

|---|---|---|

| Definition | Buying scrap metal cheaply in one market and selling it higher in another. | Exploiting regulatory differences between jurisdictions to reduce costs or gain advantages. |

| Primary Focus | Physical commodity price differences. | Legal and regulatory frameworks. |

| Key Drivers | Local scrap metal prices, supply-demand imbalances, transportation costs. | Variation in tax, labor, environmental, and financial regulations. |

| Risk Factors | Market price volatility, transport delays, legal restrictions on scrap trade. | Regulatory changes, legal penalties, reputational risk. |

| Typical Participants | Scrap dealers, exporters, commodity traders. | Multinational corporations, financial institutions, legal advisors. |

| Economic Impact | Optimizes resource allocation, influences metal market prices globally. | Can lead to regulatory competition, tax base erosion, or increased efficiency. |

| Examples | Buying scrap steel in low-cost countries and selling in high-demand markets. | Shifting profits to low-tax countries, choosing jurisdictions with lax environmental rules. |

Which is better?

Scrap metal arbitrage leverages price differentials in global metal markets to generate profits through buying low and selling high, benefiting from fluctuations in supply and demand. Regulatory arbitrage exploits differences in regulatory frameworks across jurisdictions to minimize compliance costs and maximize financial returns, often impacting tax, environmental, or labor regulations. The optimal choice depends on factors such as market volatility, regulatory complexity, and risk tolerance, with scrap metal arbitrage favoring tangible asset trading and regulatory arbitrage focusing on strategic legal positioning.

Connection

Scrap metal arbitrage exploits price differences in metal markets across regions, while regulatory arbitrage involves shifting operations to jurisdictions with more favorable regulations. These practices intersect as companies engage in scrap metal trading in countries with lenient environmental or trade policies to maximize profits. This connection illustrates how regulatory environments influence global commodity flows and economic decision-making.

Key Terms

Compliance costs

Regulatory arbitrage involves shifting operations to benefit from lower compliance costs, often reducing expenses related to legal, environmental, and safety standards. Scrap metal arbitrage exploits price discrepancies in different markets for recyclable metals, with compliance costs including transportation and environmental regulations. Explore how these arbitrage strategies impact overall business efficiency and legal risks by delving deeper into compliance cost management.

Cross-border transactions

Cross-border regulatory arbitrage exploits differences in international laws to minimize compliance costs, while scrap metal arbitrage capitalizes on price disparities in global scrap metal markets through strategic buying and selling. Regulatory arbitrage demands deep understanding of varying legal environments, whereas scrap metal arbitrage requires real-time market analysis and logistics management to maximize profit margins. Explore more to understand how cross-border dynamics uniquely influence these arbitrage strategies.

Asset valuation

Regulatory arbitrage involves exploiting differences in regulatory frameworks to gain financial advantages, often impacting asset valuation by shifting risks and returns across jurisdictions. Scrap metal arbitrage capitalizes on price discrepancies in scrap metal markets internationally, affecting asset valuation through inventory and resale value fluctuations. Discover more about how these arbitrage strategies influence asset valuation dynamics and financial decision-making.

Source and External Links

Managing Regulatory Arbitrage: A Conflict of Laws Approach - Regulatory arbitrage involves taking advantage of differences in regulatory costs or rules across jurisdictions to profit, such as locating activities where regulations or penalties are minimal then selling in higher-regulation markets.

Tech, Regulatory Arbitrage, and Limits - Regulatory arbitrage is structuring business or legal arrangements to exploit gaps or variations in regulations, as seen in tech companies adjusting user data terms or classifying workers to reduce regulatory burdens, with limits arising from social license and legal mismatches.

Gaming the rules or ruling the game? - How to deal with regulatory arbitrage - Regulatory arbitrage allows entities, especially banks, to circumvent regulatory rules often by exploiting loopholes, challenging regulatory objectives, and requiring harmonized, principle-based rules and flexible supervision to limit it.

dowidth.com

dowidth.com