Locavesting focuses on investing in local businesses and projects to stimulate regional economic growth and community development. Crowdinvesting pools funds from multiple investors online, spreading risk across a diverse range of startups and ventures globally. Discover how these innovative investment strategies can reshape personal finance and economic empowerment.

Why it is important

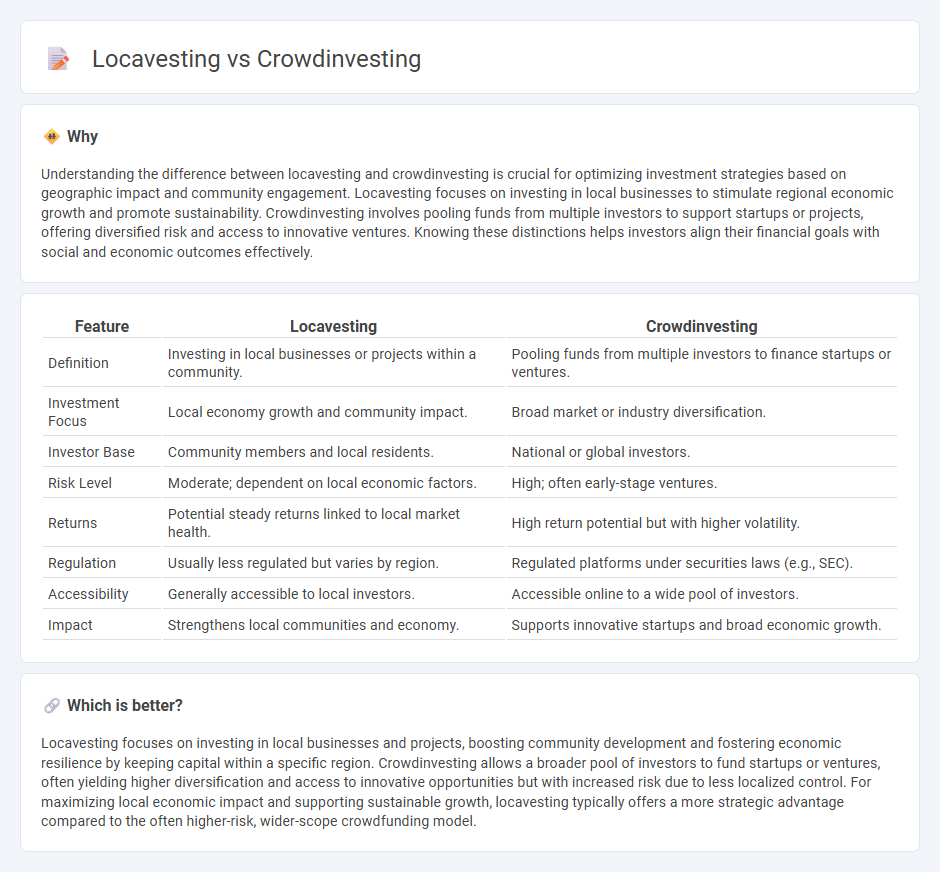

Understanding the difference between locavesting and crowdinvesting is crucial for optimizing investment strategies based on geographic impact and community engagement. Locavesting focuses on investing in local businesses to stimulate regional economic growth and promote sustainability. Crowdinvesting involves pooling funds from multiple investors to support startups or projects, offering diversified risk and access to innovative ventures. Knowing these distinctions helps investors align their financial goals with social and economic outcomes effectively.

Comparison Table

| Feature | Locavesting | Crowdinvesting |

|---|---|---|

| Definition | Investing in local businesses or projects within a community. | Pooling funds from multiple investors to finance startups or ventures. |

| Investment Focus | Local economy growth and community impact. | Broad market or industry diversification. |

| Investor Base | Community members and local residents. | National or global investors. |

| Risk Level | Moderate; dependent on local economic factors. | High; often early-stage ventures. |

| Returns | Potential steady returns linked to local market health. | High return potential but with higher volatility. |

| Regulation | Usually less regulated but varies by region. | Regulated platforms under securities laws (e.g., SEC). |

| Accessibility | Generally accessible to local investors. | Accessible online to a wide pool of investors. |

| Impact | Strengthens local communities and economy. | Supports innovative startups and broad economic growth. |

Which is better?

Locavesting focuses on investing in local businesses and projects, boosting community development and fostering economic resilience by keeping capital within a specific region. Crowdinvesting allows a broader pool of investors to fund startups or ventures, often yielding higher diversification and access to innovative opportunities but with increased risk due to less localized control. For maximizing local economic impact and supporting sustainable growth, locavesting typically offers a more strategic advantage compared to the often higher-risk, wider-scope crowdfunding model.

Connection

Locavesting and crowdinvesting both focus on channeling private capital into local businesses and projects, fostering community economic growth. Locavesting emphasizes investing within one's immediate geographic area to support local enterprises, while crowdinvesting leverages online platforms to pool funds from numerous small investors for shared ownership opportunities. Together, these investment models democratize access to capital and stimulate regional development by aligning investor interests with local economic success.

Key Terms

Capital pooling

Crowdinvesting enables a diverse group of investors to pool capital into scalable ventures, leveraging collective funding to support startups or larger projects with equity shares. Locavesting concentrates investments within a specific geographic area, fostering community development and local economic growth by channeling pooled funds into local businesses or real estate. Explore further to understand how capital pooling strategies differ between these two investment models.

Local enterprise

Crowdinvesting channels funds from a broad base of online investors to fuel local enterprise growth, offering equity stakes and potential dividends, while locavesting emphasizes investment within a specific community to support nearby businesses and strengthen regional economies. Both methods promote economic development and community engagement but differ in scale and investor reach. Explore the nuances of these investment models to discover how they empower local enterprises effectively.

Investor returns

Crowdinvesting offers investors the opportunity to participate in diverse projects, often with higher potential returns but accompanied by increased risk and longer liquidity horizons. Locavesting focuses on investing in local businesses and communities, providing investors with tangible social impact and potentially steadier, though sometimes lower, financial returns. Explore further to understand which investment model aligns best with your financial goals and values.

Source and External Links

Crowdinvesting - Investing Together via the Internet - Crowdinvesting, also known as equity crowdfunding or investment crowdfunding, involves anonymous micro-investors funding businesses online in exchange for equity stakes, often used by startups to raise capital without traditional banks and regulated by laws depending on the country.

Crowdinvesting - Worldwide | Statista Market Forecast - Crowdinvesting is equity-based crowdfunding where multiple investors pool funds for startup equity, with a global market forecast to reach $1.81 billion in 2025, driven by increased investor interest, regulatory support, and sustainable project demand.

Equity crowdfunding - Wikipedia - Equity crowdfunding (crowdinvesting) allows wide groups of investors to invest in startups and small businesses for equity shares, subject to financial regulation, providing early-stage funding opportunities typically for smaller investments.

dowidth.com

dowidth.com