Shadow inflation refers to the subtle rise in prices of goods and services not immediately captured by official inflation metrics, often driven by reduced product sizes or lower quality. Imported inflation occurs when the cost of imported goods increases due to external factors like currency depreciation or global supply chain disruptions, directly impacting domestic price levels. Explore the nuances of these inflation types to understand their distinct effects on the economy.

Why it is important

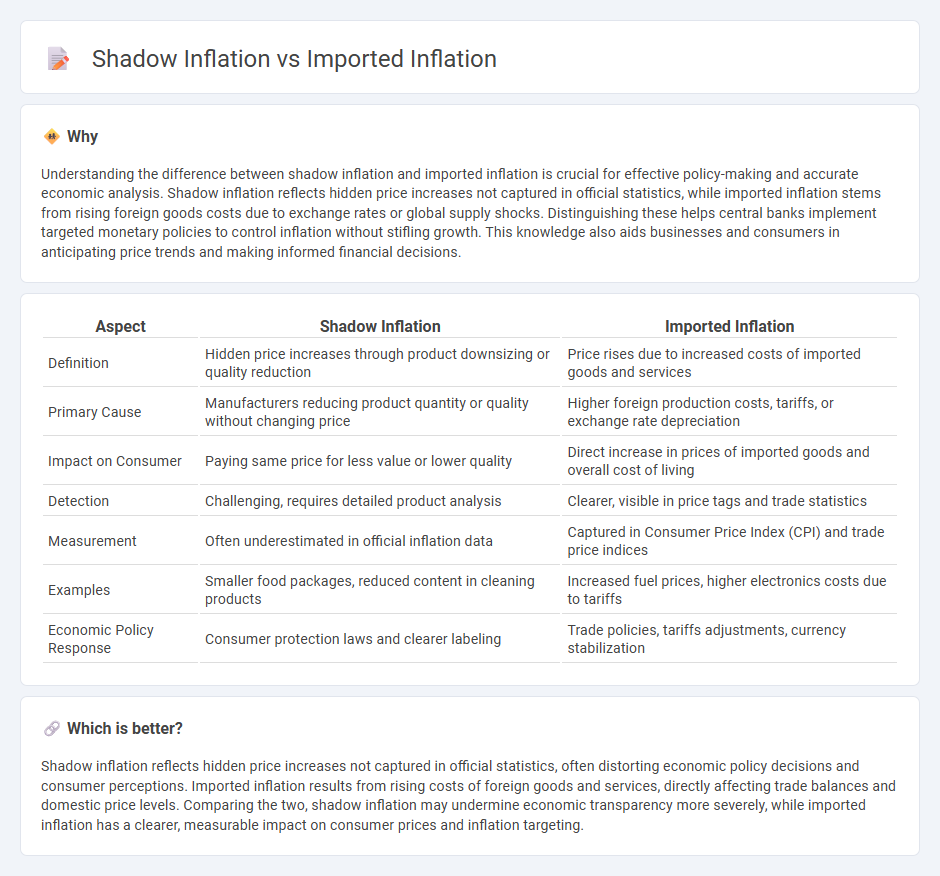

Understanding the difference between shadow inflation and imported inflation is crucial for effective policy-making and accurate economic analysis. Shadow inflation reflects hidden price increases not captured in official statistics, while imported inflation stems from rising foreign goods costs due to exchange rates or global supply shocks. Distinguishing these helps central banks implement targeted monetary policies to control inflation without stifling growth. This knowledge also aids businesses and consumers in anticipating price trends and making informed financial decisions.

Comparison Table

| Aspect | Shadow Inflation | Imported Inflation |

|---|---|---|

| Definition | Hidden price increases through product downsizing or quality reduction | Price rises due to increased costs of imported goods and services |

| Primary Cause | Manufacturers reducing product quantity or quality without changing price | Higher foreign production costs, tariffs, or exchange rate depreciation |

| Impact on Consumer | Paying same price for less value or lower quality | Direct increase in prices of imported goods and overall cost of living |

| Detection | Challenging, requires detailed product analysis | Clearer, visible in price tags and trade statistics |

| Measurement | Often underestimated in official inflation data | Captured in Consumer Price Index (CPI) and trade price indices |

| Examples | Smaller food packages, reduced content in cleaning products | Increased fuel prices, higher electronics costs due to tariffs |

| Economic Policy Response | Consumer protection laws and clearer labeling | Trade policies, tariffs adjustments, currency stabilization |

Which is better?

Shadow inflation reflects hidden price increases not captured in official statistics, often distorting economic policy decisions and consumer perceptions. Imported inflation results from rising costs of foreign goods and services, directly affecting trade balances and domestic price levels. Comparing the two, shadow inflation may undermine economic transparency more severely, while imported inflation has a clearer, measurable impact on consumer prices and inflation targeting.

Connection

Shadow inflation, reflecting rising costs of goods and services not captured in official statistics, often stems from imported inflation, where increased prices of foreign goods elevate domestic expenses. Imported inflation occurs when higher global commodity prices or exchange rate fluctuations raise the cost of imports, directly impacting production and consumer prices locally. The interplay between these factors intensifies overall inflationary pressures, complicating accurate economic measurement and policy response.

Key Terms

**Imported Inflation:**

Imported inflation occurs when the rising cost of foreign goods and raw materials drives up domestic prices, often caused by adverse exchange rates or global supply chain disruptions. This type of inflation significantly impacts consumer prices, especially in countries heavily reliant on imports for essential products. Explore further to understand how imported inflation shapes economic policies and consumer behavior worldwide.

Exchange Rate

Imported inflation occurs when currency depreciation increases the cost of foreign goods, pushing up domestic prices due to a weaker exchange rate. Shadow inflation reflects unrecorded price rises in the economy, often linked to exchange rate volatility that affects pricing power behind official statistics. Explore the nuanced impact of exchange rates on both imported and shadow inflation to understand broader economic dynamics.

Trade Balance

Imported inflation directly affects a country's trade balance by increasing the cost of foreign goods, leading to higher import prices and potential trade deficits. Shadow inflation, representing hidden price increases not immediately reflected in consumer price indexes, can distort true trade balance assessments by obscuring underlying cost pressures in imported goods. Explore how these inflation types influence trade dynamics to gain deeper insights into economic stability and policy responses.

Source and External Links

Imported Inflation: Causes & Impact - Imported inflation occurs due to increases in the prices of imported goods and services, influenced by factors like exchange rates and global commodity prices.

What Drives U.S. Import Price Inflation? - This paper examines the drivers of global import price inflation, highlighting a common global component and U.S. demand shocks as key factors.

The Impact of Tariffs on Inflation - Tariffs can significantly increase inflation by raising the border prices of imported goods, affecting consumer prices beyond direct imports.

dowidth.com

dowidth.com