Public shaming boycotts influence economic behavior by targeting companies with negative consumer feedback, leading to revenue declines without government intervention. Taxation directly alters consumer and business activity through imposed financial charges, funding public services and affecting market dynamics. Explore how these mechanisms shape economic outcomes and social accountability for deeper insights.

Why it is important

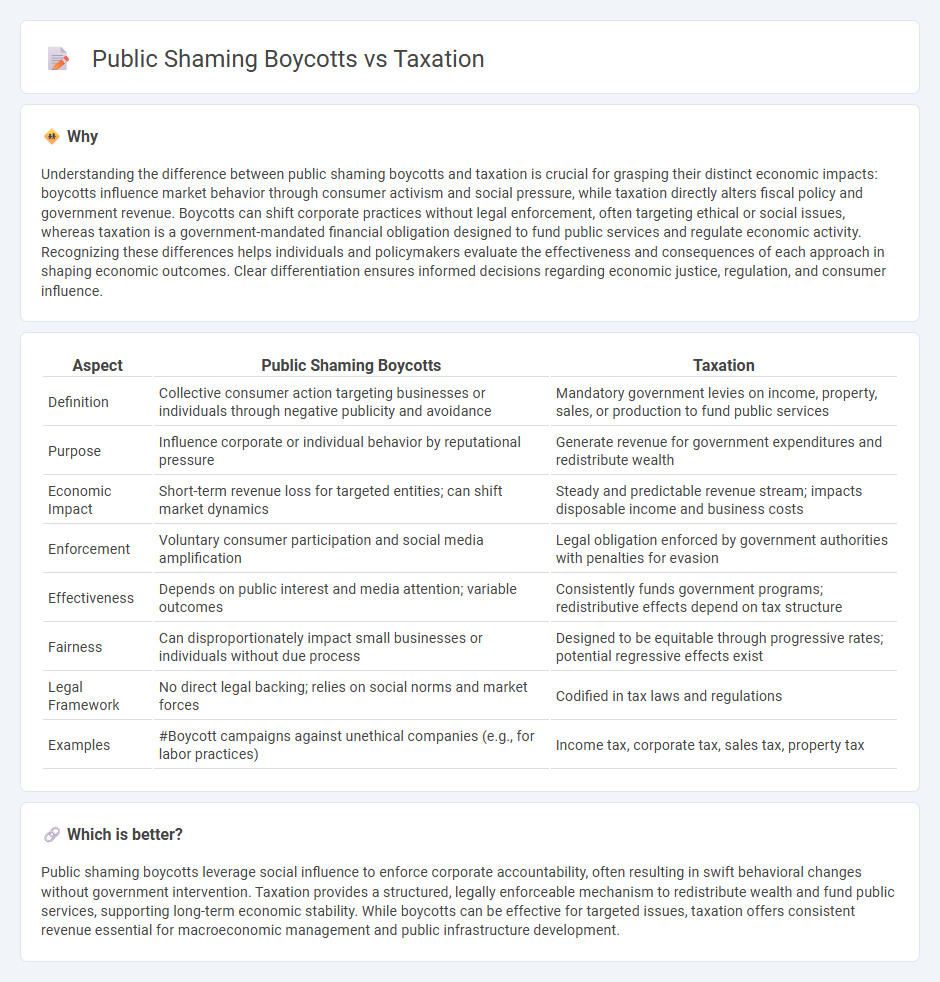

Understanding the difference between public shaming boycotts and taxation is crucial for grasping their distinct economic impacts: boycotts influence market behavior through consumer activism and social pressure, while taxation directly alters fiscal policy and government revenue. Boycotts can shift corporate practices without legal enforcement, often targeting ethical or social issues, whereas taxation is a government-mandated financial obligation designed to fund public services and regulate economic activity. Recognizing these differences helps individuals and policymakers evaluate the effectiveness and consequences of each approach in shaping economic outcomes. Clear differentiation ensures informed decisions regarding economic justice, regulation, and consumer influence.

Comparison Table

| Aspect | Public Shaming Boycotts | Taxation |

|---|---|---|

| Definition | Collective consumer action targeting businesses or individuals through negative publicity and avoidance | Mandatory government levies on income, property, sales, or production to fund public services |

| Purpose | Influence corporate or individual behavior by reputational pressure | Generate revenue for government expenditures and redistribute wealth |

| Economic Impact | Short-term revenue loss for targeted entities; can shift market dynamics | Steady and predictable revenue stream; impacts disposable income and business costs |

| Enforcement | Voluntary consumer participation and social media amplification | Legal obligation enforced by government authorities with penalties for evasion |

| Effectiveness | Depends on public interest and media attention; variable outcomes | Consistently funds government programs; redistributive effects depend on tax structure |

| Fairness | Can disproportionately impact small businesses or individuals without due process | Designed to be equitable through progressive rates; potential regressive effects exist |

| Legal Framework | No direct legal backing; relies on social norms and market forces | Codified in tax laws and regulations |

| Examples | #Boycott campaigns against unethical companies (e.g., for labor practices) | Income tax, corporate tax, sales tax, property tax |

Which is better?

Public shaming boycotts leverage social influence to enforce corporate accountability, often resulting in swift behavioral changes without government intervention. Taxation provides a structured, legally enforceable mechanism to redistribute wealth and fund public services, supporting long-term economic stability. While boycotts can be effective for targeted issues, taxation offers consistent revenue essential for macroeconomic management and public infrastructure development.

Connection

Public shaming, boycotts, and taxation intersect as tools influencing economic behavior and market dynamics. Boycotts leverage consumer power to apply economic pressure on businesses or governments, often spurred by public shaming campaigns aimed at unethical practices. Taxation policies can respond to or deter certain behaviors promoted by these social movements, shaping economic incentives and regulatory frameworks.

Key Terms

Government Revenue

Taxation serves as a primary mechanism for government revenue generation, providing stable and predictable funds essential for public services and infrastructure development. Public shaming boycotts, while impactful socially, do not directly contribute to government coffers and can lead to unpredictable economic consequences. Explore the comparative effects of these approaches on fiscal policy and public finance management for deeper insights.

Social Sanctions

Social sanctions like boycotts leverage collective social pressure to enforce behavioral norms, often creating immediate reputational consequences without legal enforcement. Taxation serves as a formal government mechanism to fund public goods and influence behavior through financial incentives or penalties. Explore the nuanced impacts of social sanctions versus taxation on individual and corporate conduct.

Market Behavior

Taxation influences market behavior by incentivizing or disincentivizing certain economic activities through fiscal policies, affecting consumer spending and corporate strategies. Public shaming boycotts impact market behavior by directly targeting brand reputation and consumer trust, often leading to swift shifts in buying patterns and corporate responses. Explore further to understand the comparative effectiveness and long-term implications of these mechanisms on market dynamics.

Source and External Links

Tax - Wikipedia - Taxation is the process by which governments transfer wealth from households or businesses to fund public goods and services, influencing economic growth, welfare, and societal equity.

Taxation - OECD - Taxation is essential for raising government revenue to provide public services, with effective tax policies supporting inclusive, sustainable growth and international cooperation to combat tax evasion.

Taxation | Definition, Purpose, Importance, & Types | Britannica Money - Taxation refers to the compulsory levies imposed by governments on individuals or entities, serving as a primary source of public revenue to fund state functions.

dowidth.com

dowidth.com