The carbon border tax targets the carbon emissions embedded in imported goods to prevent carbon leakage and ensure fair competition for domestic industries. In contrast, the carbon tax directly imposes a price on carbon emissions produced within a country, incentivizing businesses to reduce their carbon footprint. Explore how these policies shape economic strategies and global trade dynamics.

Why it is important

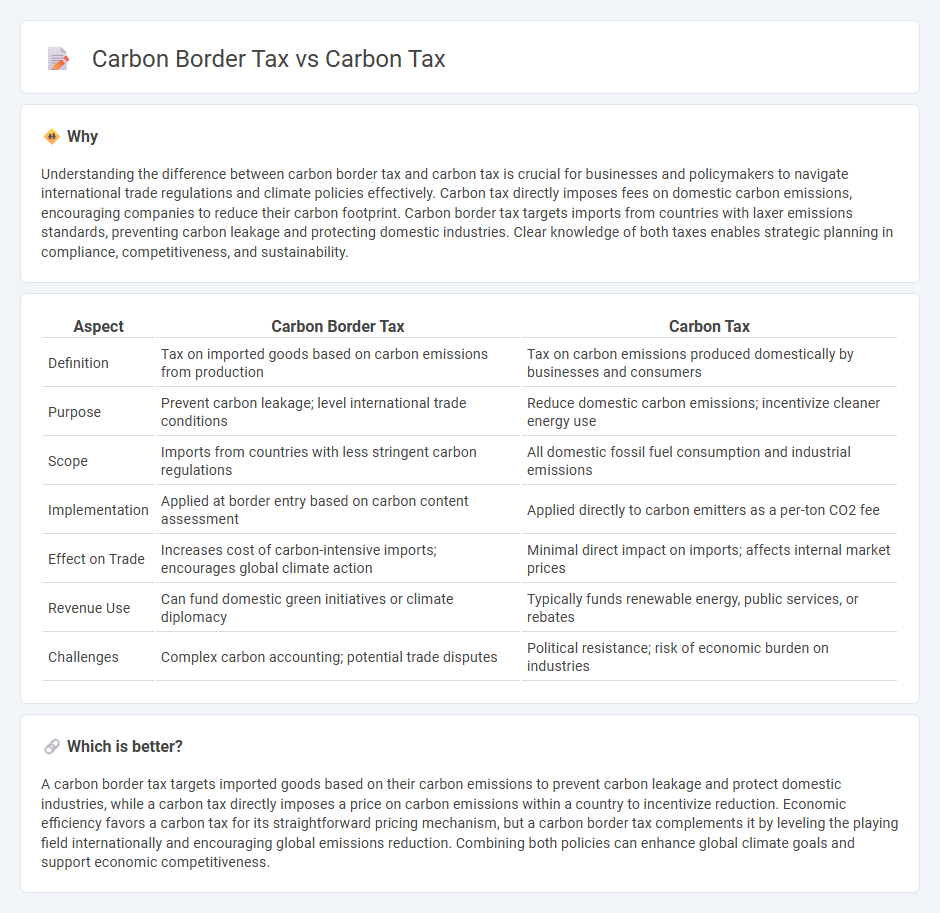

Understanding the difference between carbon border tax and carbon tax is crucial for businesses and policymakers to navigate international trade regulations and climate policies effectively. Carbon tax directly imposes fees on domestic carbon emissions, encouraging companies to reduce their carbon footprint. Carbon border tax targets imports from countries with laxer emissions standards, preventing carbon leakage and protecting domestic industries. Clear knowledge of both taxes enables strategic planning in compliance, competitiveness, and sustainability.

Comparison Table

| Aspect | Carbon Border Tax | Carbon Tax |

|---|---|---|

| Definition | Tax on imported goods based on carbon emissions from production | Tax on carbon emissions produced domestically by businesses and consumers |

| Purpose | Prevent carbon leakage; level international trade conditions | Reduce domestic carbon emissions; incentivize cleaner energy use |

| Scope | Imports from countries with less stringent carbon regulations | All domestic fossil fuel consumption and industrial emissions |

| Implementation | Applied at border entry based on carbon content assessment | Applied directly to carbon emitters as a per-ton CO2 fee |

| Effect on Trade | Increases cost of carbon-intensive imports; encourages global climate action | Minimal direct impact on imports; affects internal market prices |

| Revenue Use | Can fund domestic green initiatives or climate diplomacy | Typically funds renewable energy, public services, or rebates |

| Challenges | Complex carbon accounting; potential trade disputes | Political resistance; risk of economic burden on industries |

Which is better?

A carbon border tax targets imported goods based on their carbon emissions to prevent carbon leakage and protect domestic industries, while a carbon tax directly imposes a price on carbon emissions within a country to incentivize reduction. Economic efficiency favors a carbon tax for its straightforward pricing mechanism, but a carbon border tax complements it by leveling the playing field internationally and encouraging global emissions reduction. Combining both policies can enhance global climate goals and support economic competitiveness.

Connection

Carbon border tax and carbon tax are interconnected economic tools designed to reduce greenhouse gas emissions by assigning a cost to carbon pollution. Carbon tax imposes a charge on the carbon content of fossil fuels within a country's borders, incentivizing businesses to lower emissions, while carbon border tax extends this principle by taxing imported goods based on their carbon footprint to prevent carbon leakage and protect domestic industries. Both mechanisms aim to create a level playing field in international trade and encourage global emissions reductions.

Key Terms

Emissions Pricing

Carbon tax imposes a direct fee on greenhouse gas emissions produced within a country, incentivizing companies to reduce their carbon footprint by increasing the cost of emitting CO2. Carbon border tax, also known as a carbon border adjustment mechanism, levies fees on imported goods based on their carbon content to prevent carbon leakage and ensure fair competition for domestic industries adhering to emissions pricing policies. Explore more about how these tools drive global emissions reduction and trade policy alignment.

Trade Competitiveness

Carbon tax imposes a direct levy on carbon emissions within a country, impacting domestic producers by increasing production costs and influencing trade competitiveness. Carbon border tax, or carbon border adjustment mechanism, applies tariffs on imported goods based on their carbon footprint, aiming to prevent carbon leakage and level the playing field for local industries. Explore how these policies reshape international trade dynamics and competitive strategies in the global market.

Carbon Leakage

Carbon tax directly charges emissions within a country, incentivizing businesses to reduce their carbon footprint, whereas carbon border tax targets imported goods to prevent carbon leakage by leveling the playing field for domestic producers facing stringent climate policies. Carbon leakage occurs when companies relocate production to countries with looser emission regulations, undermining global climate goals. Explore further to understand how these mechanisms interact in international climate policy.

Source and External Links

Carbon Tax: Definition, Pros and Cons, and Implementation - A carbon tax puts a price on carbon emissions from fossil fuels, incentivizing reduction in greenhouse gases by making polluting activities more costly and encouraging shifts to cleaner alternatives, with revenues able to fund climate projects or be returned to citizens.

What is a carbon tax? | Tax Policy Center - A carbon tax charges emitters for their greenhouse gas emissions to encourage less pollution, and the revenue raised can be used to offset negative socioeconomic impacts, reduce other taxes, or invest in clean energy and climate adaptation.

What You Need to Know About a Federal Carbon Tax in the United States - A carbon tax financially motivates emissions reductions by making polluting activities more expensive, accelerating technology innovation and deployment, with the power sector seeing the greatest emissions reductions under proposed tax scenarios.

dowidth.com

dowidth.com