Vibe shifts reflect broad cultural and social changes influencing consumer behavior, while consumer sentiment swings are short-term fluctuations in economic confidence affecting spending patterns. Understanding the interplay between these factors is crucial for predicting market trends and developing effective economic policies. Explore how vibe shifts and consumer sentiment swings shape the future of the economy.

Why it is important

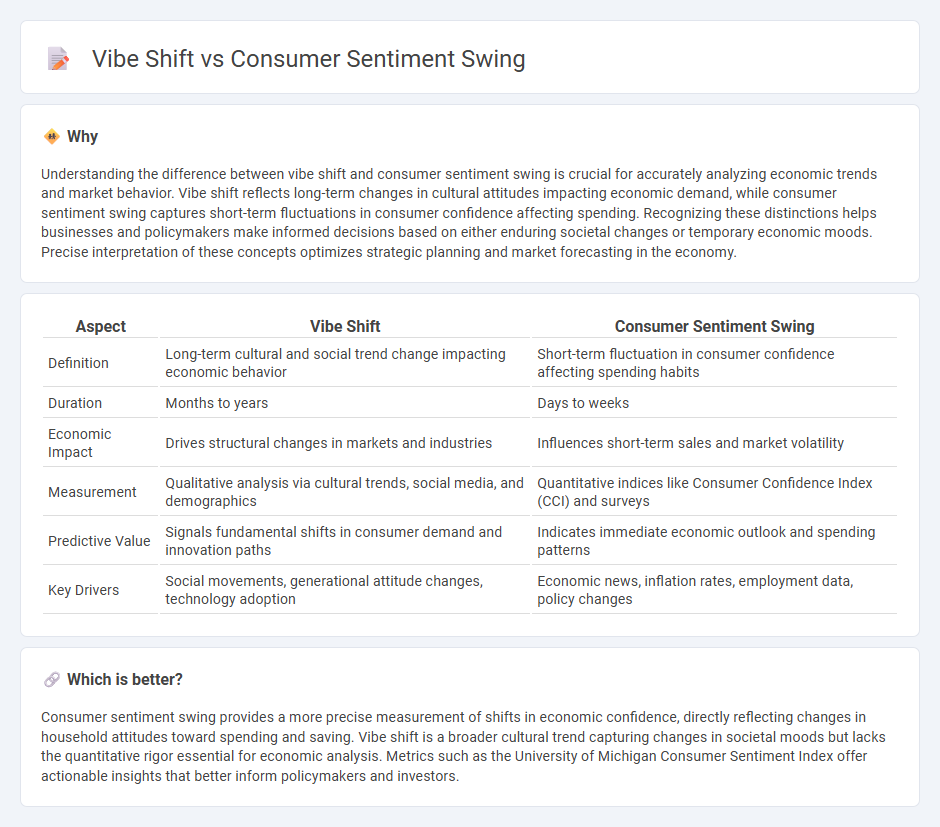

Understanding the difference between vibe shift and consumer sentiment swing is crucial for accurately analyzing economic trends and market behavior. Vibe shift reflects long-term changes in cultural attitudes impacting economic demand, while consumer sentiment swing captures short-term fluctuations in consumer confidence affecting spending. Recognizing these distinctions helps businesses and policymakers make informed decisions based on either enduring societal changes or temporary economic moods. Precise interpretation of these concepts optimizes strategic planning and market forecasting in the economy.

Comparison Table

| Aspect | Vibe Shift | Consumer Sentiment Swing |

|---|---|---|

| Definition | Long-term cultural and social trend change impacting economic behavior | Short-term fluctuation in consumer confidence affecting spending habits |

| Duration | Months to years | Days to weeks |

| Economic Impact | Drives structural changes in markets and industries | Influences short-term sales and market volatility |

| Measurement | Qualitative analysis via cultural trends, social media, and demographics | Quantitative indices like Consumer Confidence Index (CCI) and surveys |

| Predictive Value | Signals fundamental shifts in consumer demand and innovation paths | Indicates immediate economic outlook and spending patterns |

| Key Drivers | Social movements, generational attitude changes, technology adoption | Economic news, inflation rates, employment data, policy changes |

Which is better?

Consumer sentiment swing provides a more precise measurement of shifts in economic confidence, directly reflecting changes in household attitudes toward spending and saving. Vibe shift is a broader cultural trend capturing changes in societal moods but lacks the quantitative rigor essential for economic analysis. Metrics such as the University of Michigan Consumer Sentiment Index offer actionable insights that better inform policymakers and investors.

Connection

Vibe shifts reflect significant changes in cultural attitudes and preferences that directly influence consumer sentiment by altering spending habits and brand loyalty. Shifts in consumer sentiment often result from underlying vibe shifts, driving fluctuations in demand, investment patterns, and economic growth. Understanding this connection helps businesses and economists predict market trends and adjust strategies accordingly.

Key Terms

Confidence Index

Consumer sentiment swing reflects short-term fluctuations in the Confidence Index, indicating rapid changes in economic outlook and spending behavior. Vibe shift represents a more sustained, cultural change influencing long-term consumer attitudes and preferences beyond immediate economic indicators. Explore how these concepts impact market strategies and economic forecasts in-depth.

Behavioral Economics

Consumer sentiment swing reflects short-term fluctuations in buyer confidence influenced by economic news and market volatility, while vibe shift denotes a deeper, cultural change in consumer attitudes shaped by evolving social values and behavioral norms. Behavioral economics studies these phenomena by analyzing how cognitive biases, heuristics, and emotional responses drive purchasing decisions and sentiment dynamics over time. Explore how these concepts impact market strategies and consumer engagement in detail.

Market Volatility

Consumer sentiment swing reflects short-term fluctuations in market confidence driven by economic reports and earnings surprises, causing immediate reactions in stock prices and investor behavior. Vibe shift denotes a deeper, longer-lasting change in collective consumer attitudes and preferences, influencing market trends and business strategies over extended periods. Explore how these dynamics shape market volatility and investment decisions in today's evolving financial landscape.

Source and External Links

Consumer sentiment swings sharply higher in June - Axios - Consumer sentiment rebounded sharply in June 2025 as tariff anxieties eased, rising 16% to 60.5 and marking the first improvement in six months, although it remains about 20% below late 2024 levels, with inflation fears moderating but still present.

Tracking consumer sentiment versus how consumers are doing ... - Federal Reserve - Since mid-2022, consumer sentiment has shifted to align more with concerns about higher prices rather than income growth, explaining why sentiment remains low despite rising wages and stable spending habits amid inflationary conditions akin to the 1970s and 80s.

Index of Consumer Sentiment - University of Michigan - In July 2025, consumer sentiment edged up slightly to 61.8, its highest in five months but still 16% lower than December 2024 levels, while inflation expectations declined to their lowest since February, signaling cautious optimism dependent on stable trade and inflation policies.

dowidth.com

dowidth.com