A soft landing in the economy refers to a controlled slowdown in growth, preventing a recession while maintaining stable employment and inflation rates. In contrast, a depression signifies a prolonged and severe downturn marked by significant declines in GDP, surging unemployment, and widespread economic distress. Explore the key indicators and strategies behind achieving a soft landing versus succumbing to depression.

Why it is important

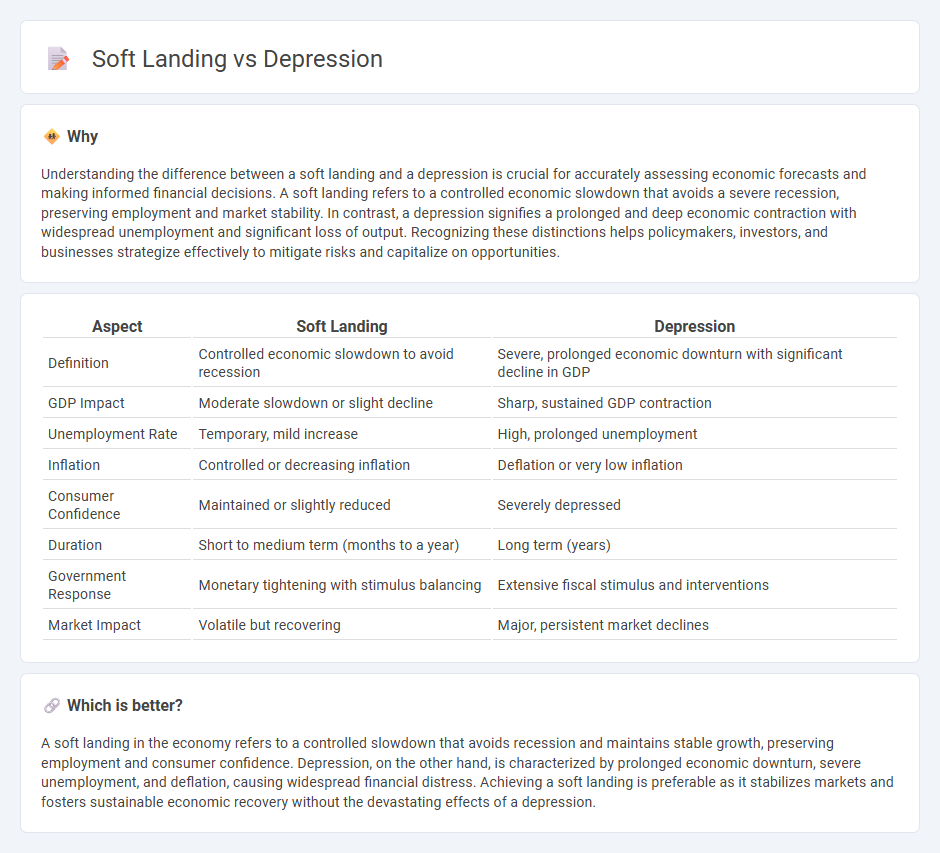

Understanding the difference between a soft landing and a depression is crucial for accurately assessing economic forecasts and making informed financial decisions. A soft landing refers to a controlled economic slowdown that avoids a severe recession, preserving employment and market stability. In contrast, a depression signifies a prolonged and deep economic contraction with widespread unemployment and significant loss of output. Recognizing these distinctions helps policymakers, investors, and businesses strategize effectively to mitigate risks and capitalize on opportunities.

Comparison Table

| Aspect | Soft Landing | Depression |

|---|---|---|

| Definition | Controlled economic slowdown to avoid recession | Severe, prolonged economic downturn with significant decline in GDP |

| GDP Impact | Moderate slowdown or slight decline | Sharp, sustained GDP contraction |

| Unemployment Rate | Temporary, mild increase | High, prolonged unemployment |

| Inflation | Controlled or decreasing inflation | Deflation or very low inflation |

| Consumer Confidence | Maintained or slightly reduced | Severely depressed |

| Duration | Short to medium term (months to a year) | Long term (years) |

| Government Response | Monetary tightening with stimulus balancing | Extensive fiscal stimulus and interventions |

| Market Impact | Volatile but recovering | Major, persistent market declines |

Which is better?

A soft landing in the economy refers to a controlled slowdown that avoids recession and maintains stable growth, preserving employment and consumer confidence. Depression, on the other hand, is characterized by prolonged economic downturn, severe unemployment, and deflation, causing widespread financial distress. Achieving a soft landing is preferable as it stabilizes markets and fosters sustainable economic recovery without the devastating effects of a depression.

Connection

A soft landing in the economy occurs when growth slows just enough to avoid recession, maintaining employment and stable inflation without triggering widespread financial distress. In contrast, a depression represents a severe, prolonged downturn marked by massive declines in GDP, skyrocketing unemployment, and deflationary pressures. Understanding the mechanisms that enable a soft landing helps policymakers prevent the transition into a deep economic depression.

Key Terms

Recession

A recession marked by economic contraction and rising unemployment contrasts with a soft landing, where central banks manage inflation without triggering a downturn. Depression involves prolonged GDP decline and deep societal impacts, while a soft landing stabilizes growth with minimal market disruption. Explore detailed strategies and economic indicators to understand these critical economic scenarios fully.

Monetary Policy

Monetary policy plays a crucial role in differentiating between a depression and a soft landing by influencing interest rates, inflation, and economic growth. In a depression scenario, tight monetary policies or ineffective stimulus can exacerbate unemployment and deflation, while a soft landing aims to balance rate adjustments to curb inflation without triggering a recession. Explore detailed insights on how central banks optimize monetary strategies to navigate between economic collapse and stable growth.

Aggregate Demand

Depression and soft landing are economic scenarios defined by contrasting aggregate demand dynamics; a depression is marked by a severe, prolonged drop in aggregate demand leading to widespread unemployment and deflation, while a soft landing features a moderate slowdown preserving overall demand stability to avoid recession. Central banks and policymakers aim to manage aggregate demand through interest rate adjustments and fiscal policies to achieve a soft landing, preventing the deep contraction typical of a depression. Explore economic strategies and data analysis on aggregate demand to better understand how these outcomes affect market stability and growth.

Source and External Links

What Is Depression? - Depression is a common and serious medical illness that affects how a person feels, thinks, and acts, with symptoms ranging from sadness and loss of interest to changes in appetite, sleep, energy, and thoughts of suicide.

Depressive disorder (depression) - Depression is a common mental disorder involving long-term depressed mood or loss of interest that affects all aspects of life and is more common in women; about 280 million people worldwide suffer from it.

Depression: Causes, Symptoms, Types & Treatment - Depression is a treatable mood disorder causing persistent sadness, loss of interest, and impairment in thinking, sleeping, and eating, with effective treatments including medication and therapy.

dowidth.com

dowidth.com