Zero-day work contracts offer businesses exceptional flexibility by allowing employment agreements to activate only on days when labor is needed, contrasting sharply with traditional contract work that typically binds employees to fixed terms regardless of workload fluctuations. This model reduces overhead costs and optimizes workforce management, especially in volatile industries such as retail and hospitality. Explore further to understand how zero-day contracts are reshaping labor markets and economic productivity.

Why it is important

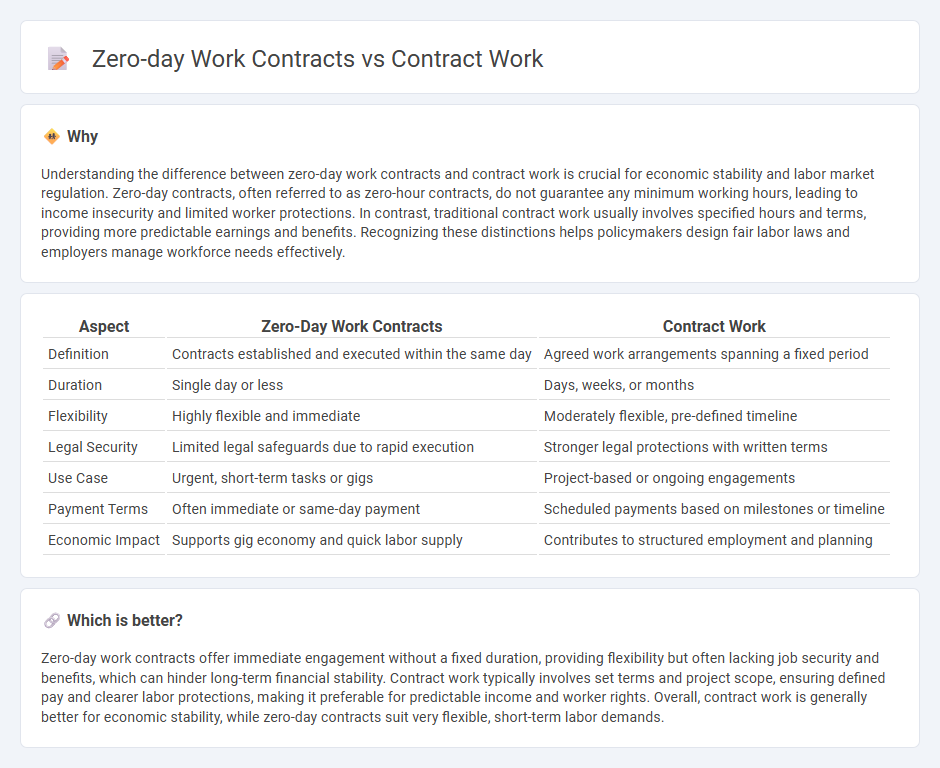

Understanding the difference between zero-day work contracts and contract work is crucial for economic stability and labor market regulation. Zero-day contracts, often referred to as zero-hour contracts, do not guarantee any minimum working hours, leading to income insecurity and limited worker protections. In contrast, traditional contract work usually involves specified hours and terms, providing more predictable earnings and benefits. Recognizing these distinctions helps policymakers design fair labor laws and employers manage workforce needs effectively.

Comparison Table

| Aspect | Zero-Day Work Contracts | Contract Work |

|---|---|---|

| Definition | Contracts established and executed within the same day | Agreed work arrangements spanning a fixed period |

| Duration | Single day or less | Days, weeks, or months |

| Flexibility | Highly flexible and immediate | Moderately flexible, pre-defined timeline |

| Legal Security | Limited legal safeguards due to rapid execution | Stronger legal protections with written terms |

| Use Case | Urgent, short-term tasks or gigs | Project-based or ongoing engagements |

| Payment Terms | Often immediate or same-day payment | Scheduled payments based on milestones or timeline |

| Economic Impact | Supports gig economy and quick labor supply | Contributes to structured employment and planning |

Which is better?

Zero-day work contracts offer immediate engagement without a fixed duration, providing flexibility but often lacking job security and benefits, which can hinder long-term financial stability. Contract work typically involves set terms and project scope, ensuring defined pay and clearer labor protections, making it preferable for predictable income and worker rights. Overall, contract work is generally better for economic stability, while zero-day contracts suit very flexible, short-term labor demands.

Connection

Zero-day work contracts, often linked to gig economy models, enable employers to minimize long-term liabilities by hiring workers only for immediate, task-specific needs. Contract work provides businesses with flexible labor options, reducing overhead costs and adapting swiftly to fluctuating market demands. Both arrangements influence the economy by promoting a shift from traditional employment to more transient, project-based engagements that impact job security and workforce statistics.

Key Terms

Employment Status

Contract work typically classifies individuals as independent contractors, offering flexibility but limited employee benefits. Zero-day work contracts often blur the line between contractor and employee, potentially triggering employment status disputes due to lack of defined probation or termination periods. Explore detailed distinctions to understand rights and obligations fully.

Job Security

Contract work offers limited job security as employment depends on project availability and contract renewals, creating income instability. Zero-day work contracts provide even less security since they typically begin without guaranteed hours or long-term commitments, exposing workers to immediate job uncertainty. Explore our detailed analysis to understand how these contract types impact job security and career planning.

Worker Benefits

Contract work often provides limited worker benefits such as paid leave or health insurance, as these are typically tied to long-term employment status. Zero-day work contracts, characterized by tasks starting and ending on the same day, usually offer minimal to no benefits, placing the onus on workers to manage their own healthcare and retirement savings. Explore deeper insights into how these contract types impact worker security and financial planning.

Source and External Links

What Is a Contract Job, and How Does It Work in 2025? - Upwork - Contract work involves hiring a professional for a specific job, with set responsibilities, fixed payment, and a defined timeframe, allowing businesses flexibility and individuals opportunities for varied projects and self-employment.

Independent contractor (self-employed) or employee? - IRS - Contract workers or independent contractors are generally self-employed and responsible for their own taxes, unlike employees for whom employers must withhold and pay taxes.

Current Openings for Remote Transcription Contract Work - 3Play Media - Contract work can include remote opportunities like transcription jobs that require specific skills and allow flexible, independent project management.

dowidth.com

dowidth.com