Carbon border adjustment mechanisms (CBAM) impose tariffs on imported goods based on their carbon footprint to prevent carbon leakage and encourage global emission reduction. Emissions trading systems (ETS) set a cap on total greenhouse gas emissions and allow companies to buy and sell emission allowances, creating a market-driven approach to reducing pollution. Explore how these two strategies compare and impact international climate policy.

Why it is important

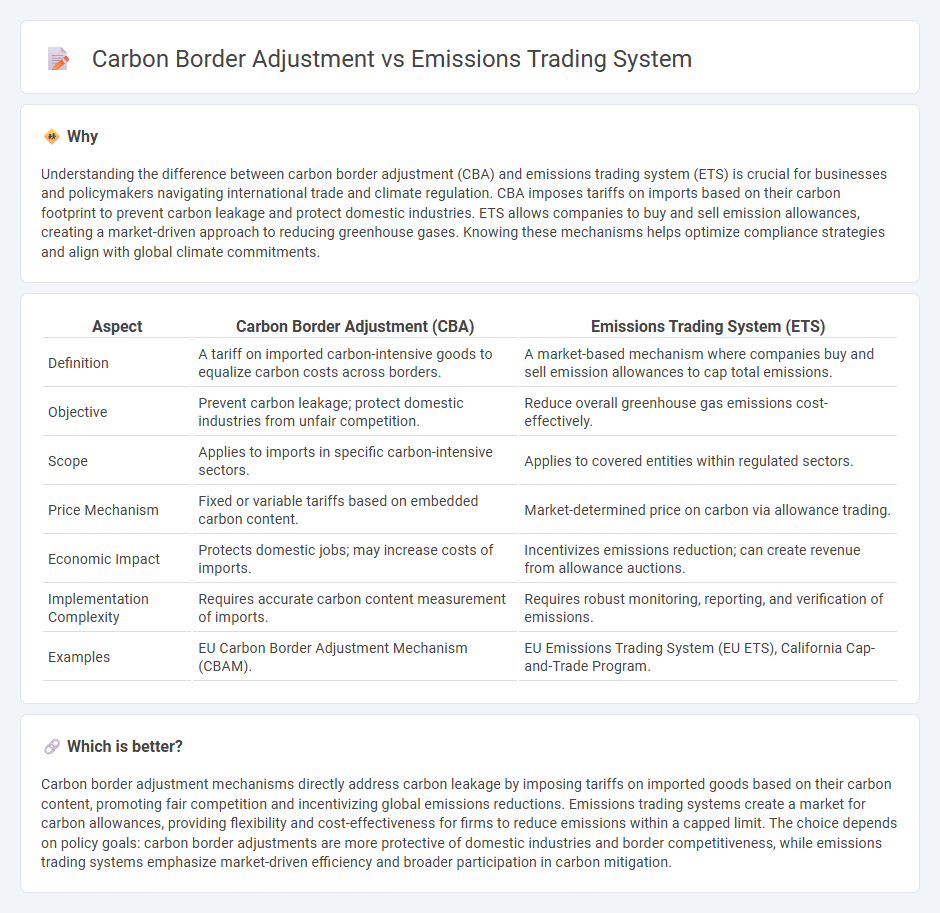

Understanding the difference between carbon border adjustment (CBA) and emissions trading system (ETS) is crucial for businesses and policymakers navigating international trade and climate regulation. CBA imposes tariffs on imports based on their carbon footprint to prevent carbon leakage and protect domestic industries. ETS allows companies to buy and sell emission allowances, creating a market-driven approach to reducing greenhouse gases. Knowing these mechanisms helps optimize compliance strategies and align with global climate commitments.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Emissions Trading System (ETS) |

|---|---|---|

| Definition | A tariff on imported carbon-intensive goods to equalize carbon costs across borders. | A market-based mechanism where companies buy and sell emission allowances to cap total emissions. |

| Objective | Prevent carbon leakage; protect domestic industries from unfair competition. | Reduce overall greenhouse gas emissions cost-effectively. |

| Scope | Applies to imports in specific carbon-intensive sectors. | Applies to covered entities within regulated sectors. |

| Price Mechanism | Fixed or variable tariffs based on embedded carbon content. | Market-determined price on carbon via allowance trading. |

| Economic Impact | Protects domestic jobs; may increase costs of imports. | Incentivizes emissions reduction; can create revenue from allowance auctions. |

| Implementation Complexity | Requires accurate carbon content measurement of imports. | Requires robust monitoring, reporting, and verification of emissions. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | EU Emissions Trading System (EU ETS), California Cap-and-Trade Program. |

Which is better?

Carbon border adjustment mechanisms directly address carbon leakage by imposing tariffs on imported goods based on their carbon content, promoting fair competition and incentivizing global emissions reductions. Emissions trading systems create a market for carbon allowances, providing flexibility and cost-effectiveness for firms to reduce emissions within a capped limit. The choice depends on policy goals: carbon border adjustments are more protective of domestic industries and border competitiveness, while emissions trading systems emphasize market-driven efficiency and broader participation in carbon mitigation.

Connection

Carbon border adjustment mechanisms align with emissions trading systems by imposing tariffs on imported goods based on their carbon emissions, ensuring fair competition between domestic and foreign producers. Emissions trading systems set a cap on total greenhouse gas emissions, allowing companies to buy and sell allowances, which incentivizes emission reductions. The linkage of these policies prevents carbon leakage by maintaining consistent carbon pricing across borders and encouraging global emission accountability.

Key Terms

Cap-and-Trade

The emissions trading system (ETS), particularly Cap-and-Trade, sets a maximum level of greenhouse gas emissions and allows companies to buy and sell emission allowances to meet regulatory limits efficiently. In contrast, the Carbon Border Adjustment Mechanism (CBAM) imposes tariffs on imported goods based on their carbon content to prevent carbon leakage and protect domestic industries. Explore the nuances of Cap-and-Trade and its global impact on climate policies for comprehensive understanding.

Carbon Leakage

Emissions Trading Systems (ETS) and Carbon Border Adjustments (CBA) are critical tools addressing carbon leakage, where production shifts to regions with laxer emission constraints, undermining climate goals. ETS cap emissions within a jurisdiction, incentivizing reductions, while CBAs impose tariffs on imports from countries with weaker climate policies to level the playing field. Discover how these mechanisms interact and complement each other to combat carbon leakage effectively.

Carbon Pricing

The emissions trading system (ETS) sets a cap on total greenhouse gas emissions, allowing companies to buy and sell emission allowances to meet reduction targets, creating a market-driven approach to carbon pricing. In contrast, the carbon border adjustment mechanism (CBAM) imposes tariffs on imported goods based on their carbon content, aiming to prevent carbon leakage and level the playing field for domestic industries subject to carbon costs. Explore how these carbon pricing tools jointly enhance global climate policy effectiveness and economic competitiveness.

Source and External Links

Emissions trading - Wikipedia - Emissions trading, also known as cap and trade or emissions trading scheme (ETS), is a market-based approach to control pollution by providing economic incentives to reduce emissions, where a central authority sets a cap on emissions and allows trading of permits among polluters.

European Union Emissions Trading System - Wikipedia - The EU ETS is a major cap and trade system that began in 2005 to reduce greenhouse gas emissions in the EU, covering about 45% of its emissions, with companies required to hold allowances equal to their emissions that can be traded within the system.

What Is Emissions Trading? | US EPA - Emissions trading programs set a pollution cap and allow sources to buy and sell emission allowances, providing accountability and flexibility to reduce pollution efficiently and protect human health and the environment.

dowidth.com

dowidth.com