Supercore inflation measures the persistent and underlying changes in prices by excluding volatile sectors like food and energy, providing a clearer view of long-term inflation trends. Non-core inflation captures price fluctuations in more volatile categories that can distort short-term inflation readings, such as fuel and agricultural products. Explore the distinctions and impacts of supercore versus non-core inflation to better understand economic policy decisions.

Why it is important

Understanding the difference between supercore inflation and non-core inflation is crucial because supercore inflation reflects persistent, underlying price changes in essential services that influence long-term monetary policy decisions, whereas non-core inflation includes volatile items like food and energy that can obscure true economic trends. Central banks rely on supercore inflation metrics to set interest rates effectively and maintain economic stability. Accurate interpretation of these inflation measures helps investors and policymakers anticipate inflationary pressures and implement responsive fiscal strategies. Distinguishing between these inflation types aids in forecasting inflation trajectories and managing economic growth sustainably.

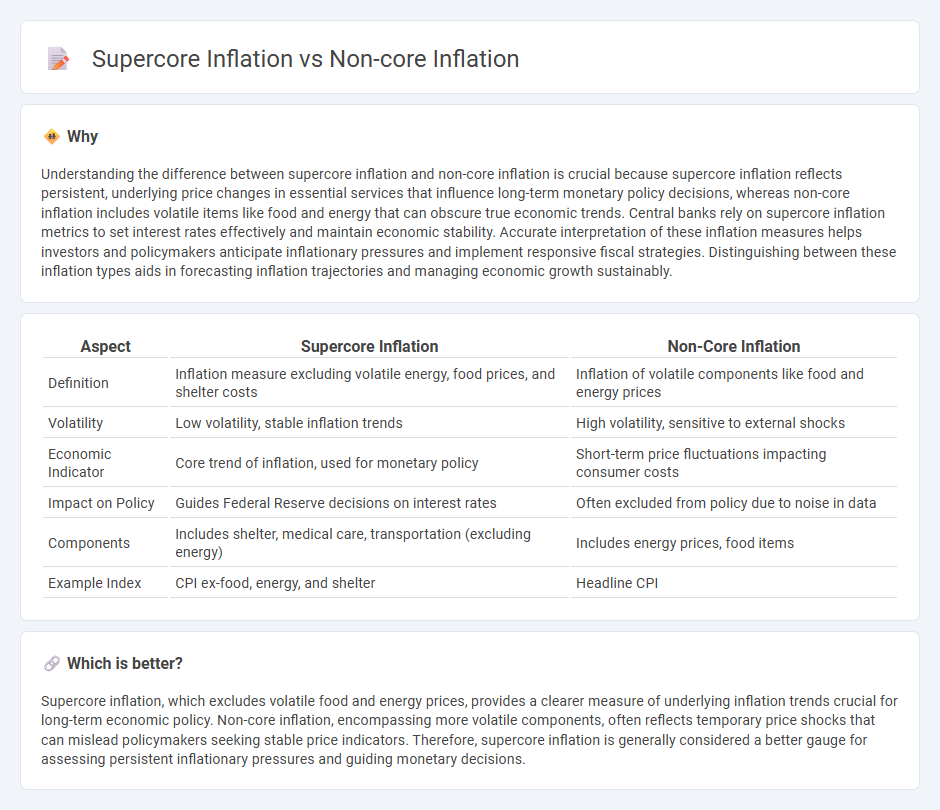

Comparison Table

| Aspect | Supercore Inflation | Non-Core Inflation |

|---|---|---|

| Definition | Inflation measure excluding volatile energy, food prices, and shelter costs | Inflation of volatile components like food and energy prices |

| Volatility | Low volatility, stable inflation trends | High volatility, sensitive to external shocks |

| Economic Indicator | Core trend of inflation, used for monetary policy | Short-term price fluctuations impacting consumer costs |

| Impact on Policy | Guides Federal Reserve decisions on interest rates | Often excluded from policy due to noise in data |

| Components | Includes shelter, medical care, transportation (excluding energy) | Includes energy prices, food items |

| Example Index | CPI ex-food, energy, and shelter | Headline CPI |

Which is better?

Supercore inflation, which excludes volatile food and energy prices, provides a clearer measure of underlying inflation trends crucial for long-term economic policy. Non-core inflation, encompassing more volatile components, often reflects temporary price shocks that can mislead policymakers seeking stable price indicators. Therefore, supercore inflation is generally considered a better gauge for assessing persistent inflationary pressures and guiding monetary decisions.

Connection

Supercore inflation, measuring core price changes excluding food and energy, directly influences monetary policy decisions and long-term inflation expectations, while non-core inflation captures volatile food and energy prices subject to external shocks. The interplay between supercore and non-core inflation determines overall inflation trends, as persistent rises in non-core components can spill over into supercore inflation through wage adjustments and supply chain costs. Monitoring both indicators provides a comprehensive understanding of inflation dynamics essential for effective economic planning and forecasting.

Key Terms

Headline Inflation

Non-core inflation excludes volatile food and energy prices, offering a clearer view of underlying price trends, while supercore inflation zeroes in on the most stable components, often excluding both food, energy, and shelter costs. Headline inflation captures the overall price changes including all categories, serving as a comprehensive measure but is influenced by these more volatile elements. Explore how differentiating between non-core and supercore inflation impacts economic policy and investment decisions.

Core Inflation

Core inflation excludes volatile food and energy prices, providing a more stable measure of underlying price trends, while non-core inflation includes these fluctuations, reflecting short-term market instability. Supercore inflation narrows the focus further to the most persistent and broad-based price changes within services, offering deeper insight into long-term inflationary pressures. Explore detailed analyses to understand how core inflation metrics guide monetary policy decisions.

Wage Growth

Non-core inflation excludes volatile components such as food and energy prices, providing a clearer view of underlying price trends, while supercore inflation specifically tracks wage growth, reflecting labor market tightness and its impact on overall inflation. Wage growth data is crucial in supercore inflation analysis, as rising wages often signal increasing inflationary pressures through higher consumer spending and production costs. Explore the intricate relationship between wage growth and inflation metrics to better understand inflation dynamics.

Source and External Links

Core Inflation: ET Explains: Difference between core and non-core inflation in India - Non-core inflation consists of volatile components like food and fuel prices driven by supply-side factors, which monetary policy has limited ability to control, contrasting with core inflation that excludes these items and is more influenced by monetary policy.

Consumer Price Data and Measures Explained - Non-core inflation typically includes food and energy prices, which are excluded from core inflation measures that aim to capture the persistent underlying trend by removing volatile items.

Inflation - Wikipedia - Inflation measures such as the Consumer Price Index often separate core inflation (excluding food and energy) from non-core inflation, which includes these more volatile price components that reflect short-term supply shocks.

dowidth.com

dowidth.com