De-dollarization involves reducing reliance on the U.S. dollar for international trade and reserves, promoting local currencies to enhance financial sovereignty and mitigate exchange rate risks. Remonetization focuses on restoring the use of precious metals or alternative stable assets as legal tender to stabilize currency value and bolster economic confidence. Explore the economic impacts and strategic approaches behind these financial shifts.

Why it is important

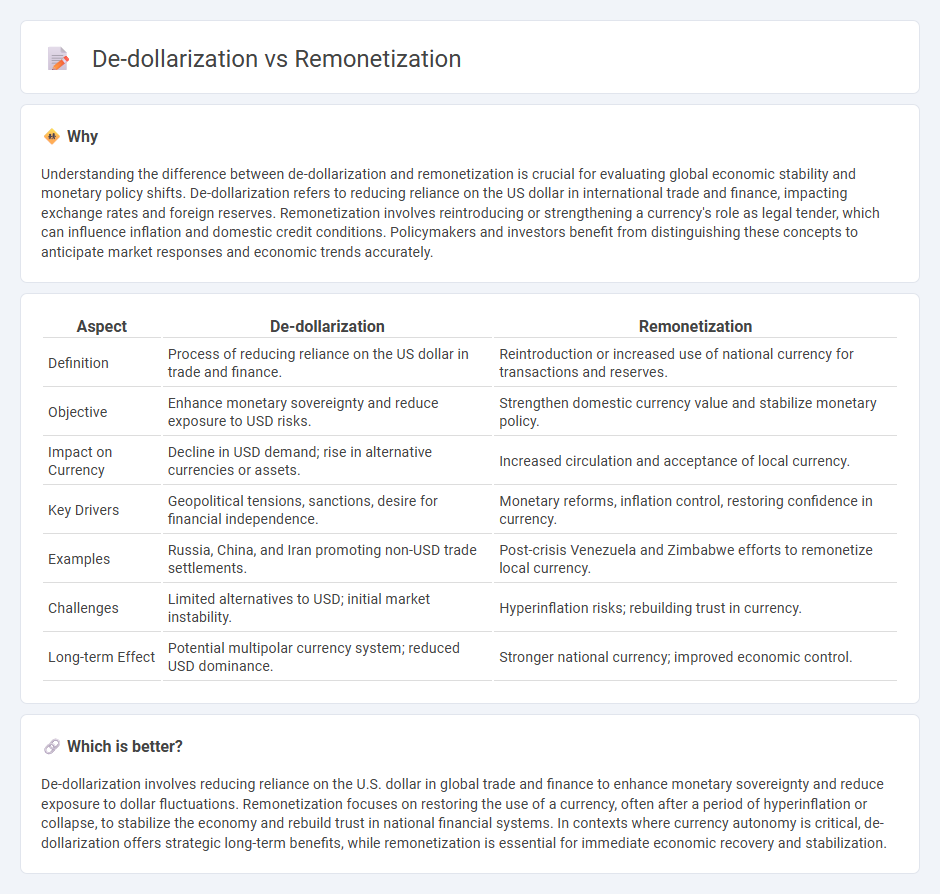

Understanding the difference between de-dollarization and remonetization is crucial for evaluating global economic stability and monetary policy shifts. De-dollarization refers to reducing reliance on the US dollar in international trade and finance, impacting exchange rates and foreign reserves. Remonetization involves reintroducing or strengthening a currency's role as legal tender, which can influence inflation and domestic credit conditions. Policymakers and investors benefit from distinguishing these concepts to anticipate market responses and economic trends accurately.

Comparison Table

| Aspect | De-dollarization | Remonetization |

|---|---|---|

| Definition | Process of reducing reliance on the US dollar in trade and finance. | Reintroduction or increased use of national currency for transactions and reserves. |

| Objective | Enhance monetary sovereignty and reduce exposure to USD risks. | Strengthen domestic currency value and stabilize monetary policy. |

| Impact on Currency | Decline in USD demand; rise in alternative currencies or assets. | Increased circulation and acceptance of local currency. |

| Key Drivers | Geopolitical tensions, sanctions, desire for financial independence. | Monetary reforms, inflation control, restoring confidence in currency. |

| Examples | Russia, China, and Iran promoting non-USD trade settlements. | Post-crisis Venezuela and Zimbabwe efforts to remonetize local currency. |

| Challenges | Limited alternatives to USD; initial market instability. | Hyperinflation risks; rebuilding trust in currency. |

| Long-term Effect | Potential multipolar currency system; reduced USD dominance. | Stronger national currency; improved economic control. |

Which is better?

De-dollarization involves reducing reliance on the U.S. dollar in global trade and finance to enhance monetary sovereignty and reduce exposure to dollar fluctuations. Remonetization focuses on restoring the use of a currency, often after a period of hyperinflation or collapse, to stabilize the economy and rebuild trust in national financial systems. In contexts where currency autonomy is critical, de-dollarization offers strategic long-term benefits, while remonetization is essential for immediate economic recovery and stabilization.

Connection

De-dollarization reduces reliance on the US dollar in international trade and finance, encouraging countries to diversify their reserve currencies and strengthen local currencies. Remonetization involves reintroducing or strengthening the use of national or alternative currencies in domestic and global markets, which complements de-dollarization by promoting monetary sovereignty. Together, these processes enhance economic resilience against external shocks and reduce vulnerability to US dollar fluctuations.

Key Terms

Currency Substitution

Remonetization involves restoring a currency's role as a primary medium of exchange and store of value, counteracting the effects of currency substitution where foreign currencies dominate domestic transactions. De-dollarization aims to reduce reliance on foreign currencies, particularly the US dollar, by promoting confidence and stability in the local currency to reclaim monetary sovereignty. Explore detailed strategies and impacts of remonetization and de-dollarization on global and emerging economies.

Monetary Sovereignty

Remonetization involves reintroducing or strengthening a national currency's role in the economy, promoting monetary sovereignty by reducing reliance on foreign currencies. De-dollarization aims to diminish the dominance of the US dollar in domestic and international transactions, fostering economic independence and a more autonomous monetary policy. Explore the implications of remonetization and de-dollarization to enhance understanding of monetary sovereignty strategies.

Reserve Currency

Remonetization involves reintroducing a national currency into broader use after a period of diminished trust or collapse, aiming to restore it as a dominant medium of exchange. De-dollarization refers to reducing reliance on the U.S. dollar in international trade and reserves, encouraging adoption of alternative currencies or regional currencies to diversify reserve holdings. Explore the strategic impacts of reserve currency shifts on global economic stability and national sovereignty.

Source and External Links

REMONETIZATION definition | Cambridge English Dictionary - Remonetization is defined as the act of changing something that is no longer recognized as money back into money, often related to restoring a metal such as gold to legal tender status.

What is remonetization? Simple Definition & Meaning - LSD.Law - Remonetization refers to the process of restoring a precious metal like gold or silver to be used again as legal tender, allowing it to function as recognized money for payment.

remonetization - Wiktionary, the free dictionary - Remonetization is the act or process of remonetizing, meaning to restore something to the status of legal tender, typically used in an economic context.

dowidth.com

dowidth.com