A liquidity crunch occurs when businesses and consumers face a sudden shortage of cash, impairing their ability to meet immediate financial obligations and causing economic slowdowns. Debt deflation exacerbates this by increasing the real burden of debt as falling prices raise the value of outstanding liabilities, leading to reduced spending and investment. Explore the dynamics and impacts of liquidity crunch and debt deflation on economic stability.

Why it is important

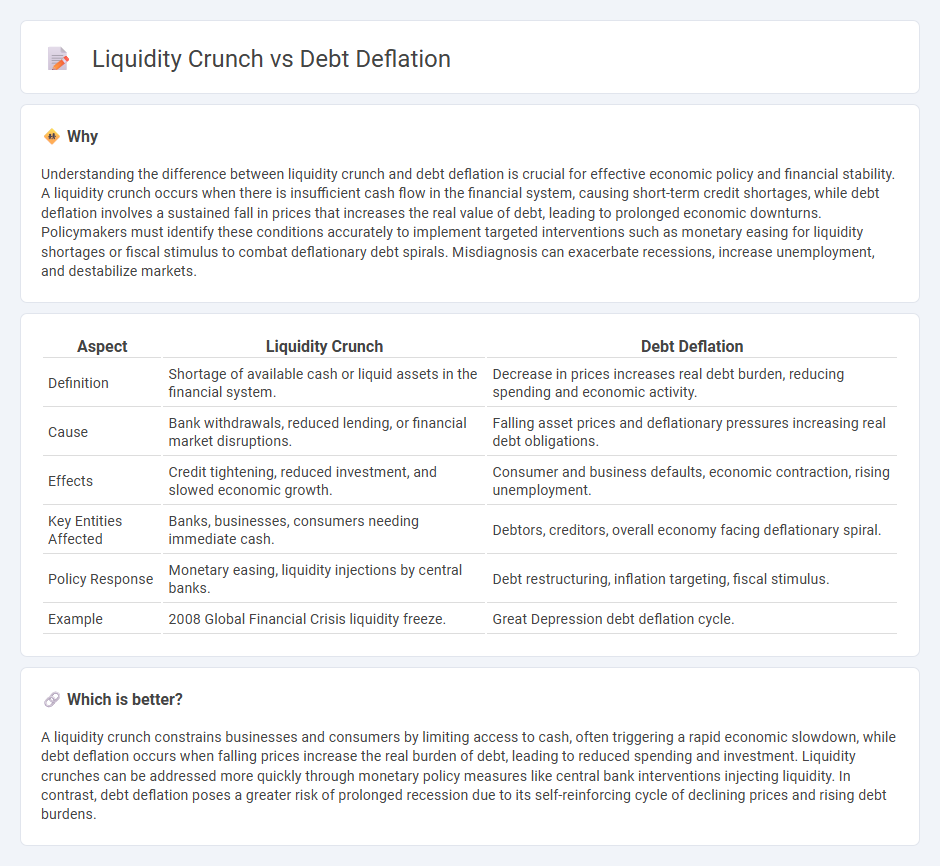

Understanding the difference between liquidity crunch and debt deflation is crucial for effective economic policy and financial stability. A liquidity crunch occurs when there is insufficient cash flow in the financial system, causing short-term credit shortages, while debt deflation involves a sustained fall in prices that increases the real value of debt, leading to prolonged economic downturns. Policymakers must identify these conditions accurately to implement targeted interventions such as monetary easing for liquidity shortages or fiscal stimulus to combat deflationary debt spirals. Misdiagnosis can exacerbate recessions, increase unemployment, and destabilize markets.

Comparison Table

| Aspect | Liquidity Crunch | Debt Deflation |

|---|---|---|

| Definition | Shortage of available cash or liquid assets in the financial system. | Decrease in prices increases real debt burden, reducing spending and economic activity. |

| Cause | Bank withdrawals, reduced lending, or financial market disruptions. | Falling asset prices and deflationary pressures increasing real debt obligations. |

| Effects | Credit tightening, reduced investment, and slowed economic growth. | Consumer and business defaults, economic contraction, rising unemployment. |

| Key Entities Affected | Banks, businesses, consumers needing immediate cash. | Debtors, creditors, overall economy facing deflationary spiral. |

| Policy Response | Monetary easing, liquidity injections by central banks. | Debt restructuring, inflation targeting, fiscal stimulus. |

| Example | 2008 Global Financial Crisis liquidity freeze. | Great Depression debt deflation cycle. |

Which is better?

A liquidity crunch constrains businesses and consumers by limiting access to cash, often triggering a rapid economic slowdown, while debt deflation occurs when falling prices increase the real burden of debt, leading to reduced spending and investment. Liquidity crunches can be addressed more quickly through monetary policy measures like central bank interventions injecting liquidity. In contrast, debt deflation poses a greater risk of prolonged recession due to its self-reinforcing cycle of declining prices and rising debt burdens.

Connection

Liquidity crunch occurs when financial institutions and markets face a shortage of liquid assets, limiting the availability of cash for borrowing and spending. Debt deflation happens as falling prices increase the real burden of debt, causing borrowers to reduce spending and default more frequently. The interaction between liquidity crunch and debt deflation creates a vicious cycle, where reduced liquidity tightens credit conditions and exacerbates deflationary pressures, deepening economic downturns.

Key Terms

Asset Prices

Debt deflation occurs when falling asset prices increase the real burden of debt, leading to reduced spending and economic contraction, whereas a liquidity crunch restricts the availability of liquid assets, causing difficulties in buying and selling assets without impacting their prices. Asset prices tend to plummet during debt deflation as forced asset sales create downward pressure, while during a liquidity crunch, prices may remain volatile due to sudden shortages of market participants or funding. Explore how these dynamics influence financial stability and investment strategies for deeper insights.

Credit Availability

Debt deflation occurs when falling prices increase the real value of debt, reducing consumers' and businesses' ability to borrow due to higher effective debt burdens. A liquidity crunch, on the other hand, restricts credit availability as financial institutions face cash shortages or insolvency risks, leading to tightened lending standards regardless of demand. Explore the dynamics of credit availability in debt deflation and liquidity crunch scenarios to understand their distinct impacts on economic recovery.

Interest Rates

Interest rates plunge during debt deflation as borrowers struggle to repay shrinking debts, causing widespread defaults and deflationary spirals. Liquidity crunches, however, trigger sharp interest rate spikes due to scarce capital and higher risk premiums, severely restricting borrowing. Explore how these interest rate dynamics influence economic stability and financial markets.

Source and External Links

Debt deflation - Wikipedia - Debt deflation is an economic theory proposed by Irving Fisher, explaining that recessions and depressions occur because the real value of debt rises during deflation, causing widespread defaults, bank insolvencies, reduced lending, and decreased spending.

Debt-deflation: concepts and a stylised model - This paper models how debt and deflation interact to destabilize economies by triggering distress selling and credit contraction, but also shows stability can persist if borrowing and lending adjust appropriately.

Debt Deflation And Its Economic Impacts - Debt deflation describes a fall in wages, asset values, and prices that makes it harder for borrowers to repay debts, potentially causing reduced consumer spending, layoffs, and an economic recession, as first described by Irving Fisher during the Great Depression.

dowidth.com

dowidth.com