De-dollarization refers to the global shift away from the US dollar as the primary currency for international trade and finance, impacting currency markets and geopolitical dynamics. In contrast, de-dollarization of reserves specifically involves central banks reducing their holdings of US dollar assets to diversify foreign exchange reserves. Explore the implications of these strategies on global economic stability and future monetary policies.

Why it is important

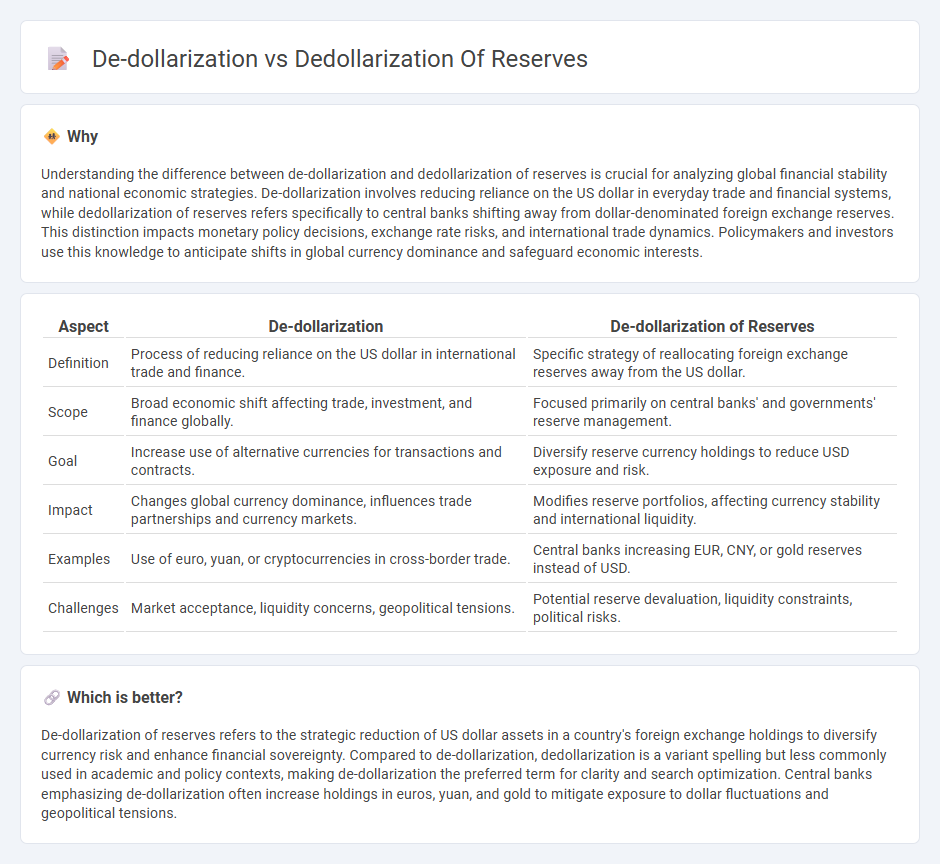

Understanding the difference between de-dollarization and dedollarization of reserves is crucial for analyzing global financial stability and national economic strategies. De-dollarization involves reducing reliance on the US dollar in everyday trade and financial systems, while dedollarization of reserves refers specifically to central banks shifting away from dollar-denominated foreign exchange reserves. This distinction impacts monetary policy decisions, exchange rate risks, and international trade dynamics. Policymakers and investors use this knowledge to anticipate shifts in global currency dominance and safeguard economic interests.

Comparison Table

| Aspect | De-dollarization | De-dollarization of Reserves |

|---|---|---|

| Definition | Process of reducing reliance on the US dollar in international trade and finance. | Specific strategy of reallocating foreign exchange reserves away from the US dollar. |

| Scope | Broad economic shift affecting trade, investment, and finance globally. | Focused primarily on central banks' and governments' reserve management. |

| Goal | Increase use of alternative currencies for transactions and contracts. | Diversify reserve currency holdings to reduce USD exposure and risk. |

| Impact | Changes global currency dominance, influences trade partnerships and currency markets. | Modifies reserve portfolios, affecting currency stability and international liquidity. |

| Examples | Use of euro, yuan, or cryptocurrencies in cross-border trade. | Central banks increasing EUR, CNY, or gold reserves instead of USD. |

| Challenges | Market acceptance, liquidity concerns, geopolitical tensions. | Potential reserve devaluation, liquidity constraints, political risks. |

Which is better?

De-dollarization of reserves refers to the strategic reduction of US dollar assets in a country's foreign exchange holdings to diversify currency risk and enhance financial sovereignty. Compared to de-dollarization, dedollarization is a variant spelling but less commonly used in academic and policy contexts, making de-dollarization the preferred term for clarity and search optimization. Central banks emphasizing de-dollarization often increase holdings in euros, yuan, and gold to mitigate exposure to dollar fluctuations and geopolitical tensions.

Connection

De-dollarization and dedollarization of reserves both involve reducing reliance on the US dollar in global economic systems, aiming to diversify currency holdings and mitigate risks associated with dollar dependency. Nations implementing de-dollarization strategies actively shift trade invoicing, financial transactions, and foreign exchange reserves toward alternative currencies such as the euro, yuan, or gold. This interconnected process reshapes international monetary dynamics by promoting multipolar currency usage and enhancing financial sovereignty.

Key Terms

Foreign Exchange Reserves

The dedollarization of foreign exchange reserves involves a strategic reduction in the proportion of U.S. dollars held by central banks, aiming to diversify currency risk and enhance financial stability. This process contrasts with broader de-dollarization, which encompasses reducing dollar usage across all economic sectors, including trade and finance. Explore how shifts in reserve currency compositions impact global markets and monetary policies.

Currency Substitution

Dedollarization of reserves involves central banks reducing holdings of U.S. dollars in favor of alternative currencies to diversify foreign exchange reserves and mitigate risks associated with dollar dependency. De-dollarization, especially in the context of currency substitution, refers to a broader economic process where domestic agents shift from using the U.S. dollar to their local currency for transactions, savings, and pricing to strengthen national monetary sovereignty. Explore deeper insights into how currency substitution drives de-dollarization trends and impacts global financial stability.

Global Trade Settlement

Dedollarization of reserves involves central banks diversifying their foreign exchange reserves away from the US dollar to reduce exposure and enhance financial stability, while de-dollarization in global trade settlement refers to shifting international transactions from the dollar to alternative currencies such as the euro, yuan, or gold. Recent trends indicate increased usage of non-dollar currencies in trade invoices and settlements, driven by geopolitical tensions and the pursuit of economic sovereignty by emerging markets. Explore deeper insights into how these shifts impact global economic power dynamics and currency strategies.

Source and External Links

De-dollarization: The end of dollar dominance? - J.P. Morgan - De-dollarization refers to the reduction in the U.S. dollar's share of global foreign exchange reserves, recently hitting a two-decade low below 60%, with emerging markets increasing gold reserves and some growth in Chinese yuan holdings.

The convergence of risk, coercion, and de-dollarization | White paper - Historical de-dollarization saw the dollar's share in foreign exchange reserves fall from 77% in 1976 to 48% by the end of the Cold War, driven by diversification to other currencies and gold amid political and economic risks.

Dollar Dominance in the International Reserve System: An Update - Although the U.S. dollar's share in global reserves is declining gradually, it remains the dominant reserve currency with no clear acceleration in its loss attributed to geopolitical sanctions, reflecting a slow but steady transition in central bank reserve portfolios.

dowidth.com

dowidth.com