Polycrisis describes overlapping economic, social, and environmental challenges that amplify systemic risks, while financial contagion refers to the rapid transmission of market shocks across global financial systems. The 2008 global financial crisis and recent supply chain disruptions illustrate how interconnected vulnerabilities can trigger widespread economic instability. Explore how understanding the differences and interactions between polycrisis and financial contagion aids in developing more resilient economic strategies.

Why it is important

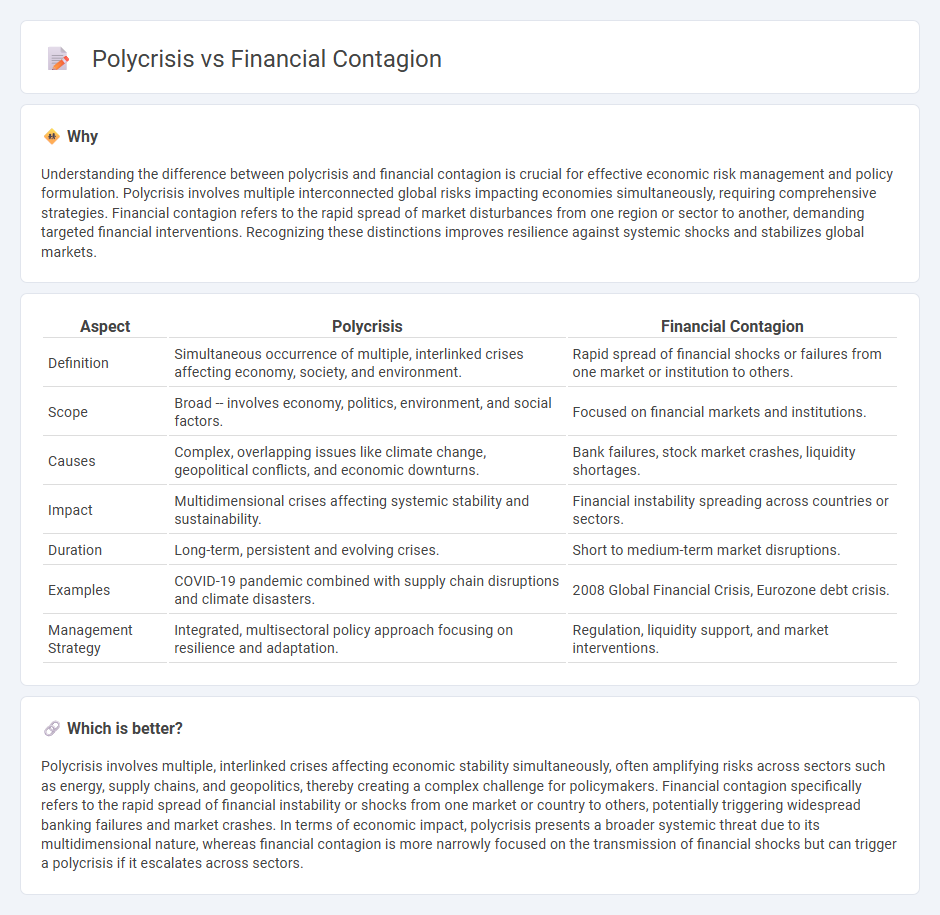

Understanding the difference between polycrisis and financial contagion is crucial for effective economic risk management and policy formulation. Polycrisis involves multiple interconnected global risks impacting economies simultaneously, requiring comprehensive strategies. Financial contagion refers to the rapid spread of market disturbances from one region or sector to another, demanding targeted financial interventions. Recognizing these distinctions improves resilience against systemic shocks and stabilizes global markets.

Comparison Table

| Aspect | Polycrisis | Financial Contagion |

|---|---|---|

| Definition | Simultaneous occurrence of multiple, interlinked crises affecting economy, society, and environment. | Rapid spread of financial shocks or failures from one market or institution to others. |

| Scope | Broad -- involves economy, politics, environment, and social factors. | Focused on financial markets and institutions. |

| Causes | Complex, overlapping issues like climate change, geopolitical conflicts, and economic downturns. | Bank failures, stock market crashes, liquidity shortages. |

| Impact | Multidimensional crises affecting systemic stability and sustainability. | Financial instability spreading across countries or sectors. |

| Duration | Long-term, persistent and evolving crises. | Short to medium-term market disruptions. |

| Examples | COVID-19 pandemic combined with supply chain disruptions and climate disasters. | 2008 Global Financial Crisis, Eurozone debt crisis. |

| Management Strategy | Integrated, multisectoral policy approach focusing on resilience and adaptation. | Regulation, liquidity support, and market interventions. |

Which is better?

Polycrisis involves multiple, interlinked crises affecting economic stability simultaneously, often amplifying risks across sectors such as energy, supply chains, and geopolitics, thereby creating a complex challenge for policymakers. Financial contagion specifically refers to the rapid spread of financial instability or shocks from one market or country to others, potentially triggering widespread banking failures and market crashes. In terms of economic impact, polycrisis presents a broader systemic threat due to its multidimensional nature, whereas financial contagion is more narrowly focused on the transmission of financial shocks but can trigger a polycrisis if it escalates across sectors.

Connection

Polycrisis refers to a simultaneous occurrence of multiple, interconnected crises that amplify economic instability across global markets. Financial contagion describes the rapid spread of financial shocks from one economy or institution to others, often triggered by interlinked vulnerabilities exposed during a polycrisis. Together, polycrisis conditions exacerbate financial contagion risks by weakening economic resilience, accelerating capital flight, and triggering systemic crises in the global economy.

Key Terms

**Financial contagion:**

Financial contagion refers to the spread of market disturbances - often triggered by financial shocks - from one country or region to others, leading to correlated economic downturns and systemic risks in global financial systems. It typically occurs through interconnected banks, cross-border investments, and investor behavior, amplifying vulnerabilities and accelerating crises across financial markets. Explore more about the mechanisms and impact of financial contagion in global economies.

Interconnectedness

Financial contagion refers to the rapid spread of market disturbances from one country or region to others, often triggered by interconnected financial institutions and global capital flows. In contrast, a polycrisis involves multiple, interacting crises across economic, social, and geopolitical domains that amplify systemic risks through overlapping vulnerabilities and interdependencies. Explore the dynamics of interconnectedness to understand how these phenomena propagate and impact global stability.

Transmission channels

Financial contagion spreads through interconnected banking systems, cross-border capital flows, and shared investor sentiments, causing rapid asset price declines and liquidity shortages. Polycrisis transmission channels involve complex interactions among economic instability, geopolitical conflicts, climate change, and social unrest, amplifying systemic risks across multiple sectors simultaneously. Discover how these distinct transmission mechanisms influence global stability and risk management strategies.

Source and External Links

Financial contagion - Wikipedia - Financial contagion refers to the spread of market disturbances from one country to another, manifesting as a crisis that causes devaluation, asset price drops, capital outflows, or defaults, occurring both domestically and internationally often beyond real economic links.

A wake-up call theory of contagion - ECB Working Paper - Financial contagion contributes to the spread and severity of crises through channels including trade, banks, portfolio investors, and especially wake-up calls where a crisis in one region prompts investors to reassess risks in others, leading to contagion across countries and markets.

Financial Market Contagion - European Central Bank - Contagion is identified by propagation of extreme negative returns and increased interdependence beyond normal times, typically via physical exposures and asymmetric information; it occurs most frequently within regions and asset classes but is relatively rare across disparate markets.

dowidth.com

dowidth.com