Excess savings during economic downturns can lead to a liquidity trap, where low interest rates fail to stimulate borrowing or spending despite abundant cash reserves. This phenomenon often results in stagnant growth and persistent unemployment, as monetary policy loses effectiveness. Explore more about how excess savings influence liquidity traps and impact economic recovery strategies.

Why it is important

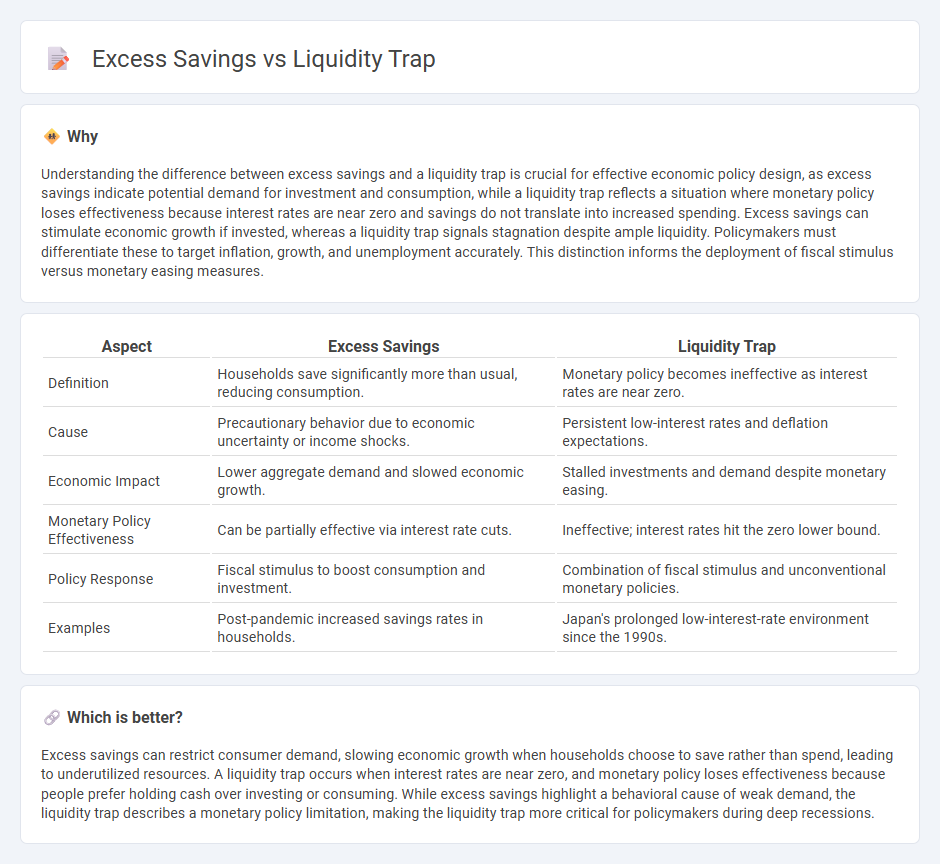

Understanding the difference between excess savings and a liquidity trap is crucial for effective economic policy design, as excess savings indicate potential demand for investment and consumption, while a liquidity trap reflects a situation where monetary policy loses effectiveness because interest rates are near zero and savings do not translate into increased spending. Excess savings can stimulate economic growth if invested, whereas a liquidity trap signals stagnation despite ample liquidity. Policymakers must differentiate these to target inflation, growth, and unemployment accurately. This distinction informs the deployment of fiscal stimulus versus monetary easing measures.

Comparison Table

| Aspect | Excess Savings | Liquidity Trap |

|---|---|---|

| Definition | Households save significantly more than usual, reducing consumption. | Monetary policy becomes ineffective as interest rates are near zero. |

| Cause | Precautionary behavior due to economic uncertainty or income shocks. | Persistent low-interest rates and deflation expectations. |

| Economic Impact | Lower aggregate demand and slowed economic growth. | Stalled investments and demand despite monetary easing. |

| Monetary Policy Effectiveness | Can be partially effective via interest rate cuts. | Ineffective; interest rates hit the zero lower bound. |

| Policy Response | Fiscal stimulus to boost consumption and investment. | Combination of fiscal stimulus and unconventional monetary policies. |

| Examples | Post-pandemic increased savings rates in households. | Japan's prolonged low-interest-rate environment since the 1990s. |

Which is better?

Excess savings can restrict consumer demand, slowing economic growth when households choose to save rather than spend, leading to underutilized resources. A liquidity trap occurs when interest rates are near zero, and monetary policy loses effectiveness because people prefer holding cash over investing or consuming. While excess savings highlight a behavioral cause of weak demand, the liquidity trap describes a monetary policy limitation, making the liquidity trap more critical for policymakers during deep recessions.

Connection

Excess savings lead to a liquidity trap when households and businesses prefer holding cash or liquid assets over investing or spending, despite low interest rates. This behavior reduces aggregate demand, causing monetary policy to lose effectiveness in stimulating economic growth. Central banks struggle to boost output as excess liquidity circulates without converting into productive investments.

Key Terms

Interest rates

Liquidity traps occur when interest rates approach zero, rendering monetary policy ineffective as individuals and businesses prefer holding cash over investments. Excess savings increase the overall supply of loanable funds, driving down interest rates but not necessarily stimulating demand or spending. Explore more to understand how these dynamics influence economic recovery and policy decisions.

Aggregate demand

A liquidity trap occurs when interest rates are near zero, leading to a situation where monetary policy loses effectiveness in stimulating aggregate demand as consumers and investors prefer holding cash over spending or investing. Excess savings, on the other hand, result in reduced consumption and investment, directly lowering aggregate demand and slowing economic growth despite available financial resources. Explore how these dynamics influence fiscal and monetary policies to better understand their impact on economic recovery.

Money supply

A liquidity trap occurs when interest rates are near zero, causing money supply increases to fail in stimulating economic activity, as individuals prefer holding cash rather than investing or spending. Excess savings refer to a situation where surplus funds accumulate but do not translate into higher consumption or investment, dampening demand despite ample money supply. Explore more to understand how monetary policy navigates these challenges.

Source and External Links

Liquidity Trap - Portland State University - A liquidity trap occurs when the nominal interest rate is near zero, rendering monetary policy ineffective because people prefer holding cash despite increases in money supply, often linked with deflation and economic stagnation.

Liquidity trap - Wikipedia - A liquidity trap is a Keynesian economic situation where interest rates are near zero and people prefer cash to financial assets, typically triggered by fears of deflation or insufficient demand.

Liquidity Trap - Definition, What to Expect, Mitigation - In a liquidity trap, expansionary monetary policy fails to lower interest rates or stimulate economic growth because interest rates are at or near zero and the demand for money becomes highly elastic.

dowidth.com

dowidth.com