Zombie companies, defined as firms barely able to cover their debt servicing costs, hinder economic dynamism by tying up capital and resources that could be better allocated to more productive ventures. Growth stocks, characterized by high earnings potential and reinvestment into business expansion, attract investors seeking long-term capital appreciation and innovation-driven market leadership. Explore the impact of these contrasting business models on economic trends and investment strategies to better understand market cycles.

Why it is important

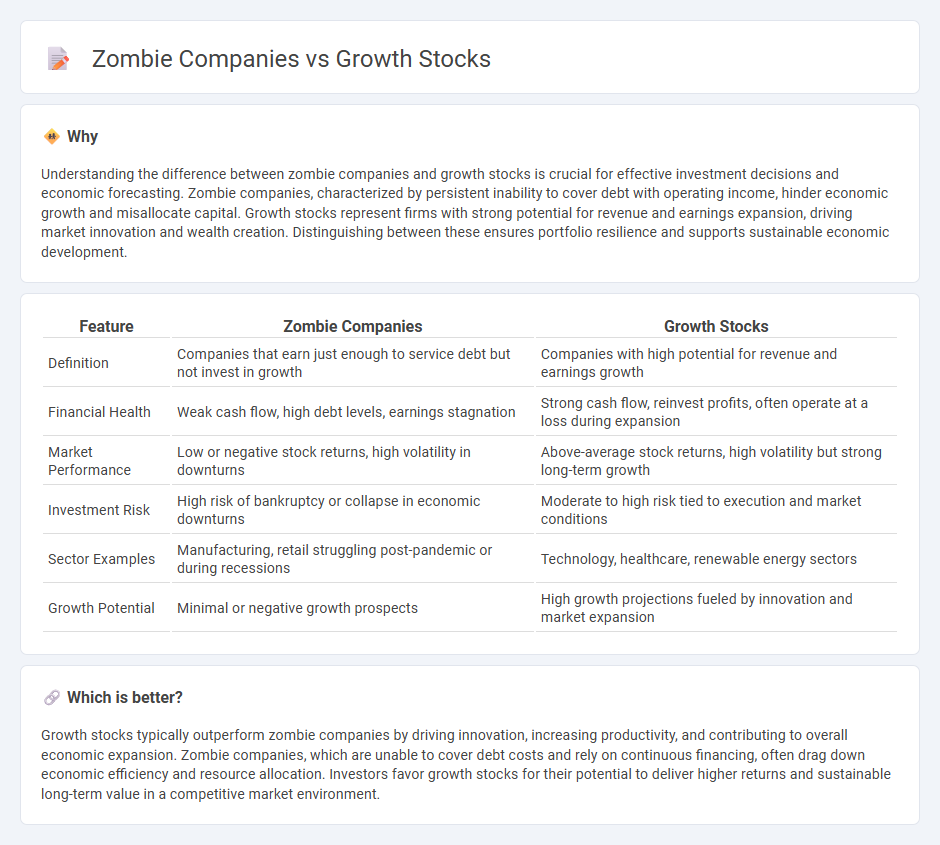

Understanding the difference between zombie companies and growth stocks is crucial for effective investment decisions and economic forecasting. Zombie companies, characterized by persistent inability to cover debt with operating income, hinder economic growth and misallocate capital. Growth stocks represent firms with strong potential for revenue and earnings expansion, driving market innovation and wealth creation. Distinguishing between these ensures portfolio resilience and supports sustainable economic development.

Comparison Table

| Feature | Zombie Companies | Growth Stocks |

|---|---|---|

| Definition | Companies that earn just enough to service debt but not invest in growth | Companies with high potential for revenue and earnings growth |

| Financial Health | Weak cash flow, high debt levels, earnings stagnation | Strong cash flow, reinvest profits, often operate at a loss during expansion |

| Market Performance | Low or negative stock returns, high volatility in downturns | Above-average stock returns, high volatility but strong long-term growth |

| Investment Risk | High risk of bankruptcy or collapse in economic downturns | Moderate to high risk tied to execution and market conditions |

| Sector Examples | Manufacturing, retail struggling post-pandemic or during recessions | Technology, healthcare, renewable energy sectors |

| Growth Potential | Minimal or negative growth prospects | High growth projections fueled by innovation and market expansion |

Which is better?

Growth stocks typically outperform zombie companies by driving innovation, increasing productivity, and contributing to overall economic expansion. Zombie companies, which are unable to cover debt costs and rely on continuous financing, often drag down economic efficiency and resource allocation. Investors favor growth stocks for their potential to deliver higher returns and sustainable long-term value in a competitive market environment.

Connection

Zombie companies, characterized by their inability to cover debt servicing costs from current profits, often coexist in markets dominated by high-growth stocks that attract speculative investment. Growth stocks, valued for projected earnings, can mask underlying economic weaknesses by diverting capital from struggling zombie firms that persist due to low interest rates and loose monetary policies. This dynamic creates market distortions, impacting resource allocation and potentially leading to reduced productivity and increased financial instability.

Key Terms

Earnings Growth

Growth stocks exhibit robust earnings growth, driven by innovative products or expanding markets, often outperforming the broader market. Zombie companies, in contrast, struggle with stagnant or negative earnings growth, barely generating enough revenue to cover debt interest, leading to limited long-term value creation. Explore detailed comparisons to understand how earnings growth impacts investment strategies between growth stocks and zombie companies.

Profitability

Growth stocks exhibit strong profitability potential, driven by scalable business models and expanding revenue streams, making them attractive to investors seeking higher returns. Zombie companies, by contrast, struggle with persistent unprofitability and rely heavily on debt refinancing to sustain operations, reflecting weak financial health. Explore deeper insights to differentiate these entities and optimize your investment strategy.

Debt Leverage

Growth stocks typically exhibit manageable debt leverage ratios, enabling them to invest in innovation and expansion without compromising financial stability. Zombie companies often struggle with high debt leverage, leading to insufficient cash flow to cover interest payments, which impedes their growth and risks insolvency. Explore further insights on the impact of debt leverage on corporate sustainability and investment decisions.

Source and External Links

2 Growth Stocks to Add to Your Roster and 1 We Brush Off - Nova (NVMI) and McKesson (MCK) are highlighted as promising growth stocks due to strong revenue increases and profitability, while Upstart (UPST) is flagged as a sell due to declining sales and high leverage--these picks reflect a focus on sustainable growth and sector leadership in technology and healthcare.

Growth stocks: what they are and why you should care - Growth stocks are shares of companies--typically in tech, healthcare, FMCG, semiconductors, and digital entertainment--expected to grow revenue and earnings much faster than the market, often by reinvesting profits into innovation and expansion.

Stocks Signals - Today 20/07: Best Growth Stocks (Charts) - Micron Technology, Dell, Lam Research, Novo Nordisk, Alibaba, Intuitive Surgical, Cadence Design Systems, Palantir, Veeva Systems, and Nio are listed as top growth stocks, with performance driven by innovation in AI, healthcare, and technology, even amid challenging economic conditions.

dowidth.com

dowidth.com