Shadow inflation represents the hidden rise in prices through reduced product size or quality without changing the listed price, affecting consumer purchasing power subtly. Push inflation occurs when rising production costs, such as wages or raw materials, drive businesses to increase prices across the market. Explore the impacts and mechanisms of these inflation types to better understand their effects on the economy.

Why it is important

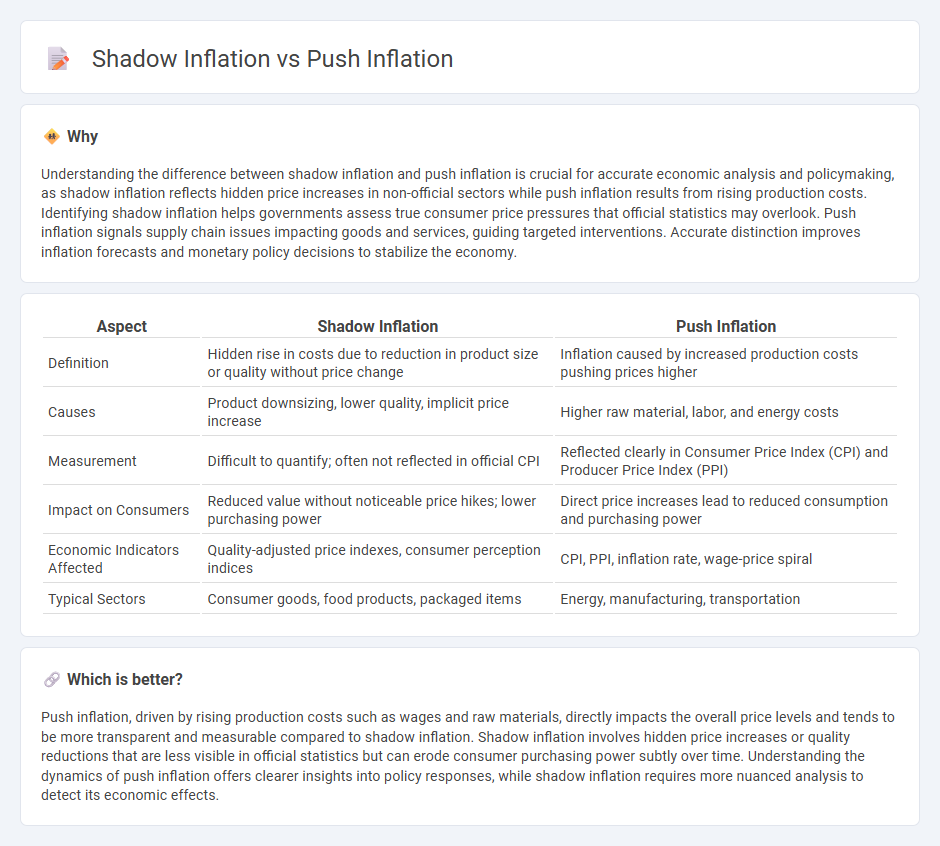

Understanding the difference between shadow inflation and push inflation is crucial for accurate economic analysis and policymaking, as shadow inflation reflects hidden price increases in non-official sectors while push inflation results from rising production costs. Identifying shadow inflation helps governments assess true consumer price pressures that official statistics may overlook. Push inflation signals supply chain issues impacting goods and services, guiding targeted interventions. Accurate distinction improves inflation forecasts and monetary policy decisions to stabilize the economy.

Comparison Table

| Aspect | Shadow Inflation | Push Inflation |

|---|---|---|

| Definition | Hidden rise in costs due to reduction in product size or quality without price change | Inflation caused by increased production costs pushing prices higher |

| Causes | Product downsizing, lower quality, implicit price increase | Higher raw material, labor, and energy costs |

| Measurement | Difficult to quantify; often not reflected in official CPI | Reflected clearly in Consumer Price Index (CPI) and Producer Price Index (PPI) |

| Impact on Consumers | Reduced value without noticeable price hikes; lower purchasing power | Direct price increases lead to reduced consumption and purchasing power |

| Economic Indicators Affected | Quality-adjusted price indexes, consumer perception indices | CPI, PPI, inflation rate, wage-price spiral |

| Typical Sectors | Consumer goods, food products, packaged items | Energy, manufacturing, transportation |

Which is better?

Push inflation, driven by rising production costs such as wages and raw materials, directly impacts the overall price levels and tends to be more transparent and measurable compared to shadow inflation. Shadow inflation involves hidden price increases or quality reductions that are less visible in official statistics but can erode consumer purchasing power subtly over time. Understanding the dynamics of push inflation offers clearer insights into policy responses, while shadow inflation requires more nuanced analysis to detect its economic effects.

Connection

Shadow inflation represents the unmeasured rise in living costs through reduced product quality or smaller quantities, while push inflation occurs when increased production costs drive overall price levels higher. Both forms contribute to hidden price pressures that erode consumer purchasing power without full reflection in official inflation metrics. Recognizing the interplay between shadow and push inflation is crucial for accurately assessing true economic inflation dynamics and their impact on household budgets.

Key Terms

Aggregate Demand

Push inflation occurs when aggregate demand outpaces aggregate supply, driving up prices due to heightened consumer spending and investment. Shadow inflation reflects hidden price increases not immediately visible in official statistics, often stemming from producers' adjustments to costs under pressure from sustained demand. Explore further to understand how these inflation types impact economic policies and consumer behavior.

Price Index

Push inflation reflects a rise in the price index driven by increased production costs such as wages and raw materials, leading to higher prices for goods and services. Shadow inflation pertains to subtle increases not fully captured by traditional price indexes, including quality reductions or smaller package sizes, which effectively raise consumer costs without altering headline inflation metrics. Explore more to understand how these different inflation types impact economic analysis and consumer behavior.

Unmeasured Costs

Push inflation occurs when rising production costs drive up overall prices, directly impacting consumer expenses, while shadow inflation represents unmeasured costs through reduced product sizes, lower quality, or hidden fees that often go unnoticed in official inflation metrics. Unmeasured costs from shadow inflation can significantly erode purchasing power and distort economic reality by making standard inflation indices underestimate actual price increases. Explore detailed analyses to better understand how these inflation types affect household budgets and economic policy.

Source and External Links

Cost Push Inflation - (AP Macroeconomics) - Fiveable - Cost-push inflation occurs when the overall price levels rise due to increases in the costs of production, such as wages and raw materials, causing producers to pass these costs onto consumers through higher prices, which decreases aggregate supply.

Cost-push inflation - Wikipedia - Cost-push inflation is caused by increases in the cost of key goods or services (e.g., oil), forcing businesses to raise prices since no alternatives exist; it contrasts with demand-pull inflation and can trigger wage-price spirals.

Causes of Inflation | Explainer | Education | RBA - Cost-push inflation happens when higher input costs reduce aggregate supply, pushing prices upward even if demand stays constant, such as through higher oil or raw material prices or supply disruptions, which then cascade into increased prices of goods and services.

dowidth.com

dowidth.com