Greedflation occurs when companies raise prices beyond the increase in costs to boost profit margins, driven by market power or opportunistic behavior. Cost-push inflation happens when rising production costs, such as wages or raw materials, force businesses to increase prices to maintain profitability. Explore the differences and impacts of greedflation and cost-push inflation to understand their roles in economic dynamics.

Why it is important

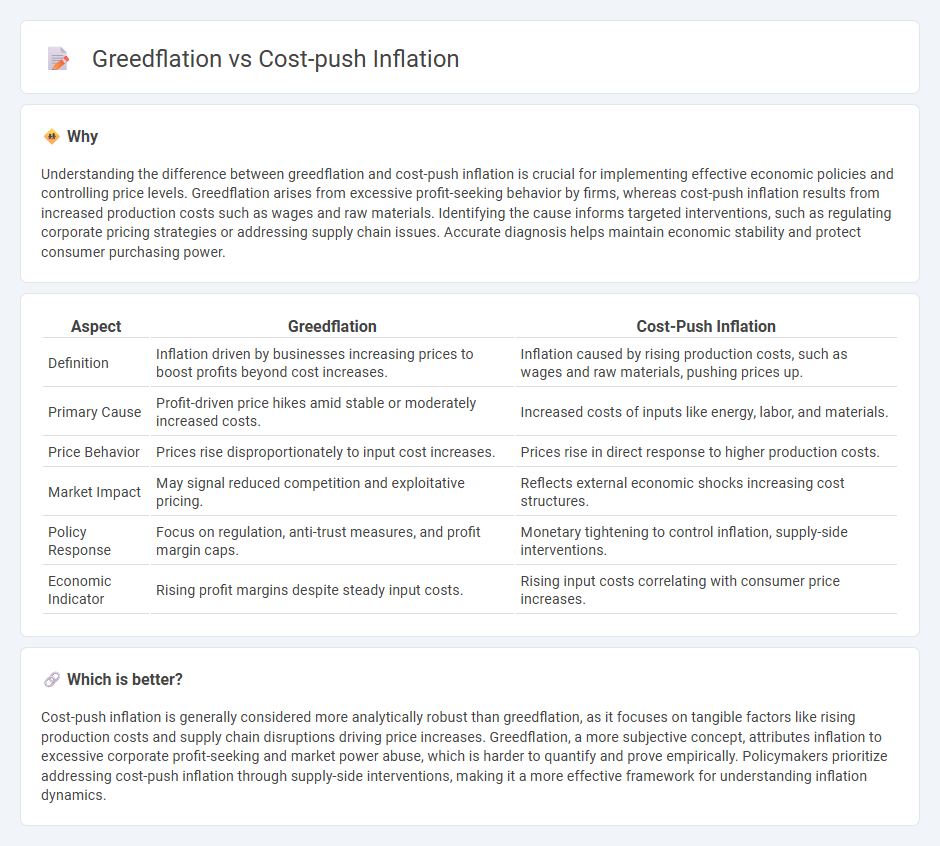

Understanding the difference between greedflation and cost-push inflation is crucial for implementing effective economic policies and controlling price levels. Greedflation arises from excessive profit-seeking behavior by firms, whereas cost-push inflation results from increased production costs such as wages and raw materials. Identifying the cause informs targeted interventions, such as regulating corporate pricing strategies or addressing supply chain issues. Accurate diagnosis helps maintain economic stability and protect consumer purchasing power.

Comparison Table

| Aspect | Greedflation | Cost-Push Inflation |

|---|---|---|

| Definition | Inflation driven by businesses increasing prices to boost profits beyond cost increases. | Inflation caused by rising production costs, such as wages and raw materials, pushing prices up. |

| Primary Cause | Profit-driven price hikes amid stable or moderately increased costs. | Increased costs of inputs like energy, labor, and materials. |

| Price Behavior | Prices rise disproportionately to input cost increases. | Prices rise in direct response to higher production costs. |

| Market Impact | May signal reduced competition and exploitative pricing. | Reflects external economic shocks increasing cost structures. |

| Policy Response | Focus on regulation, anti-trust measures, and profit margin caps. | Monetary tightening to control inflation, supply-side interventions. |

| Economic Indicator | Rising profit margins despite steady input costs. | Rising input costs correlating with consumer price increases. |

Which is better?

Cost-push inflation is generally considered more analytically robust than greedflation, as it focuses on tangible factors like rising production costs and supply chain disruptions driving price increases. Greedflation, a more subjective concept, attributes inflation to excessive corporate profit-seeking and market power abuse, which is harder to quantify and prove empirically. Policymakers prioritize addressing cost-push inflation through supply-side interventions, making it a more effective framework for understanding inflation dynamics.

Connection

Greedflation amplifies cost-push inflation by driving companies to increase prices beyond rising production costs to boost profit margins. Cost-push inflation occurs when higher input costs, such as wages or raw materials, force businesses to raise prices, and greedflation intensifies this effect through strategic price hikes. Together, they contribute to sustained inflationary pressures that erode consumer purchasing power and economic stability.

Key Terms

Production costs

Cost-push inflation arises from rising production costs such as wages, raw materials, and energy, which force producers to increase prices to maintain profit margins. Greedflation, however, occurs when companies exploit higher demand or supply constraints to boost prices beyond necessary production cost increases, reflecting opportunistic pricing rather than genuine cost pressures. Explore further to understand how production costs distinctly impact inflation dynamics in these scenarios.

Profit margins

Cost-push inflation occurs when rising production costs, such as wages and raw materials, force businesses to increase prices, squeezing profit margins if not fully passed on. Greedflation describes a scenario where companies deliberately raise prices beyond cost increases to expand profit margins, often exploiting market power. Explore detailed analyses to distinguish how profit margins behave under these inflation types.

Market power

Cost-push inflation occurs when increased production costs force businesses to raise prices, often due to supply chain disruptions or rising wages. Greedflation, by contrast, stems from firms exercising extensive market power to boost profit margins disproportionately, independent of underlying cost changes. Explore how market dominance shapes pricing strategies and its impact on inflation dynamics to understand these phenomena better.

Source and External Links

Economics Help - Cost-Push Inflation - Cost-push inflation occurs when prices rise due to increased production costs such as higher wages or raw material prices, shifting the aggregate supply curve left and raising the overall price level.

RBA - Causes of Inflation - Cost-push inflation happens when a decrease in aggregate supply, often due to higher production costs, leads to upward pressure on prices while aggregate demand remains unchanged.

SmartAsset - Cost-Push Inflation: Definition & Examples - Cost-push inflation is when businesses pass increased production costs on to consumers, resulting in higher prices for goods and services even when demand stays steady.

dowidth.com

dowidth.com