Carbon border tax targets imported goods based on their carbon emissions, aiming to level the playing field for domestic producers facing strict climate regulations. Environmental taxes broadly include levies on pollution, resource extraction, and waste to incentivize sustainable practices across various sectors. Explore the distinctions and impacts of these fiscal policies to understand their roles in shaping global economic and environmental sustainability.

Why it is important

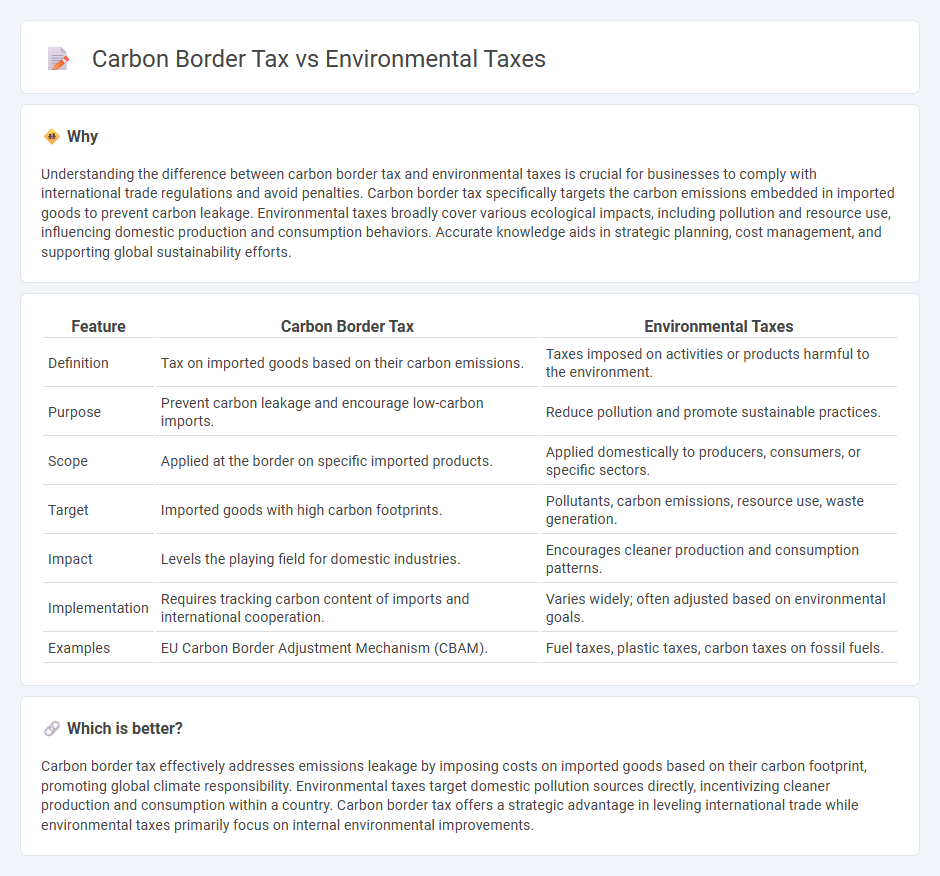

Understanding the difference between carbon border tax and environmental taxes is crucial for businesses to comply with international trade regulations and avoid penalties. Carbon border tax specifically targets the carbon emissions embedded in imported goods to prevent carbon leakage. Environmental taxes broadly cover various ecological impacts, including pollution and resource use, influencing domestic production and consumption behaviors. Accurate knowledge aids in strategic planning, cost management, and supporting global sustainability efforts.

Comparison Table

| Feature | Carbon Border Tax | Environmental Taxes |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions. | Taxes imposed on activities or products harmful to the environment. |

| Purpose | Prevent carbon leakage and encourage low-carbon imports. | Reduce pollution and promote sustainable practices. |

| Scope | Applied at the border on specific imported products. | Applied domestically to producers, consumers, or specific sectors. |

| Target | Imported goods with high carbon footprints. | Pollutants, carbon emissions, resource use, waste generation. |

| Impact | Levels the playing field for domestic industries. | Encourages cleaner production and consumption patterns. |

| Implementation | Requires tracking carbon content of imports and international cooperation. | Varies widely; often adjusted based on environmental goals. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | Fuel taxes, plastic taxes, carbon taxes on fossil fuels. |

Which is better?

Carbon border tax effectively addresses emissions leakage by imposing costs on imported goods based on their carbon footprint, promoting global climate responsibility. Environmental taxes target domestic pollution sources directly, incentivizing cleaner production and consumption within a country. Carbon border tax offers a strategic advantage in leveling international trade while environmental taxes primarily focus on internal environmental improvements.

Connection

Carbon border tax and environmental taxes are connected through their shared goal of reducing carbon emissions and promoting sustainable economic practices. Both mechanisms impose financial charges on carbon-intensive goods or activities, incentivizing businesses to lower their environmental impact. These taxes help internalize environmental costs, ensuring that economic growth aligns with global climate targets.

Key Terms

Pigovian Tax

Environmental taxes, including carbon taxes, serve as Pigovian taxes designed to internalize negative externalities by imposing costs on activities that harm the environment, thus incentivizing reduced emissions. Carbon border taxes, a subset of environmental taxes, specifically target imports based on their carbon footprint to prevent carbon leakage and ensure fair competition in global markets. Explore how Pigovian principles underpin these tax policies and their impact on sustainable economic behavior.

Carbon Leakage

Environmental taxes aim to reduce pollution by imposing charges on harmful emissions, encouraging cleaner production methods. Carbon border tax specifically targets imported goods based on their carbon footprint to prevent carbon leakage, where companies shift emissions-intensive production to countries with laxer regulations. Explore the impact of carbon border tax on global trade and emission reduction strategies for deeper insights.

Trade Competitiveness

Environmental taxes shape market behaviors by internalizing pollution costs, promoting sustainable production practices across industries. Carbon border taxes target imported goods with high carbon footprints, preventing carbon leakage and leveling the competitive field for domestic producers. Explore how these fiscal tools influence trade competitiveness and global environmental commitments in greater detail.

Source and External Links

Environmental tax - OECD - Environmental taxes are levied on environmental domains such as energy products, transport, emissions, waste management, and natural resource management and are measured as a percentage of GDP and tax revenue.

Environmental tax - Wikipedia - Environmental taxes include energy, transport, pollution, and resource taxes designed to internalize negative environmental externalities and promote sustainable development.

Green tax or promoting environmentally friendly behavior - Green taxes such as carbon taxes, congestion charges, landfill taxes, and plastic bag taxes incentivize sustainable practices and pollution reduction by shifting economic incentives.

dowidth.com

dowidth.com