Ghost kitchen expansion capitalizes on lower operational costs and flexible locations to meet rising food delivery demand, reshaping urban food service landscapes. Digital-only restaurants leverage virtual branding and data analytics to optimize menu offerings and enhance customer experience without physical dining spaces. Explore more insights on how these models are transforming the future of the food industry.

Why it is important

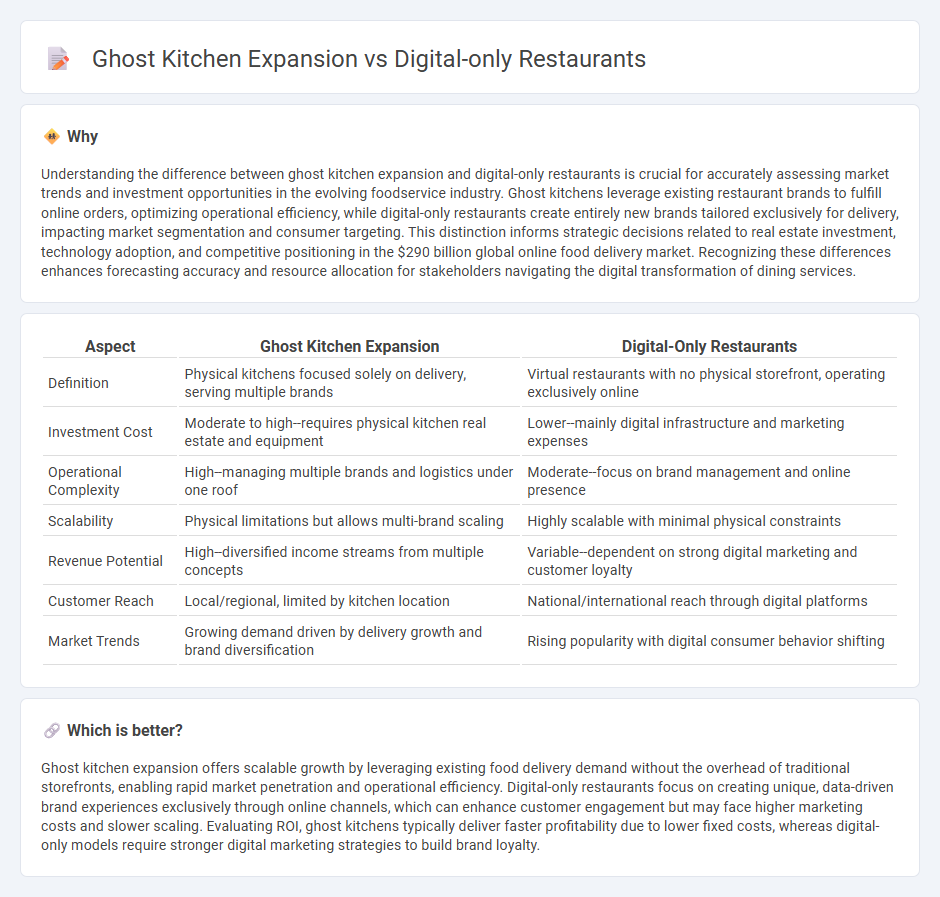

Understanding the difference between ghost kitchen expansion and digital-only restaurants is crucial for accurately assessing market trends and investment opportunities in the evolving foodservice industry. Ghost kitchens leverage existing restaurant brands to fulfill online orders, optimizing operational efficiency, while digital-only restaurants create entirely new brands tailored exclusively for delivery, impacting market segmentation and consumer targeting. This distinction informs strategic decisions related to real estate investment, technology adoption, and competitive positioning in the $290 billion global online food delivery market. Recognizing these differences enhances forecasting accuracy and resource allocation for stakeholders navigating the digital transformation of dining services.

Comparison Table

| Aspect | Ghost Kitchen Expansion | Digital-Only Restaurants |

|---|---|---|

| Definition | Physical kitchens focused solely on delivery, serving multiple brands | Virtual restaurants with no physical storefront, operating exclusively online |

| Investment Cost | Moderate to high--requires physical kitchen real estate and equipment | Lower--mainly digital infrastructure and marketing expenses |

| Operational Complexity | High--managing multiple brands and logistics under one roof | Moderate--focus on brand management and online presence |

| Scalability | Physical limitations but allows multi-brand scaling | Highly scalable with minimal physical constraints |

| Revenue Potential | High--diversified income streams from multiple concepts | Variable--dependent on strong digital marketing and customer loyalty |

| Customer Reach | Local/regional, limited by kitchen location | National/international reach through digital platforms |

| Market Trends | Growing demand driven by delivery growth and brand diversification | Rising popularity with digital consumer behavior shifting |

Which is better?

Ghost kitchen expansion offers scalable growth by leveraging existing food delivery demand without the overhead of traditional storefronts, enabling rapid market penetration and operational efficiency. Digital-only restaurants focus on creating unique, data-driven brand experiences exclusively through online channels, which can enhance customer engagement but may face higher marketing costs and slower scaling. Evaluating ROI, ghost kitchens typically deliver faster profitability due to lower fixed costs, whereas digital-only models require stronger digital marketing strategies to build brand loyalty.

Connection

The rapid expansion of ghost kitchens and digital-only restaurants is transforming the economy by reducing traditional overhead costs and enabling scalable, tech-driven food delivery models. This shift leverages advanced data analytics and online ordering platforms to optimize operational efficiency and market reach. Consequently, these innovations stimulate economic growth by creating new employment opportunities and increasing consumer access to diverse dining options.

Key Terms

Revenue Streams

Digital-only restaurants generate revenue primarily through direct online orders and delivery partnerships, minimizing overhead costs associated with physical locations. Ghost kitchens expand revenue streams by serving multiple brands from a single kitchen, optimizing operational efficiency and scaling delivery capacity. Explore how these models transform foodservice revenue dynamics and strategic growth opportunities.

Operational Overhead

Digital-only restaurants significantly reduce operational overhead by eliminating front-of-house expenses such as dining area maintenance and in-person staff salaries. Ghost kitchens leverage shared kitchen spaces to maximize resource utilization and minimize costs associated with real estate and equipment. Explore how these models optimize efficiency and profitability in the evolving foodservice landscape.

Market Penetration

Digital-only restaurants leverage online ordering platforms to quickly enter urban markets, reducing overhead costs associated with physical locations and enhancing market penetration through targeted delivery services. Ghost kitchens expand by utilizing shared kitchen spaces to support multiple brands simultaneously, optimizing operational efficiency and rapidly scaling presence in diverse neighborhoods. Explore detailed strategies and growth metrics to understand which model best drives market penetration.

Source and External Links

Digital-Only Restaurant by Whataburger Opens - Kiosk Industry - Whataburger opened its first digital-only restaurant in Austin, Texas, called the Whataburger Digital Kitchen, which is cashless, off-premises only, and features a mobile order lane, self-service kiosks, and food lockers for pickup.

Whataburger Opens First Digital-Only Restaurant - This digital-only location operates 24/7 (closed on Christmas) with no dining room or curbside pickup, relying entirely on website/app orders, staffed by 50 employees to serve pickup-only customers.

Panera Opens First "Panera to Go" Digital-only Restaurant for Off-Premise Dining - Panera's "Panera To Go" concept is a digital-only bakery-cafe focused on rapid pickup and delivery, with ordering exclusively through digital channels, offering a smaller physical footprint without traditional dine-in options.

dowidth.com

dowidth.com