Shadow inflation refers to the hidden rise in prices that occurs through reduced product sizes or quality deterioration, rather than direct price hikes, thereby eroding consumer purchasing power subtly. Cost-push inflation arises when increased production costs, such as higher wages or raw material prices, lead businesses to raise overall prices to maintain profit margins. Explore in-depth analysis and examples to understand how these inflation types impact the economy differently.

Why it is important

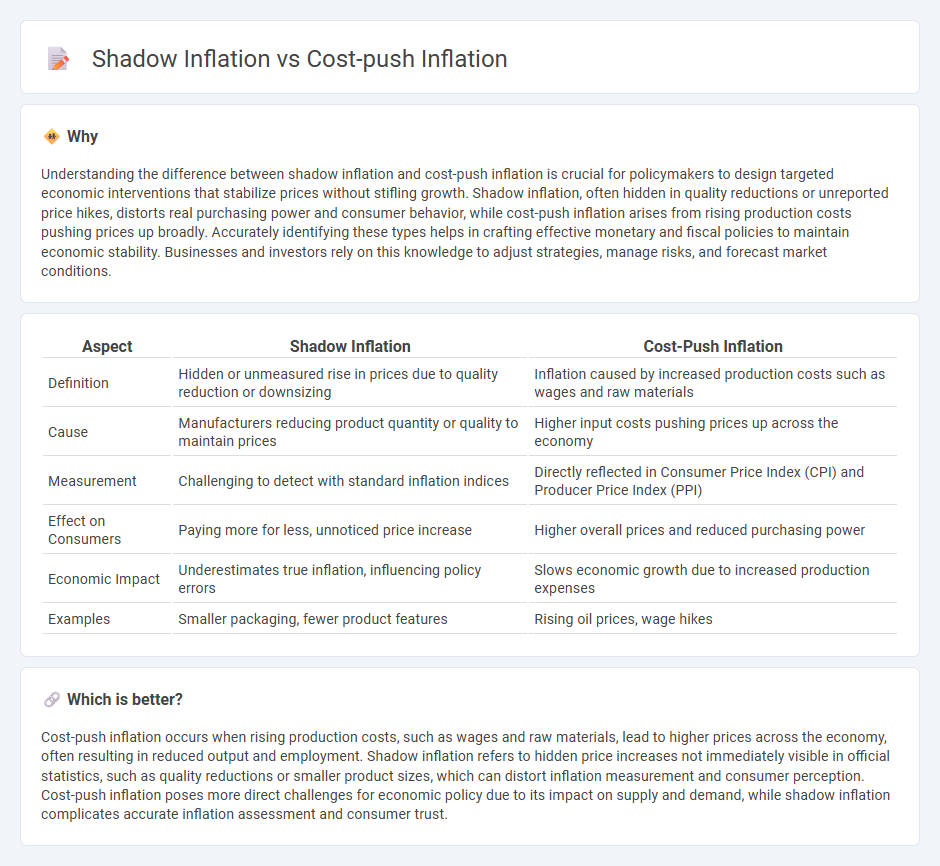

Understanding the difference between shadow inflation and cost-push inflation is crucial for policymakers to design targeted economic interventions that stabilize prices without stifling growth. Shadow inflation, often hidden in quality reductions or unreported price hikes, distorts real purchasing power and consumer behavior, while cost-push inflation arises from rising production costs pushing prices up broadly. Accurately identifying these types helps in crafting effective monetary and fiscal policies to maintain economic stability. Businesses and investors rely on this knowledge to adjust strategies, manage risks, and forecast market conditions.

Comparison Table

| Aspect | Shadow Inflation | Cost-Push Inflation |

|---|---|---|

| Definition | Hidden or unmeasured rise in prices due to quality reduction or downsizing | Inflation caused by increased production costs such as wages and raw materials |

| Cause | Manufacturers reducing product quantity or quality to maintain prices | Higher input costs pushing prices up across the economy |

| Measurement | Challenging to detect with standard inflation indices | Directly reflected in Consumer Price Index (CPI) and Producer Price Index (PPI) |

| Effect on Consumers | Paying more for less, unnoticed price increase | Higher overall prices and reduced purchasing power |

| Economic Impact | Underestimates true inflation, influencing policy errors | Slows economic growth due to increased production expenses |

| Examples | Smaller packaging, fewer product features | Rising oil prices, wage hikes |

Which is better?

Cost-push inflation occurs when rising production costs, such as wages and raw materials, lead to higher prices across the economy, often resulting in reduced output and employment. Shadow inflation refers to hidden price increases not immediately visible in official statistics, such as quality reductions or smaller product sizes, which can distort inflation measurement and consumer perception. Cost-push inflation poses more direct challenges for economic policy due to its impact on supply and demand, while shadow inflation complicates accurate inflation assessment and consumer trust.

Connection

Shadow inflation and cost-push inflation are interconnected as both reflect rising prices driven by increased production costs. Shadow inflation occurs when official inflation statistics understate true price increases, often due to measurement limitations in capturing cost-push effects like higher wages and raw material expenses. Understanding the link between shadow and cost-push inflation helps policymakers address hidden inflation pressures that erode consumer purchasing power.

Key Terms

Production Costs

Cost-push inflation arises from increased production costs such as higher wages, raw material prices, and energy expenses, which force businesses to raise prices to maintain profit margins. Shadow inflation reflects disguised price increases, often through downsizing product quantity or quality, effectively raising customer costs without overt price hikes. Explore deeper insights on how production cost dynamics shape these inflation types and their economic impact.

Hidden Price Increases

Cost-push inflation occurs when rising production costs, such as wages and raw materials, drive up overall prices, whereas shadow inflation refers to subtle or hidden price increases not immediately apparent in official inflation metrics, often through product downsizing or quality reduction. These hidden price increases erode purchasing power without being fully captured in consumer price indices, presenting challenges for accurate inflation measurement and economic policy. Explore further to understand how these inflation types impact consumer behavior and economic planning.

Consumer Purchasing Power

Cost-push inflation occurs when rising production costs, such as wages and raw materials, lead to increased prices, directly reducing consumer purchasing power by making goods and services more expensive. Shadow inflation, often stemming from hidden price increases or quality reductions not fully captured by official inflation metrics, subtly erodes purchasing power without immediate recognition. Explore further to understand how these inflation types uniquely impact consumer budgets and economic behavior.

Source and External Links

Cost-Push Inflation - Economics Help - Cost-push inflation occurs when prices rise due to higher production costs and raw materials, driven by supply-side factors like higher wages and oil prices, shifting aggregate supply leftward and causing both higher prices and lower real GDP.

Cost-Push Inflation: Definition & Examples - SmartAsset - Cost-push inflation happens when increased production costs, such as wages or materials, lead companies to raise prices, assuming demand remains stable, thereby decreasing aggregate supply and causing inflation.

Causes of Inflation | Explainer | Education | RBA - Cost-push inflation arises when aggregate supply decreases due to higher input costs, causing firms to produce less and raise prices, with effects spreading as higher costs in one sector (e.g., oil) increase prices in others.

dowidth.com

dowidth.com