A soft landing occurs when an economy slows down just enough to curb inflation without triggering a recession, maintaining steady growth and employment. Economic contraction, by contrast, involves a significant decline in economic activity, leading to increased unemployment and reduced consumer spending. Explore the factors influencing soft landing prospects versus the risks of economic contraction to understand their impact on financial stability.

Why it is important

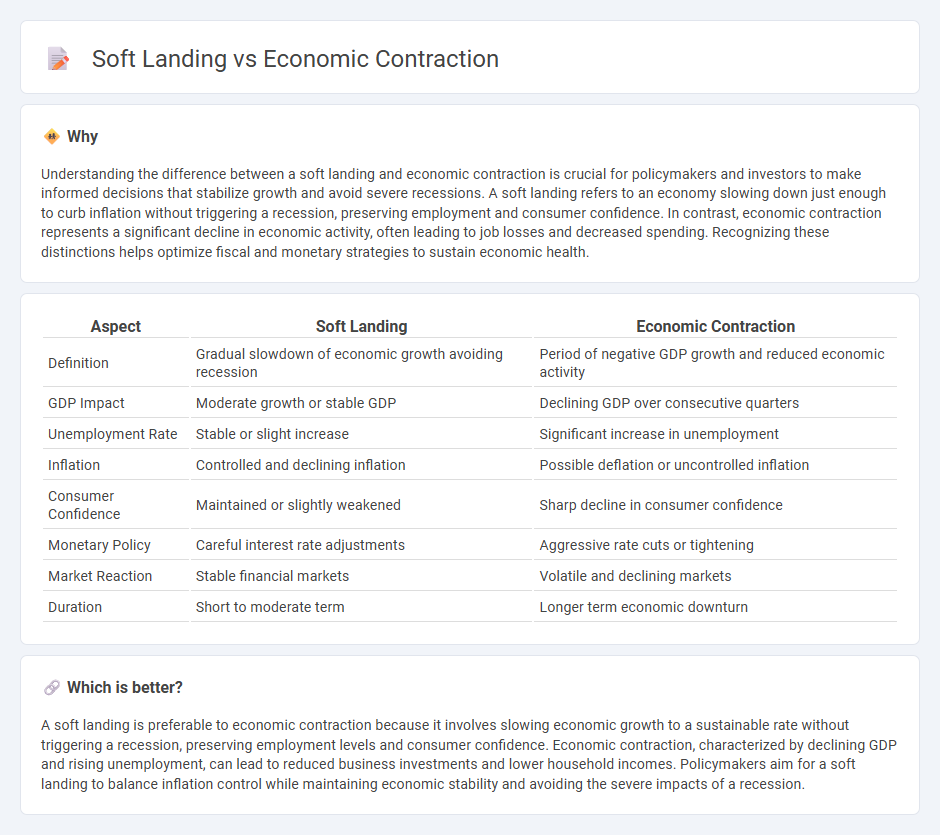

Understanding the difference between a soft landing and economic contraction is crucial for policymakers and investors to make informed decisions that stabilize growth and avoid severe recessions. A soft landing refers to an economy slowing down just enough to curb inflation without triggering a recession, preserving employment and consumer confidence. In contrast, economic contraction represents a significant decline in economic activity, often leading to job losses and decreased spending. Recognizing these distinctions helps optimize fiscal and monetary strategies to sustain economic health.

Comparison Table

| Aspect | Soft Landing | Economic Contraction |

|---|---|---|

| Definition | Gradual slowdown of economic growth avoiding recession | Period of negative GDP growth and reduced economic activity |

| GDP Impact | Moderate growth or stable GDP | Declining GDP over consecutive quarters |

| Unemployment Rate | Stable or slight increase | Significant increase in unemployment |

| Inflation | Controlled and declining inflation | Possible deflation or uncontrolled inflation |

| Consumer Confidence | Maintained or slightly weakened | Sharp decline in consumer confidence |

| Monetary Policy | Careful interest rate adjustments | Aggressive rate cuts or tightening |

| Market Reaction | Stable financial markets | Volatile and declining markets |

| Duration | Short to moderate term | Longer term economic downturn |

Which is better?

A soft landing is preferable to economic contraction because it involves slowing economic growth to a sustainable rate without triggering a recession, preserving employment levels and consumer confidence. Economic contraction, characterized by declining GDP and rising unemployment, can lead to reduced business investments and lower household incomes. Policymakers aim for a soft landing to balance inflation control while maintaining economic stability and avoiding the severe impacts of a recession.

Connection

A soft landing in economics refers to a scenario where economic growth slows down enough to curb inflation without triggering a recession or significant economic contraction. Economic contraction, characterized by a decline in GDP, employment, and spending, is avoided during a successful soft landing due to careful monetary policies and balanced fiscal measures. The connection lies in managing economic indicators to stabilize markets and prevent severe downturns while addressing inflationary pressures.

Key Terms

Recession

Economic contraction refers to a period of decline in GDP, increased unemployment, and reduced consumer spending, often signaling the onset of a recession. A soft landing occurs when policymakers successfully slow economic growth to prevent overheating without triggering a recession or significant economic downturn. Explore further to understand the key indicators, policy approaches, and impacts defining recession scenarios and economic recovery strategies.

Monetary policy

Monetary policy plays a critical role in distinguishing economic contraction from a soft landing by adjusting interest rates and liquidity to influence inflation and growth. During a soft landing, central banks fine-tune policy to slow inflation without triggering a severe recession, often through gradual rate hikes and targeted asset purchases. Explore our detailed analysis to understand how these monetary strategies impact economic trajectories.

Inflation

Economic contraction occurs when inflation remains persistently high, leading to reduced consumer spending and business investment, often resulting in a recession. A soft landing, by contrast, involves carefully managed monetary policies that slow inflation without triggering a significant decline in GDP, maintaining economic stability. Explore more about how inflation dynamics influence the balance between economic contraction and soft landing strategies.

Source and External Links

Economic Contraction | Definition, Business Cycle & Impact - Economic contraction is a sustained decrease in overall economic activity, often marked by falling investment, employment, wages, and consumer spending, and can lead to increased unemployment and recession if prolonged.

All About the Business Cycle: Where Do Recessions Come From - An economic contraction represents the downward phase of the business cycle when economic output declines, and while two consecutive quarters of negative GDP growth is a common recession indicator, the official determination in the U.S. is made by the National Bureau of Economic Research (NBER).

The Business Cycle | Audio Assignment - During a contraction, the economy produces fewer goods and services than before, often resulting in job losses and economic hardship, and the NBER is responsible for identifying the precise start and end dates of these cycles based on a broad range of economic data.

dowidth.com

dowidth.com