The quits rate, an indicator of worker confidence, often rises when inflation rates increase, reflecting employees' willingness to seek better-paying jobs amid higher living costs. Inflation rate fluctuations directly impact consumer purchasing power and business costs, influencing labor market dynamics and wage demands. Explore the intricate relationship between quits rate and inflation rate to better understand economic health and labor market trends.

Why it is important

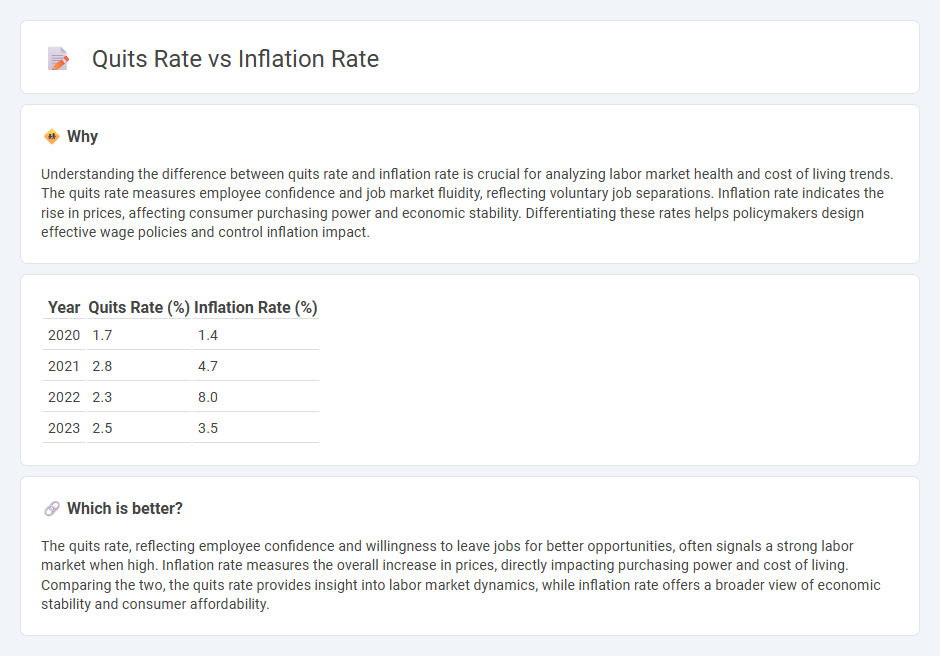

Understanding the difference between quits rate and inflation rate is crucial for analyzing labor market health and cost of living trends. The quits rate measures employee confidence and job market fluidity, reflecting voluntary job separations. Inflation rate indicates the rise in prices, affecting consumer purchasing power and economic stability. Differentiating these rates helps policymakers design effective wage policies and control inflation impact.

Comparison Table

| Year | Quits Rate (%) | Inflation Rate (%) |

|---|---|---|

| 2020 | 1.7 | 1.4 |

| 2021 | 2.8 | 4.7 |

| 2022 | 2.3 | 8.0 |

| 2023 | 2.5 | 3.5 |

Which is better?

The quits rate, reflecting employee confidence and willingness to leave jobs for better opportunities, often signals a strong labor market when high. Inflation rate measures the overall increase in prices, directly impacting purchasing power and cost of living. Comparing the two, the quits rate provides insight into labor market dynamics, while inflation rate offers a broader view of economic stability and consumer affordability.

Connection

Rising inflation rates often increase the quits rate as workers seek higher wages to maintain purchasing power amid escalating living costs. Elevated quits rates signal labor market confidence, indicating employees are willing to leave jobs for better pay despite inflation-related economic uncertainty. Employers respond by raising wages, which can further fuel inflation in a feedback loop affecting overall economic stability.

Key Terms

Price Levels

Rising inflation rates often correlate with increased quits rates as workers seek better wages to keep up with higher price levels. High consumer price indices signal diminished purchasing power, prompting employees to leave jobs for positions with improved compensation or benefits. Explore the dynamics between inflation and labor market behavior to understand this economic relationship more deeply.

Labor Turnover

The inflation rate directly impacts the quits rate by influencing workers' real wages and job satisfaction, often leading to higher labor turnover during periods of rising inflation as employees seek better compensation. Data from the Bureau of Labor Statistics shows that quits rates tend to increase when the Consumer Price Index (CPI) rises sharply, reflecting workers' response to diminished purchasing power. Explore how these economic indicators interact to better understand labor market dynamics and turnover trends.

Wage Growth

The inflation rate influences wage growth as workers demand higher pay to maintain purchasing power, driving up the quits rate when wages lag behind rising living costs. A rising quits rate often signals confidence in the labor market and can pressure employers to increase wages to retain talent. Explore how wage dynamics interplay with inflation and employee turnover to better understand labor market trends.

Source and External Links

United States Inflation Rate - Trading Economics - The inflation rate in the US increased to 2.70% in June 2025 from 2.40% in May 2025, with an expected rise to 3.20% by the end of the quarter and projections around 2.40% in 2026 and 2.30% in 2027.

What is the current inflation rate in the US? - USAFacts - As of June 2025, the US inflation rate stands at approximately 2.7%, reflecting the rise in prices of goods and services that reduce the purchasing power of the dollar.

Consumer Price Index, 1913- | Federal Reserve Bank of Minneapolis - The estimated inflation rate for 2025 is around 2.7%, based on the Consumer Price Index change from late 2023 to late 2024.

dowidth.com

dowidth.com