Locavesting empowers local investors to support community businesses, fostering regional economic growth through proximity-based investment opportunities. Direct public offerings (DPOs) allow companies to raise capital directly from the public without intermediaries, broadening access to funding and shareholder diversity. Explore how locavesting and DPOs reshape modern investment landscapes and drive sustainable local economies.

Why it is important

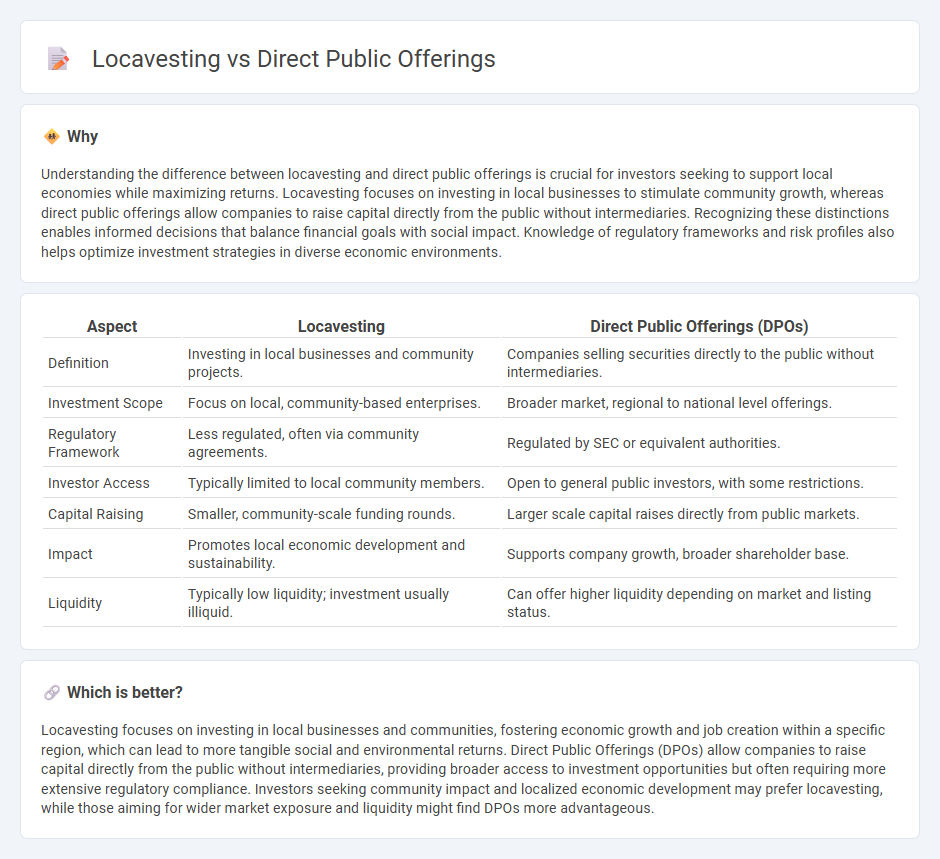

Understanding the difference between locavesting and direct public offerings is crucial for investors seeking to support local economies while maximizing returns. Locavesting focuses on investing in local businesses to stimulate community growth, whereas direct public offerings allow companies to raise capital directly from the public without intermediaries. Recognizing these distinctions enables informed decisions that balance financial goals with social impact. Knowledge of regulatory frameworks and risk profiles also helps optimize investment strategies in diverse economic environments.

Comparison Table

| Aspect | Locavesting | Direct Public Offerings (DPOs) |

|---|---|---|

| Definition | Investing in local businesses and community projects. | Companies selling securities directly to the public without intermediaries. |

| Investment Scope | Focus on local, community-based enterprises. | Broader market, regional to national level offerings. |

| Regulatory Framework | Less regulated, often via community agreements. | Regulated by SEC or equivalent authorities. |

| Investor Access | Typically limited to local community members. | Open to general public investors, with some restrictions. |

| Capital Raising | Smaller, community-scale funding rounds. | Larger scale capital raises directly from public markets. |

| Impact | Promotes local economic development and sustainability. | Supports company growth, broader shareholder base. |

| Liquidity | Typically low liquidity; investment usually illiquid. | Can offer higher liquidity depending on market and listing status. |

Which is better?

Locavesting focuses on investing in local businesses and communities, fostering economic growth and job creation within a specific region, which can lead to more tangible social and environmental returns. Direct Public Offerings (DPOs) allow companies to raise capital directly from the public without intermediaries, providing broader access to investment opportunities but often requiring more extensive regulatory compliance. Investors seeking community impact and localized economic development may prefer locavesting, while those aiming for wider market exposure and liquidity might find DPOs more advantageous.

Connection

Locavesting emphasizes investing in local businesses to stimulate regional economic growth, which closely aligns with direct public offerings (DPOs) that enable companies to raise capital directly from community investors. By leveraging DPOs, local enterprises can attract funds from residents who have a vested interest in the area's economic prosperity, fostering a more resilient and self-sustaining economy. This connection enhances community engagement, bolsters local job creation, and keeps financial returns circulating within the region.

Key Terms

Capital raising

Direct public offerings (DPOs) enable companies to raise capital directly from the public without intermediaries, often resulting in lower costs and increased community engagement. Locavesting emphasizes raising funds from local investors to support regional businesses, fostering economic growth within specific communities and offering investors a stake in nearby ventures. Explore more to understand the strategic benefits and processes involved in these capital-raising methods.

Community investment

Direct public offerings (DPOs) enable companies to raise capital directly from the general public, bypassing traditional intermediaries and fostering broader community ownership. Locavesting emphasizes investing within local geographic areas to support neighborhood businesses and promote sustainable economic growth through community engagement. Explore how these models empower local investors and strengthen community ties by learning more about their impact on regional development.

Securities regulation

Direct Public Offerings (DPOs) allow companies to raise capital by selling securities directly to the public, bypassing traditional intermediaries, but must comply with Securities and Exchange Commission (SEC) regulations including registration requirements or exemptions. Locavesting emphasizes local investments, often using DPOs or Regulation Crowdfunding under SEC rules designed to protect local investors and promote community engagement while ensuring transparency and adherence to state securities laws. Explore detailed comparisons of regulatory frameworks and compliance strategies to optimize capital raising through DPOs and locavesting.

Source and External Links

Direct Offering - Overview, How It Works, and Process - Direct offerings allow companies to sell securities directly to investors without intermediaries, reducing costs and regulatory requirements compared to traditional IPOs.

Direct public offering - Wikipedia - A direct public offering (DPO) is a method for companies to offer securities directly to the public, enabling broader access to investment capital and community participation, though it requires self-marketing and ongoing compliance with disclosure rules.

Direct Public Offering (DPO): Expanding Your Team of Stakeholders - DPOs raise capital by selling shares directly to employees, customers, and individual investors, offering a less expensive and less regulated alternative to IPOs, but typically raising less capital.

dowidth.com

dowidth.com