Carbon border adjustment imposes tariffs on imported goods based on their carbon emissions, targeting emission reductions beyond domestic industries. Cap and trade systems set a limit on total emissions and allow companies to buy and sell emission permits, creating a market-driven approach to carbon reduction. Explore deeper insights into how these policies shape global economic and environmental strategies.

Why it is important

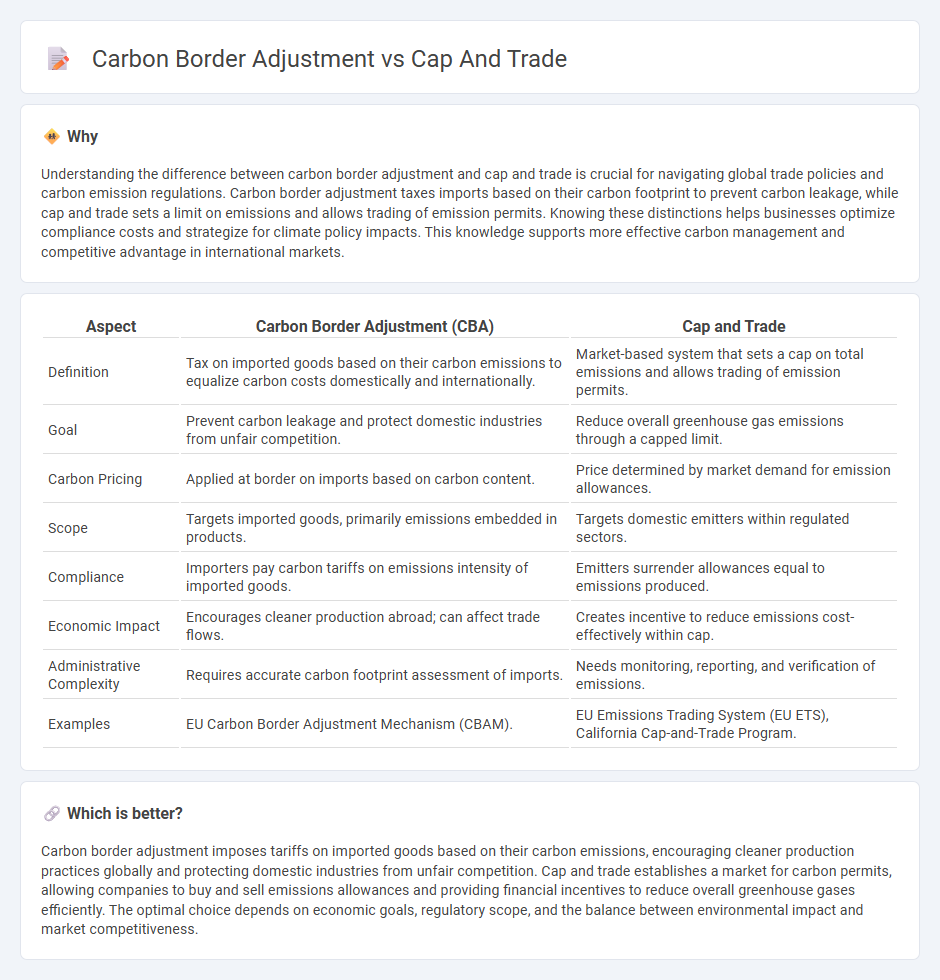

Understanding the difference between carbon border adjustment and cap and trade is crucial for navigating global trade policies and carbon emission regulations. Carbon border adjustment taxes imports based on their carbon footprint to prevent carbon leakage, while cap and trade sets a limit on emissions and allows trading of emission permits. Knowing these distinctions helps businesses optimize compliance costs and strategize for climate policy impacts. This knowledge supports more effective carbon management and competitive advantage in international markets.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Cap and Trade |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions to equalize carbon costs domestically and internationally. | Market-based system that sets a cap on total emissions and allows trading of emission permits. |

| Goal | Prevent carbon leakage and protect domestic industries from unfair competition. | Reduce overall greenhouse gas emissions through a capped limit. |

| Carbon Pricing | Applied at border on imports based on carbon content. | Price determined by market demand for emission allowances. |

| Scope | Targets imported goods, primarily emissions embedded in products. | Targets domestic emitters within regulated sectors. |

| Compliance | Importers pay carbon tariffs on emissions intensity of imported goods. | Emitters surrender allowances equal to emissions produced. |

| Economic Impact | Encourages cleaner production abroad; can affect trade flows. | Creates incentive to reduce emissions cost-effectively within cap. |

| Administrative Complexity | Requires accurate carbon footprint assessment of imports. | Needs monitoring, reporting, and verification of emissions. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | EU Emissions Trading System (EU ETS), California Cap-and-Trade Program. |

Which is better?

Carbon border adjustment imposes tariffs on imported goods based on their carbon emissions, encouraging cleaner production practices globally and protecting domestic industries from unfair competition. Cap and trade establishes a market for carbon permits, allowing companies to buy and sell emissions allowances and providing financial incentives to reduce overall greenhouse gases efficiently. The optimal choice depends on economic goals, regulatory scope, and the balance between environmental impact and market competitiveness.

Connection

Carbon border adjustment and cap-and-trade systems are interconnected mechanisms designed to reduce greenhouse gas emissions while maintaining economic competitiveness. Cap-and-trade sets a limit on emissions and allows trading of emission permits, creating a market-driven incentive to lower carbon output, whereas carbon border adjustment imposes tariffs on imported goods based on their carbon content to prevent carbon leakage. Together, they ensure domestic industries comply with emission targets without being undercut by imports from countries with laxer environmental regulations.

Key Terms

Emissions Allowances

Cap and trade systems allocate emissions allowances that companies can buy and sell to meet regulatory limits, creating a market-driven approach to reducing greenhouse gas emissions. Carbon Border Adjustment Mechanisms (CBAM) impose fees on imported goods based on their carbon content, aiming to prevent carbon leakage and encourage cleaner production abroad. Explore how emissions allowances function within these frameworks to balance environmental goals and economic competitiveness.

Carbon Pricing

Cap and trade systems set a maximum emissions limit and allow companies to buy and sell permits, creating a market-driven carbon price that incentivizes reductions. Carbon Border Adjustment Mechanisms (CBAM) impose fees on imported goods based on their carbon content to prevent carbon leakage and ensure fair competition with domestic producers subject to carbon pricing. Explore more about how these policies influence global carbon markets and drive climate action.

Leakage

Cap and trade systems set a maximum emissions limit while allowing trading of allowances to reduce overall carbon output efficiently, addressing leakage by incentivizing domestic reductions without losing competitiveness. Carbon Border Adjustment Mechanisms (CBAM) impose tariffs on imported goods based on their carbon footprint to prevent production shifting to countries with laxer climate policies, directly targeting carbon leakage through border controls. Explore how these mechanisms mitigate leakage risks and support global climate goals in greater detail.

Source and External Links

Cap and Trade Basics - C2ES - Cap and trade is a market-based approach to reducing emissions by setting a cap on total emissions and allowing companies to trade allowances, providing flexibility and cost-effective emissions reductions while the market determines the carbon price.

How cap and trade works - Environmental Defense Fund - Cap and trade sets a pollution limit and creates a market where companies that reduce emissions faster can sell allowances to others, incentivizing innovation and earlier emission cuts.

Cap-and-trade programme | UNFCCC - An Emission Trading System (ETS), or cap and trade, sets a limit on GHG emissions and allows entities to buy and sell emission permits, with caps declining over time to reduce emissions.

dowidth.com

dowidth.com