Shadow inflation occurs when hidden price increases reduce purchasing power without official inflation rates reflecting these changes, while deflation signifies a general decline in prices leading to decreased consumer spending and economic slowdown. Shadow inflation can erode savings and distort economic decisions, whereas deflation often triggers higher unemployment and lower profits. Explore the complex dynamics of shadow inflation versus deflation to understand their impact on the modern economy.

Why it is important

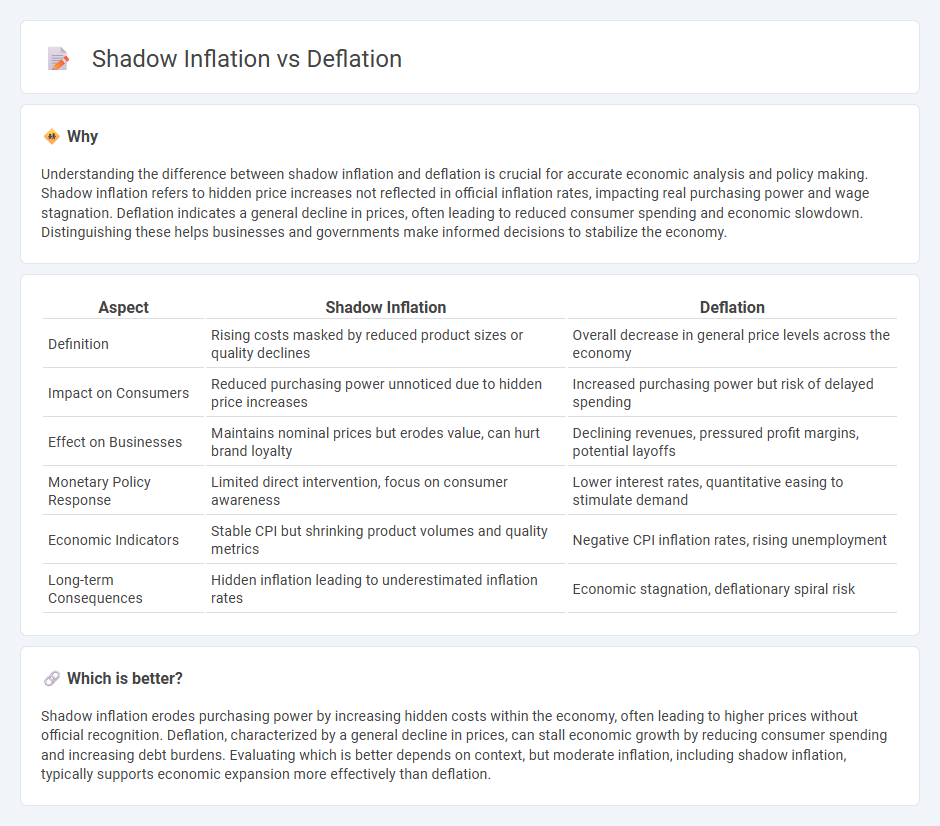

Understanding the difference between shadow inflation and deflation is crucial for accurate economic analysis and policy making. Shadow inflation refers to hidden price increases not reflected in official inflation rates, impacting real purchasing power and wage stagnation. Deflation indicates a general decline in prices, often leading to reduced consumer spending and economic slowdown. Distinguishing these helps businesses and governments make informed decisions to stabilize the economy.

Comparison Table

| Aspect | Shadow Inflation | Deflation |

|---|---|---|

| Definition | Rising costs masked by reduced product sizes or quality declines | Overall decrease in general price levels across the economy |

| Impact on Consumers | Reduced purchasing power unnoticed due to hidden price increases | Increased purchasing power but risk of delayed spending |

| Effect on Businesses | Maintains nominal prices but erodes value, can hurt brand loyalty | Declining revenues, pressured profit margins, potential layoffs |

| Monetary Policy Response | Limited direct intervention, focus on consumer awareness | Lower interest rates, quantitative easing to stimulate demand |

| Economic Indicators | Stable CPI but shrinking product volumes and quality metrics | Negative CPI inflation rates, rising unemployment |

| Long-term Consequences | Hidden inflation leading to underestimated inflation rates | Economic stagnation, deflationary spiral risk |

Which is better?

Shadow inflation erodes purchasing power by increasing hidden costs within the economy, often leading to higher prices without official recognition. Deflation, characterized by a general decline in prices, can stall economic growth by reducing consumer spending and increasing debt burdens. Evaluating which is better depends on context, but moderate inflation, including shadow inflation, typically supports economic expansion more effectively than deflation.

Connection

Shadow inflation and deflation are interconnected through their impact on purchasing power and economic behavior; shadow inflation reflects rising prices not captured in official statistics, leading consumers to feel the burden of higher costs despite reported stability. This hidden rise in living expenses can suppress demand, contributing to deflationary pressures as businesses lower prices to attract cautious buyers. The subtle interplay between these phenomena complicates monetary policy decisions aimed at stabilizing economic growth and price levels.

Key Terms

Price Level

Deflation refers to a sustained decrease in the general price level of goods and services, leading to increased purchasing power and often signaling reduced consumer demand and economic slowdown. Shadow inflation, however, involves a covert rise in prices that isn't fully captured by official inflation metrics, reflecting hidden cost increases in essential sectors like housing, education, and healthcare. Explore more to understand how these contrasting phenomena impact economic planning and personal finance strategies.

Purchasing Power

Deflation causes a general decline in prices, increasing the purchasing power of money as consumers can buy more goods and services with the same amount of currency. Shadow inflation, often unnoticed, entails disguised price increases in specific sectors like healthcare, education, or housing, eroding consumer purchasing power despite stable official inflation rates. Explore the nuanced impacts these phenomena have on real purchasing power and household finances for a deeper understanding.

Hidden Costs

Deflation reduces general price levels but often conceals hidden costs such as decreased wages, lower investment, and economic stagnation that undermine long-term growth. Shadow inflation refers to hidden price increases in essential goods or services not captured by official inflation metrics, eroding purchasing power silently. Explore more about how these hidden costs impact economies and personal finances in-depth.

Source and External Links

Deflation - Definition, Causes, Effects, Impact - Deflation is a sustained decrease in the general price level of goods and services, leading to an increase in currency value and often linked to falling aggregate demand or rising aggregate supply, potentially causing economic recession or a deflationary spiral.

Deflation | EBSCO Research Starters - Deflation is characterized by a decline in prices due to reduced money or credit supply, often signaling deeper economic troubles like recessions and leading to job losses, wage cuts, and increased defaults.

Deflation - Deflation occurs when inflation turns negative, increasing money value but causing consumers to delay purchases, which reduces economic activity and can result in a deflationary spiral requiring government or central bank stimulus to reverse.

dowidth.com

dowidth.com