Doom spending often leads to excessive debt accumulation, causing economic instability and heightened financial risk. Deleveraging, the process of reducing debt levels, can stabilize markets but may also slow economic growth if done too rapidly. Explore the dynamics between doom spending and deleveraging to understand their impact on global economies.

Why it is important

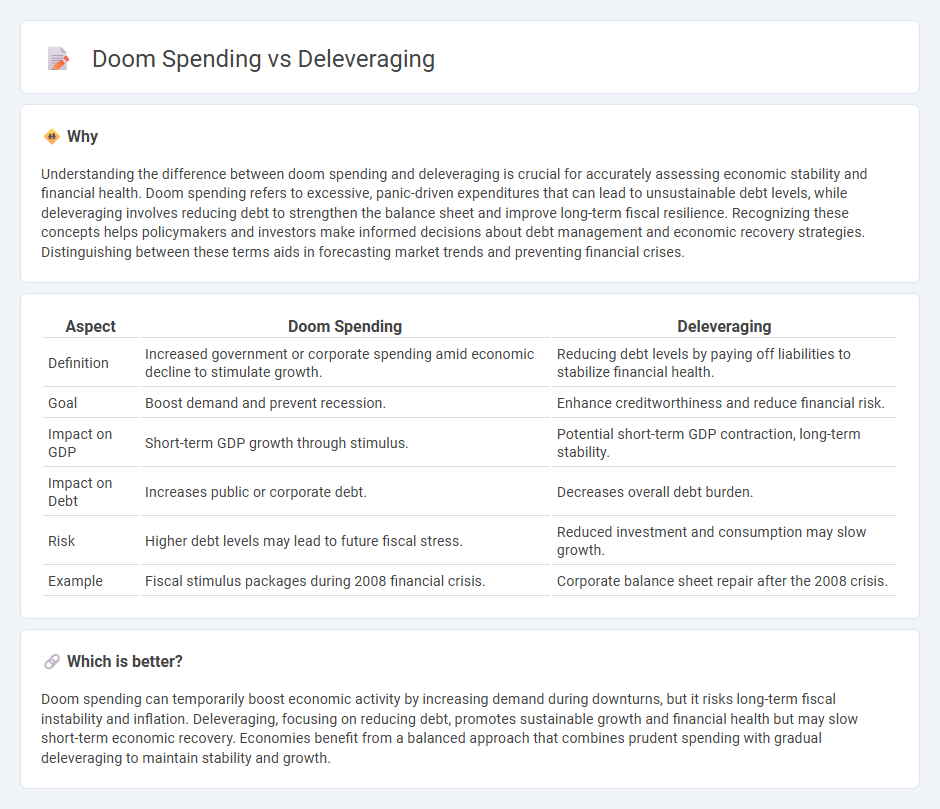

Understanding the difference between doom spending and deleveraging is crucial for accurately assessing economic stability and financial health. Doom spending refers to excessive, panic-driven expenditures that can lead to unsustainable debt levels, while deleveraging involves reducing debt to strengthen the balance sheet and improve long-term fiscal resilience. Recognizing these concepts helps policymakers and investors make informed decisions about debt management and economic recovery strategies. Distinguishing between these terms aids in forecasting market trends and preventing financial crises.

Comparison Table

| Aspect | Doom Spending | Deleveraging |

|---|---|---|

| Definition | Increased government or corporate spending amid economic decline to stimulate growth. | Reducing debt levels by paying off liabilities to stabilize financial health. |

| Goal | Boost demand and prevent recession. | Enhance creditworthiness and reduce financial risk. |

| Impact on GDP | Short-term GDP growth through stimulus. | Potential short-term GDP contraction, long-term stability. |

| Impact on Debt | Increases public or corporate debt. | Decreases overall debt burden. |

| Risk | Higher debt levels may lead to future fiscal stress. | Reduced investment and consumption may slow growth. |

| Example | Fiscal stimulus packages during 2008 financial crisis. | Corporate balance sheet repair after the 2008 crisis. |

Which is better?

Doom spending can temporarily boost economic activity by increasing demand during downturns, but it risks long-term fiscal instability and inflation. Deleveraging, focusing on reducing debt, promotes sustainable growth and financial health but may slow short-term economic recovery. Economies benefit from a balanced approach that combines prudent spending with gradual deleveraging to maintain stability and growth.

Connection

Doom spending refers to excessive consumption driven by pessimistic economic outlooks, often causing reduced savings and increased debt levels. Deleveraging occurs when individuals or institutions reduce their debt burdens, typically by cutting back on spending and selling assets to restore financial stability. These processes are interconnected as doom spending can elevate debt levels, making deleveraging necessary to mitigate financial risks and stabilize the economy.

Key Terms

Debt Reduction

Deleveraging involves strategically reducing overall debt levels to improve financial stability and creditworthiness, often by prioritizing debt repayment and curbing new borrowing. Doom spending refers to increased consumption driven by economic pessimism, which can exacerbate debt and financial strain. Explore effective debt reduction strategies to maintain financial health and resilience.

Fiscal Stimulus

Fiscal stimulus strategies vary significantly between deleveraging and doom spending approaches, with deleveraging emphasizing debt reduction and sustainable economic recovery. Doom spending prioritizes immediate, often excessive, fiscal outlays to boost demand but risks long-term financial instability and inflation. Explore how these contrasting fiscal policies influence economic resilience and inflation control to understand their broader impact.

Financial Stability

Deleveraging involves reducing debt levels to improve financial stability by decreasing risk exposure and strengthening balance sheets. In contrast, doom spending refers to increased consumer or organizational expenses driven by fear of future scarcity or inflation, often undermining long-term financial health. Explore how these opposing behaviors impact economic resilience and financial planning strategies.

Source and External Links

Deleveraging | Definition + LBO Calculator - Wall Street Prep - Deleveraging is the reduction of debt by a company to lower financial leverage, especially in leveraged buyout (LBO) contexts where cash flows are used to pay down outstanding debt, thus increasing the value of equity returns.

What Is Deleveraging? - Corporate Finance Institute - Deleveraging is the process by which a company or economy reduces total debt to avoid risks like default or bankruptcy, often measured as a decline in debt-to-GDP ratio at the macroeconomic level.

Deleveraging - Wikipedia - Deleveraging means lowering the leverage ratio--or the proportion of debt in an entity's balance sheet--opposite of leveraging, and at the macro level, it refers to widespread debt reduction across sectors, often associated with recessions after financial crises.

dowidth.com

dowidth.com