Greenflation refers to the rising costs associated with transitioning to sustainable energy and environmentally friendly technologies, driven by increased demand for green resources and regulatory changes. Stagflation combines stagnant economic growth with high inflation and unemployment, creating a challenging environment for policymakers. Explore the complexities of greenflation versus stagflation to understand their distinct impacts on economic stability.

Why it is important

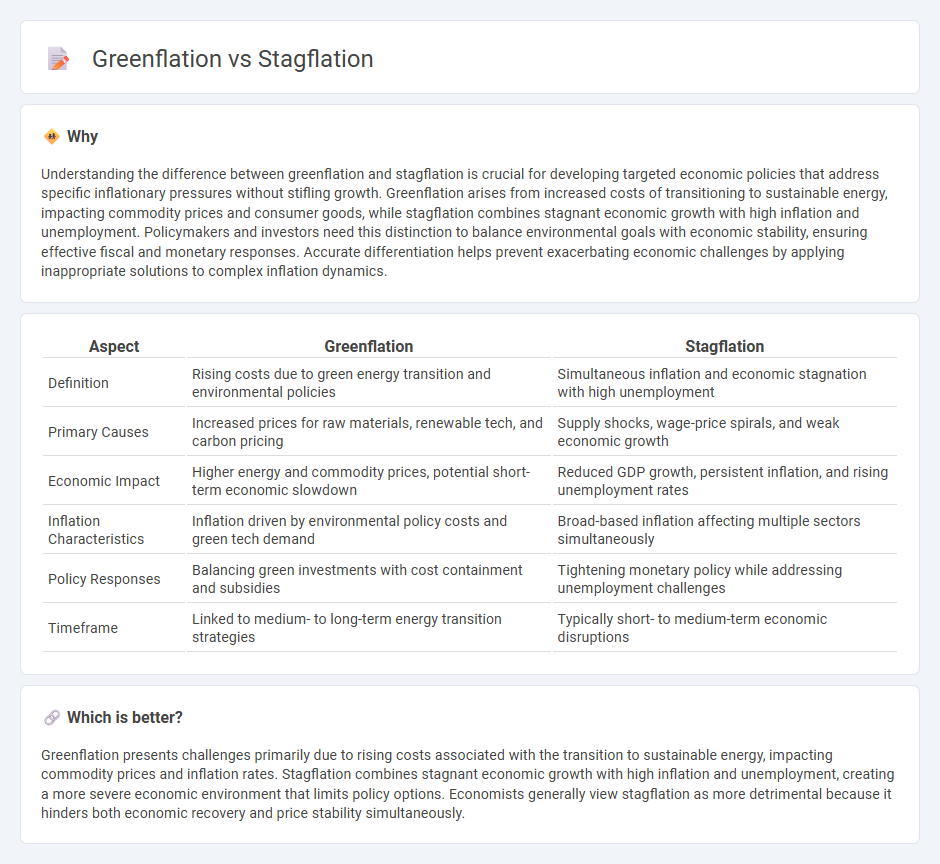

Understanding the difference between greenflation and stagflation is crucial for developing targeted economic policies that address specific inflationary pressures without stifling growth. Greenflation arises from increased costs of transitioning to sustainable energy, impacting commodity prices and consumer goods, while stagflation combines stagnant economic growth with high inflation and unemployment. Policymakers and investors need this distinction to balance environmental goals with economic stability, ensuring effective fiscal and monetary responses. Accurate differentiation helps prevent exacerbating economic challenges by applying inappropriate solutions to complex inflation dynamics.

Comparison Table

| Aspect | Greenflation | Stagflation |

|---|---|---|

| Definition | Rising costs due to green energy transition and environmental policies | Simultaneous inflation and economic stagnation with high unemployment |

| Primary Causes | Increased prices for raw materials, renewable tech, and carbon pricing | Supply shocks, wage-price spirals, and weak economic growth |

| Economic Impact | Higher energy and commodity prices, potential short-term economic slowdown | Reduced GDP growth, persistent inflation, and rising unemployment rates |

| Inflation Characteristics | Inflation driven by environmental policy costs and green tech demand | Broad-based inflation affecting multiple sectors simultaneously |

| Policy Responses | Balancing green investments with cost containment and subsidies | Tightening monetary policy while addressing unemployment challenges |

| Timeframe | Linked to medium- to long-term energy transition strategies | Typically short- to medium-term economic disruptions |

Which is better?

Greenflation presents challenges primarily due to rising costs associated with the transition to sustainable energy, impacting commodity prices and inflation rates. Stagflation combines stagnant economic growth with high inflation and unemployment, creating a more severe economic environment that limits policy options. Economists generally view stagflation as more detrimental because it hinders both economic recovery and price stability simultaneously.

Connection

Greenflation and stagflation are connected through their shared impact on rising inflation rates amid economic stagnation. Greenflation results from increased costs in transitioning to sustainable energy and environmental regulations, driving up prices for goods and services. Stagflation occurs when inflation persists alongside stagnant economic growth and high unemployment, often exacerbated by the supply constraints and higher production costs linked to greenflation.

Key Terms

Inflation

Stagflation describes a persistent high inflation rate combined with stagnant economic growth and rising unemployment, often triggered by supply shocks or poor economic policies. Greenflation refers to inflationary pressures driven specifically by the costs associated with transitioning to a green economy, such as increased prices in energy, raw materials, and sustainable technologies. Explore further to understand how these inflation types impact economic strategies and policy decisions.

Supply Shock

Stagflation arises from supply shocks that simultaneously constrain production and drive up prices, leading to stagnant growth and high inflation. Greenflation specifically refers to inflation driven by supply chain disruptions and increased costs associated with transitioning to sustainable energy and resources. Explore the differences and impacts of these supply shocks to understand their economic implications more deeply.

Energy Transition

Stagflation involves rising inflation, stagnant economic growth, and high unemployment, whereas greenflation centers on inflationary pressures specifically driven by the energy transition, including the increased costs of raw materials like lithium and cobalt used in renewable technologies. The energy transition's demand for critical minerals and clean energy infrastructure investment contributes to greenflation by impacting supply chains and production costs in the global economy. Explore how greenflation challenges traditional economic models and influences policy decisions for a sustainable energy future.

Source and External Links

Overview, Examples, Why Stagflation is Feared - Stagflation is an economic event characterized by high inflation, slow economic growth, and persistently high unemployment, presenting a dilemma for policymakers because measures to reduce inflation can increase unemployment, and vice versa.

Is the worst of both worlds returning? Understanding stagflation risk - Stagflation describes a period of rising prices coupled with stagnant or declining GDP growth, often with rising unemployment, defying the usual pattern where inflation and unemployment tend to move inversely.

Stagflation - Wikipedia - The term stagflation originated in the 1960s and refers to the simultaneous occurrence of high inflation, stagnant economic growth, and elevated unemployment, notably intensified during the 1970s global oil crisis, challenging traditional economic theories like the Phillips Curve.

dowidth.com

dowidth.com