Living wage measures the income needed to cover basic living expenses such as housing, food, healthcare, and transportation, while real wage accounts for purchasing power adjusted for inflation. Real wages sometimes stagnate or decline despite nominal wage increases, impacting workers' actual economic well-being. Explore the dynamics between living wage and real wage to understand labor market trends and economic policy implications.

Why it is important

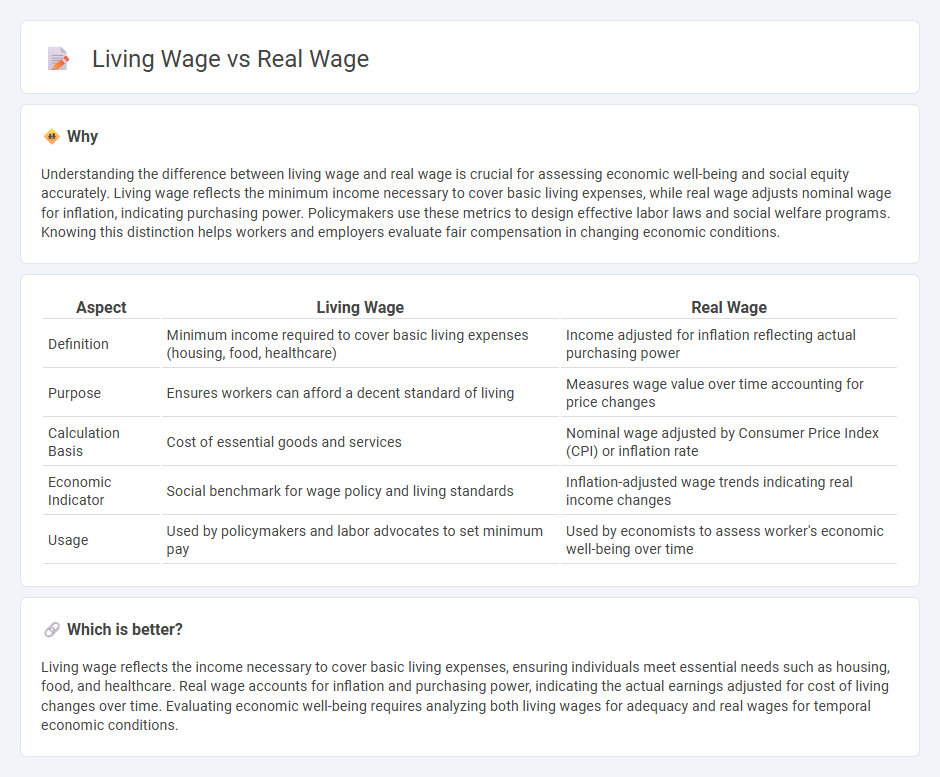

Understanding the difference between living wage and real wage is crucial for assessing economic well-being and social equity accurately. Living wage reflects the minimum income necessary to cover basic living expenses, while real wage adjusts nominal wage for inflation, indicating purchasing power. Policymakers use these metrics to design effective labor laws and social welfare programs. Knowing this distinction helps workers and employers evaluate fair compensation in changing economic conditions.

Comparison Table

| Aspect | Living Wage | Real Wage |

|---|---|---|

| Definition | Minimum income required to cover basic living expenses (housing, food, healthcare) | Income adjusted for inflation reflecting actual purchasing power |

| Purpose | Ensures workers can afford a decent standard of living | Measures wage value over time accounting for price changes |

| Calculation Basis | Cost of essential goods and services | Nominal wage adjusted by Consumer Price Index (CPI) or inflation rate |

| Economic Indicator | Social benchmark for wage policy and living standards | Inflation-adjusted wage trends indicating real income changes |

| Usage | Used by policymakers and labor advocates to set minimum pay | Used by economists to assess worker's economic well-being over time |

Which is better?

Living wage reflects the income necessary to cover basic living expenses, ensuring individuals meet essential needs such as housing, food, and healthcare. Real wage accounts for inflation and purchasing power, indicating the actual earnings adjusted for cost of living changes over time. Evaluating economic well-being requires analyzing both living wages for adequacy and real wages for temporal economic conditions.

Connection

Living wage and real wage are connected through their measurement of workers' purchasing power and economic well-being. Real wage accounts for inflation by reflecting the actual buying capacity of income, while a living wage is the minimum income necessary for a worker to meet basic needs like housing, food, and healthcare. Understanding the gap between real wage and living wage helps policymakers address wage adequacy and poverty reduction in labor markets.

Key Terms

Purchasing Power

Real wage measures the income earned by workers adjusted for inflation, reflecting their true purchasing power over goods and services. Living wage represents the minimum income necessary for a worker to cover basic needs such as housing, food, healthcare, and transportation within a specific location and time period. Explore the relationship between real wages and living wages to understand economic well-being and labor market conditions.

Cost of Living

Real wage measures the purchasing power of income after adjusting for inflation, reflecting how much goods and services workers can afford. Living wage calculates the minimum income necessary to cover essential expenses like housing, food, healthcare, and transportation, directly tied to the local cost of living. Explore how these metrics impact economic well-being and policy decisions for a deeper understanding.

Minimum Wage

The minimum wage establishes the lowest legal remuneration employers can pay workers, often falling short of a living wage, which accounts for basic cost of living expenses such as housing, food, and healthcare. Real wages adjust nominal wages for inflation, reflecting the actual purchasing power of workers, while many minimum wages fail to keep pace with rising living costs, leading to a gap between income and essentials. Explore detailed comparisons and policy implications of minimum wage laws versus living wage standards to understand their impact on worker well-being.

Source and External Links

Nominal Wage vs. Real Wage: What's the Difference? - Real wage represents earnings adjusted for inflation, calculated by reducing nominal wages by the inflation rate to reflect the true purchasing power of income.

Real wages - Real wages are inflation-adjusted wages expressing the amount of goods and services a worker can buy, providing a clearer indicator of purchasing power than nominal wages.

Real Wage Definition, Formula & Examples - Lesson - Real wage is the amount received for labor after adjusting nominal wages for inflation, reflecting true purchasing power and enabling comparison over time.

dowidth.com

dowidth.com