Carbon border tax imposes tariffs on imported goods based on their carbon emissions, incentivizing greener production methods and leveling the playing field for domestic industries adhering to strict environmental regulations. Fossil fuel subsidies, often provided by governments to reduce energy costs, can distort market prices, encourage excessive consumption, and hinder the transition to renewable energy sources. Explore how these contrasting economic tools impact climate policy and global trade dynamics.

Why it is important

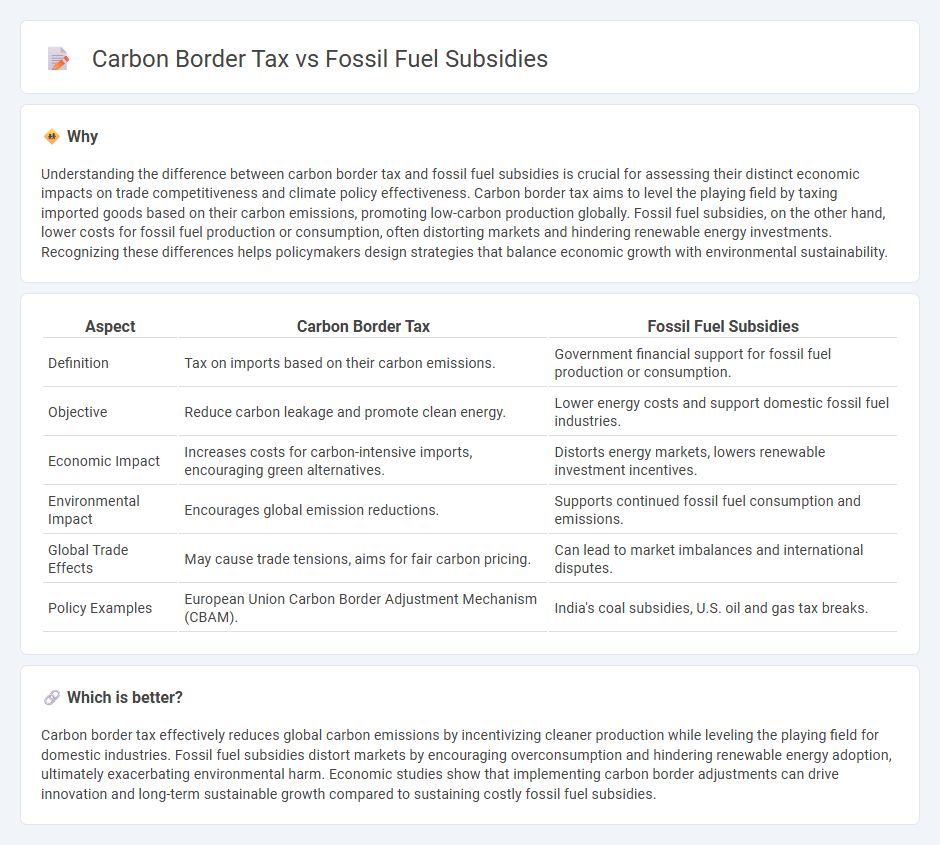

Understanding the difference between carbon border tax and fossil fuel subsidies is crucial for assessing their distinct economic impacts on trade competitiveness and climate policy effectiveness. Carbon border tax aims to level the playing field by taxing imported goods based on their carbon emissions, promoting low-carbon production globally. Fossil fuel subsidies, on the other hand, lower costs for fossil fuel production or consumption, often distorting markets and hindering renewable energy investments. Recognizing these differences helps policymakers design strategies that balance economic growth with environmental sustainability.

Comparison Table

| Aspect | Carbon Border Tax | Fossil Fuel Subsidies |

|---|---|---|

| Definition | Tax on imports based on their carbon emissions. | Government financial support for fossil fuel production or consumption. |

| Objective | Reduce carbon leakage and promote clean energy. | Lower energy costs and support domestic fossil fuel industries. |

| Economic Impact | Increases costs for carbon-intensive imports, encouraging green alternatives. | Distorts energy markets, lowers renewable investment incentives. |

| Environmental Impact | Encourages global emission reductions. | Supports continued fossil fuel consumption and emissions. |

| Global Trade Effects | May cause trade tensions, aims for fair carbon pricing. | Can lead to market imbalances and international disputes. |

| Policy Examples | European Union Carbon Border Adjustment Mechanism (CBAM). | India's coal subsidies, U.S. oil and gas tax breaks. |

Which is better?

Carbon border tax effectively reduces global carbon emissions by incentivizing cleaner production while leveling the playing field for domestic industries. Fossil fuel subsidies distort markets by encouraging overconsumption and hindering renewable energy adoption, ultimately exacerbating environmental harm. Economic studies show that implementing carbon border adjustments can drive innovation and long-term sustainable growth compared to sustaining costly fossil fuel subsidies.

Connection

Carbon border taxes aim to equalize the cost of carbon emissions between domestic and imported goods, encouraging greener production methods globally. Fossil fuel subsidies distort market prices by lowering the cost of carbon-intensive energy, undermining the effectiveness of carbon border tax policies. Coordinated reform of fossil fuel subsidies and implementation of carbon border taxes can drive a fair transition toward low-carbon economies and reduce carbon leakage.

Key Terms

Externalities

Fossil fuel subsidies often exacerbate negative externalities by lowering the cost of carbon-intensive energy, leading to increased greenhouse gas emissions and environmental degradation. In contrast, a carbon border tax internalizes these external costs by imposing tariffs on imported goods based on their carbon footprint, encouraging cleaner production methods globally. Explore further to understand how these policies impact climate economics and international trade.

Market Distortion

Fossil fuel subsidies create significant market distortions by artificially lowering the cost of carbon-intensive energy, encouraging overconsumption and hindering the transition to renewable alternatives. In contrast, a carbon border tax aims to correct these distortions by imposing tariffs on imported goods based on their carbon footprint, leveling the playing field for domestic industries committed to sustainable practices. Explore how these mechanisms impact global trade and climate policy to understand their role in designing effective environmental strategies.

Trade Competitiveness

Fossil fuel subsidies distort international trade by artificially lowering energy costs, undermining the competitiveness of industries in countries committed to carbon reduction, while carbon border taxes aim to level the playing field by internalizing environmental costs into import prices. The implementation of carbon border adjustments can protect domestic industries from unfair competition and incentivize global emission reductions without triggering trade disputes under World Trade Organization rules. Explore how balancing these policies impacts global trade dynamics and climate goals by learning more about the intersection of trade competitiveness and environmental policy.

Source and External Links

Fossil Fuel Subsidies Are Mostly Fiction - This article argues that fossil fuels are not heavily subsidized, citing official data showing renewables receive more subsidies.

Fossil Fuel Subsidies - Globally, fossil fuel subsidies were estimated at $7 trillion in 2022, reflecting both explicit and implicit forms of support.

Fossil Fuel Subsidies - Fossil fuel subsidies include tax breaks, reduced pricing, and unpriced environmental costs, totaling $1.5 trillion to $7 trillion in 2022 depending on the definition.

dowidth.com

dowidth.com