Zombie companies are businesses that generate just enough revenue to continue operating but struggle to pay off debt or invest in growth, often stifling economic dynamism. In contrast, unicorn companies are privately-held startups valued at over $1 billion, driving innovation and attracting significant venture capital investment. Discover how the balance between these two types of companies impacts economic growth and market health.

Why it is important

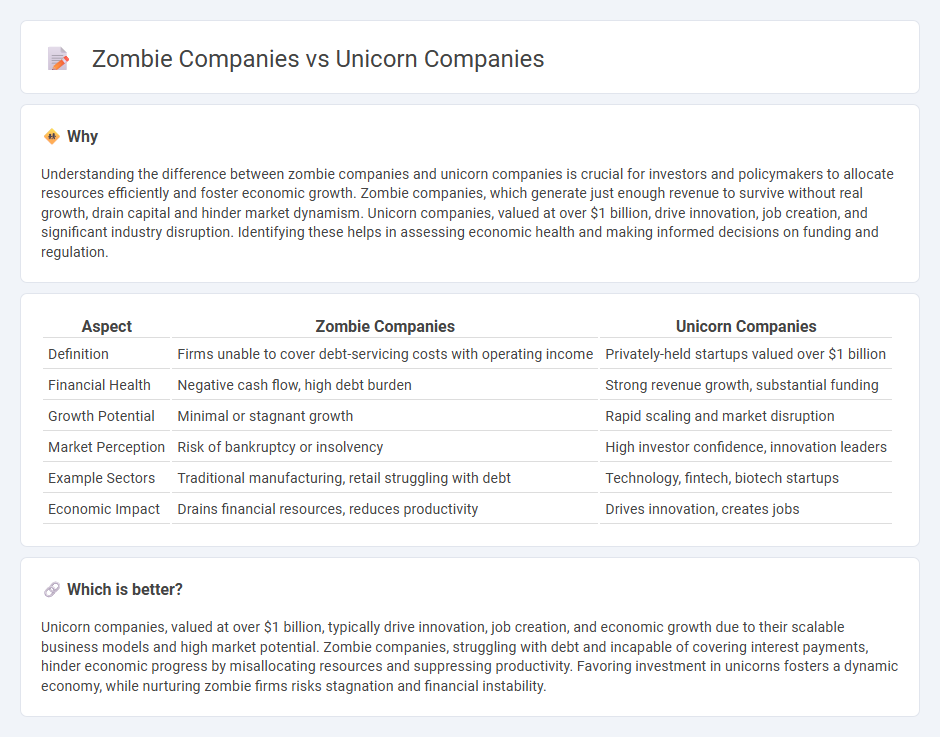

Understanding the difference between zombie companies and unicorn companies is crucial for investors and policymakers to allocate resources efficiently and foster economic growth. Zombie companies, which generate just enough revenue to survive without real growth, drain capital and hinder market dynamism. Unicorn companies, valued at over $1 billion, drive innovation, job creation, and significant industry disruption. Identifying these helps in assessing economic health and making informed decisions on funding and regulation.

Comparison Table

| Aspect | Zombie Companies | Unicorn Companies |

|---|---|---|

| Definition | Firms unable to cover debt-servicing costs with operating income | Privately-held startups valued over $1 billion |

| Financial Health | Negative cash flow, high debt burden | Strong revenue growth, substantial funding |

| Growth Potential | Minimal or stagnant growth | Rapid scaling and market disruption |

| Market Perception | Risk of bankruptcy or insolvency | High investor confidence, innovation leaders |

| Example Sectors | Traditional manufacturing, retail struggling with debt | Technology, fintech, biotech startups |

| Economic Impact | Drains financial resources, reduces productivity | Drives innovation, creates jobs |

Which is better?

Unicorn companies, valued at over $1 billion, typically drive innovation, job creation, and economic growth due to their scalable business models and high market potential. Zombie companies, struggling with debt and incapable of covering interest payments, hinder economic progress by misallocating resources and suppressing productivity. Favoring investment in unicorns fosters a dynamic economy, while nurturing zombie firms risks stagnation and financial instability.

Connection

Zombie companies, characterized by persistent inability to cover debt servicing costs, distort market efficiency by occupying resources that could fuel genuine innovation, while unicorn companies represent high-growth startups valued at over $1 billion driving technological advancements and economic transformation. The coexistence of zombie and unicorn companies highlights the contrasting dynamics within the economy, where inefficient capital allocation to zombie firms suppresses competition and profitability, whereas unicorn firms attract significant investment, fostering job creation and disrupting traditional industries. Understanding this interplay is crucial for policymakers aiming to balance financial stability with entrepreneurial growth to sustain long-term economic development.

Key Terms

Valuation

Unicorn companies boast valuations exceeding $1 billion, reflecting rapid growth, innovation, and strong investor confidence. In contrast, zombie companies struggle with stagnant valuations, barely covering debt and operational costs, indicating weak market performance and limited growth prospects. Explore the key financial metrics and valuation trends to better understand the dynamics between unicorn and zombie firms.

Profitability

Unicorn companies typically exhibit rapid growth combined with strong profitability metrics, signaling robust business models and high investor confidence. In contrast, zombie companies struggle with persistent low or negative profits, often relying on continuous debt to sustain operations without true financial health. Explore deeper insights into how profitability distinguishes thriving unicorns from struggling zombies.

Debt sustainability

Unicorn companies, valued at over $1 billion, often secure substantial funding that supports growth but also increases debt obligations, requiring efficient debt sustainability strategies to avoid liquidity issues. Zombie companies, with weak earnings and heavy debt burdens, struggle to service their debt, risking default and economic drag, highlighting the importance of debt restructuring and financial discipline. Explore detailed strategies to enhance debt sustainability in high-growth versus distressed firms.

Source and External Links

Complete List of Unicorn Companies Globally in 2025 - Unicorn companies are privately held startups valued at $1 billion or more, including high-profile examples like OpenAI ($157B), SpaceX ($125B), Stripe ($65B), and Reliance Retail ($95.45B) known for rapid growth and innovation across fintech, space, and retail sectors.

15 Unicorn Companies in San Francisco to Know - San Francisco unicorns such as Carta ($2.2B), Checkr ($1B), and Sonder have achieved billion-dollar valuation by innovating in equity management, hiring processes, and hospitality tech, reflecting a diverse tech ecosystem.

Unicorn Companies 2025: Global List, Stats & Valuation - Unicorn companies are defined as privately held startups valued at $1 billion plus, characterized by innovative business models, hypergrowth, strong market positioning, and significant venture capital backing, with total valuations exceeding $5.9 trillion globally in 2025.

dowidth.com

dowidth.com